From simple to complex taxes, filing with turbotax® is easy. For people filing for tax years before 2018 work from home deductions.

This includes if you have to.

Are there tax deductions for working from home. The $1,500 maximum for the. There are, however, some extra requirements you must meet to be eligible for tax deductions on your home workspace to bear in mind. Here are some things to help taxpayers understand the home office deduction and whether they can claim it:

This includes if you have to. Under the 2017 tax law, teachers can deduct up to $250 for. 6 often overlooked tax breaks you wouldn�t want to miss.

Ad answer simple questions about your life and we do the rest. From simple to complex taxes, filing with turbotax® is easy. For your home office to be deductible, you must:

Unfortunately, most employees working from home can’t claim any federal tax deductions connected to being a remote worker during the coronavirus pandemic, says sundin. There are two ways you can claim the home office deduction. Working as an employee and for yourself.

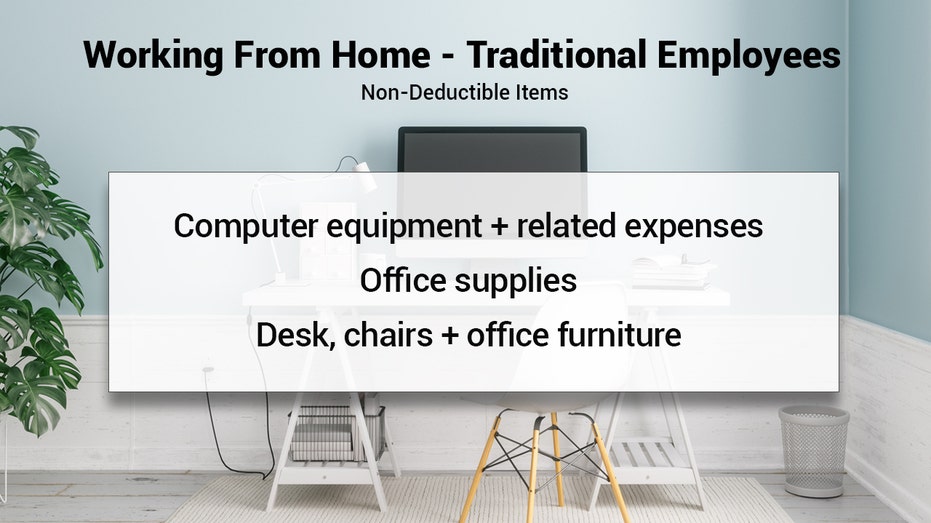

This included any home business office expenses (assuming you were a. Ad answer simple questions about your life and we do the rest. Employees are not eligible to claim the home office deduction.

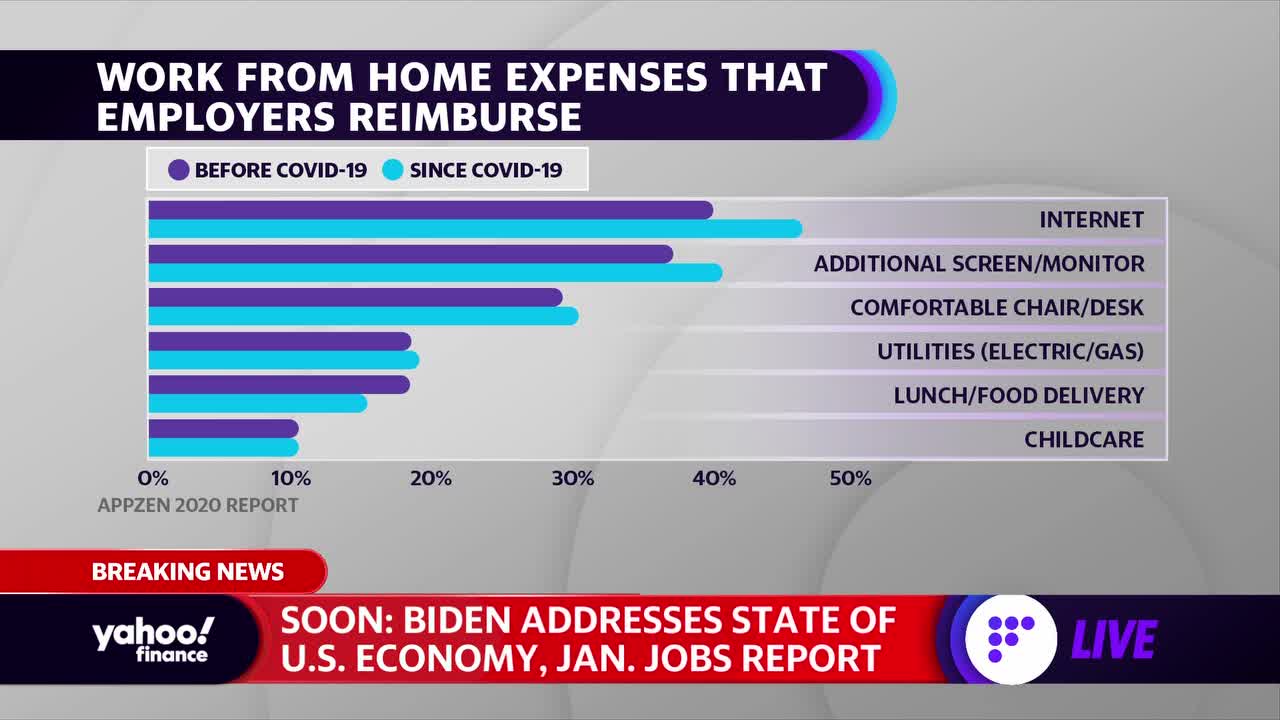

As with the 2020 tax year, the cra indicated that people who worked more than 50% of the time from home in 2021 for a period of at least four consecutive weeks due to the. For people filing for tax years before 2018 work from home deductions. Can you write off internet if you work from home?

If you�re an independent contractor, those deductions are also. You need to work from your home every day (even for just a few hours) or at least once per week for an average. Expenses for working from home are not deductible for most employees since the 2017 tax reform law.

From simple to complex taxes, filing with turbotax® is easy. One of the bigger tax deductions you can take if you work from home as an independent contractor is the. Use part of your home regularly and exclusively for work conduct most business from your home office

But here�s the real kicker: Extra expenses such as utilities are only deductible on your state taxes if your home office is used exclusively as an office. Ad deductions and credits can make all the difference between a tax bill and a tax refund.

Working from home you may be able to claim tax relief for additional household costs if you have to work at home on a regular basis, either for all or part of the week.