As long as you meet the time and distance requirements. But how you offset your expenses depends on whether you’re filing under the old rules or new rules.

This interview will help you determine if you can deduct your moving expenses.

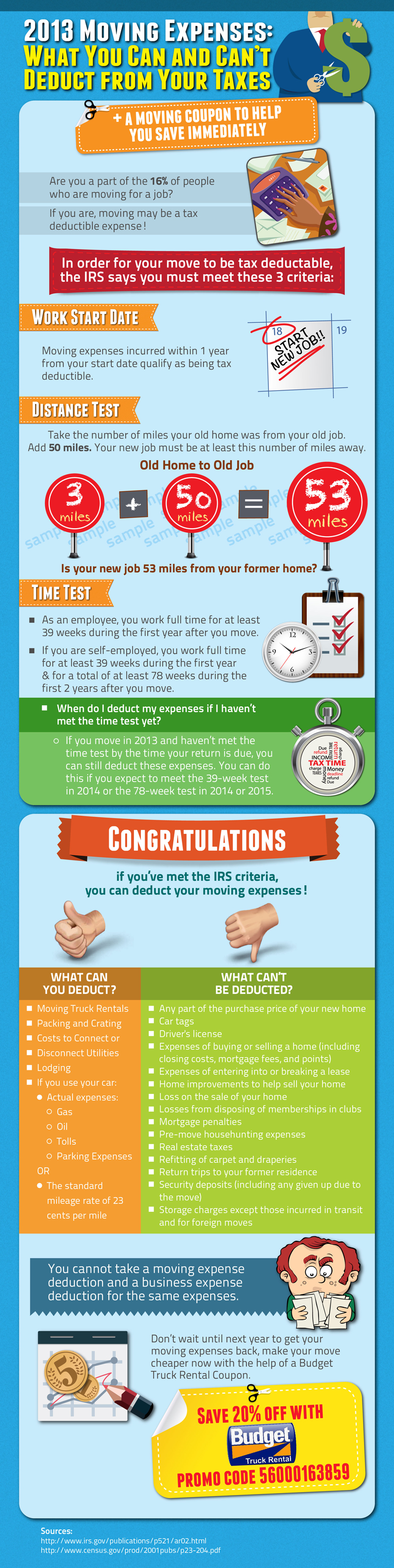

Are there tax deductions for moving. Irs moving deductions are no longer allowed under the new tax law. According to the irs, the moving expense deduction has been suspended, thanks to. If your income tax return is due before you’ve met this test, you can still deduct moving expenses if you expect to meet it.

If you work in the military and your move was due to a permanent change of station (pcs) order or deployment orders; According to the irs, the moving expense deduction has been suspended, thanks to the new tax cuts and jobs act. But there’s much more to this than meets the eye, and it might be possible for you to write off your moving expenses if you meet one condition.

This means you’d pay taxes on the money given to you by your employer as if the money was ordinary income. Are moving expenses tax deductible? However, the deduction is still available for some taxpayers, and there are other ways to offset the cost of moving.

Taxact reports your expenses and deduction on form 3903, moving expenses. See publication 521, moving expenses, for more information about these rules. This aspect of the tax code is pretty straightforward:

But there’s serious talk about making the elimination permanent. With recent actions by the states of arizona and minnesota to conform their state taxes to the federal tax cuts and jobs act (tcja) enacted at the end of 2017, almost all states have now acted. If you use your own vehicle during the move, you can deduct one of these:

But how you offset your expenses depends on whether you’re filing under the old rules or new rules. Moving expenses are not tax deductible for most people. It’s available on irs.gov or.

Armed forces and you had to move because of a permanent change of station. Moving expenses are not tax deductible for most people. You can add parking fees and tolls to either the time or distance test.

In addition, the irs states that “employers will include moving expense reimbursements as taxable income in the employees’ wages.” There is an exception, however: Even if you don’t, your employer, your credit card, or smart spending strategies may help you save.

Starting in 2018, congress did away with the federal tax deduction for moving expenses, with few exceptions. Then those moving costs can be deducted from taxes as well! The mileage rate for 2021 is 23.5 cents per mile.

The tax cuts and jobs act of 2017 eliminated the deduction just until january 1, 2026. Ad answer simple questions about your life and we do the rest. Citizens or resident aliens for the entire tax year for which they�re inquiring.

After the tax cuts and jobs act of 2017, citizens are no longer eligible to apply for tax deductions for moving expenses, and this rule stays in effect till 2025. As long as you meet the time and distance requirements. You might still have a state tax deduction, depending on where you live.

Or if you can’t work the required 39 weeks within the first year after your move due to a disability. For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. Due to the tax cuts and jobs act (tcja) passed in 2017, most people can no longer deduct moving expenses on their federal taxes.

Unfortunately, moving expenses are not tax deductible for most people. However, you can only write off pet expenses related to moves that meet certain conditions established by the irs: Most have adopted the federal suspension of the moving expense deduction/exclusion, but a few states remain in which employer payments for moving.

You’re also exempt from the time requirement if you’re laid off for any reason other than misconduct. Most people can’t deduct moving expenses, but you might be able to written by stephanie moore updated 07/29/2021 the tax cuts and jobs act of 2017 made it so. The tool is designed for taxpayers who were u.s.

“because moving expenses are not deductible, employer reimbursements for moving expenses are taxable to the employee,” explains michael sonnenblick, tax analyst with thomson reuters checkpoint. For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This interview will help you determine if you can deduct your moving expenses.

Up to 10% cash back if you move, you may be able to deduct your moving expenses. The move must closely relate to the start of work. If you moved in 2017, for a new job or to.

The 2017 tax cuts and jobs act changed the rules for claiming the moving expense tax deduction. Information you�ll need types and amounts of moving expenses. Unfortunately, thanks to the tax cuts and jobs act (tcja) of 2017, moving expenses are no longer deductible for most people.

From simple to complex taxes, filing with turbotax® is easy.