Can i write off tenant improvements? Unfortunately, the answer isn’t as simple as a yes or no.

If the improvements you’re making on your property are purely for cosmetic reasons, like changing your flooring for a nicer kind or adding an en suite, you won’t be eligible for tax deductions but you could save money by applying for a home improvement tax credit 2021.

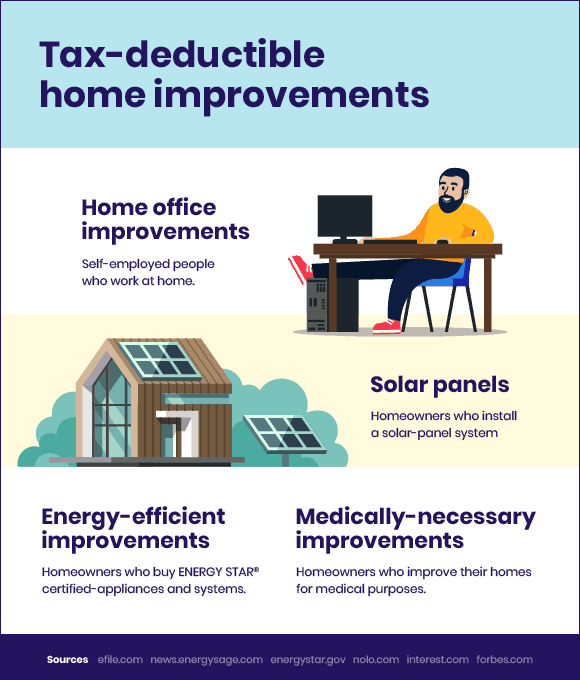

Are there tax deductions for home improvements. These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. If you decide to upgrade your fully functioning kitchen, those improvement costs may not qualify. Home improvements on a personal residence are generally not tax deductible for federal income taxes.

Any permanent home improvements in this category can be included as a medical expense, which is tax exempt. This one gets a bit tricky. You can alter the home to support the medical welfare of you, your spouse, or your children.

Although you can�t deduct home improvements, it is possible to depreciate them. Necessary home improvements can qualify as tax deductions. There are other tax benefits of home improvements.

Luckily, there are a few exceptions to this rule. Are home improvements tax deductible? In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500).

Ad get your taxes done right with support from an experienced turbotax® tax expert online! It depends on their purpose credit cards credit card reviews best credit cards best rewards credit cards best cash back credit cards best airline credit cards. Don�t know how to start filing your taxes?

If the improvements you’re making on your property are purely for cosmetic reasons, like changing your flooring for a nicer kind or adding an en suite, you won’t be eligible for tax deductions but you could save money by applying for a home improvement tax credit 2021. Can i write off tenant improvements? Connect with an expert for unlimited advice

In order to claim a tax deduction on repairs necessary due to a natural. To qualify to depreciate home improvement costs, you must use a portion of your home other than as a personal residence. As a homeowner, one of the questions that often gets asked is, “are there tax incentives for my home improvement projects?” unfortunately, home improvements are not always tax deductible because the irs considers them personal expenditures.

This tax deduction cannot be used when you spend the money, but it can reduce your taxes in the year you decide to sell your house. “if you needed to make home improvements in order to sell your home, you can deduct those expenses as selling costs as long as they were made within 90 days of the closing,” says zimmelman. One type of a capital improvement that can be considered for a tax deduction is a change made for medical purposes.

Tax deductible home improvement & repairs for 2022. Home improvements that are tax deductible home office Unfortunately, the answer isn’t as simple as a yes or no.

However, installing energy efficient equipment on your property may qualify you for a tax credit, and renovations to a home for medical purposes may qualify as a tax deductible medical expense. However, if you have to make permanent improvements to make your home more accessible for medical reasons, that should qualify. However, there are some exceptions with which you can claim credit or file tax deductions.

However, installing energy efficient equipment may qualify you for a tax credit, and renovations for medical purposes. It’s not exactly the type of home improvement you plan to do with pieces of paint or blueprints, but the reality is that losses from accident, disaster, or theft can be deducted on your tax return, as applicable. Are home improvements tax deductible?

Renovation of a home is not generally an expense that can be deducted from your federal taxes, but there are a number of ways that you can use home renovations and improvements to minimize your taxes. When you make a home improvement, such as installing central air conditioning or replacing the roof, you can�t deduct the cost in the year you spend the money. Of course, the definition of ‘necessary’ is somewhat limited.

Thereof what home expenses can you write off? Renovating your home can increase your total financial investment in the. You qualify for the home office deduction

Although the cost of regular, humdrum improvements isn�t deductible on your return, there really are some clever ways to recoup a few of your home costs by knowing the ins and outs of a tax return. From energy efficiency upgrades to improving the parts of your house you use as a home office , we might just find a deduction for the work you�ve put into your place. Improvements based on medical care.

But, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house. Home improvements on a personal residence are generally not tax deductible for federal income taxes. Generally, the party who pays for and owns the improvements may take the depreciation deductions.when landlords construct and pay for improvements, they own and depreciate the improvements, and there are no tax consequences to.