Content updated daily for arizona 529 tax deduction 9 rows arizona residents and taxpayers are eligible for a state tax deduction on 529 contributions.

Ad save for college in a 529 plan and enjoy tax deductions and other benefits.

Arizona tax deductions for 529 plan. Ad among america�s best plans. 25 rows families who invest in 529 plans may be eligible for tax deductions. The state of arizona also provides an annual arizona state income tax deduction for 529 plan contributions of up to $2,000 for individual tax filers, and up to $4,000 for married couples filing.

Learn what you can expect from the vanguard 529 plan and how it can benefit you. Ad save for college in a 529 plan and enjoy tax deductions and other benefits. 529 tax benefits for arizona residents arizona offers tax benefits and deductions when savings are put into your child�s 529 savings plan.

9 rows arizona residents and taxpayers are eligible for a state tax deduction on 529 contributions. Powered by state street spdr etfs. Here are the special tax benefits and considerations for using a 529 plan in arizona.

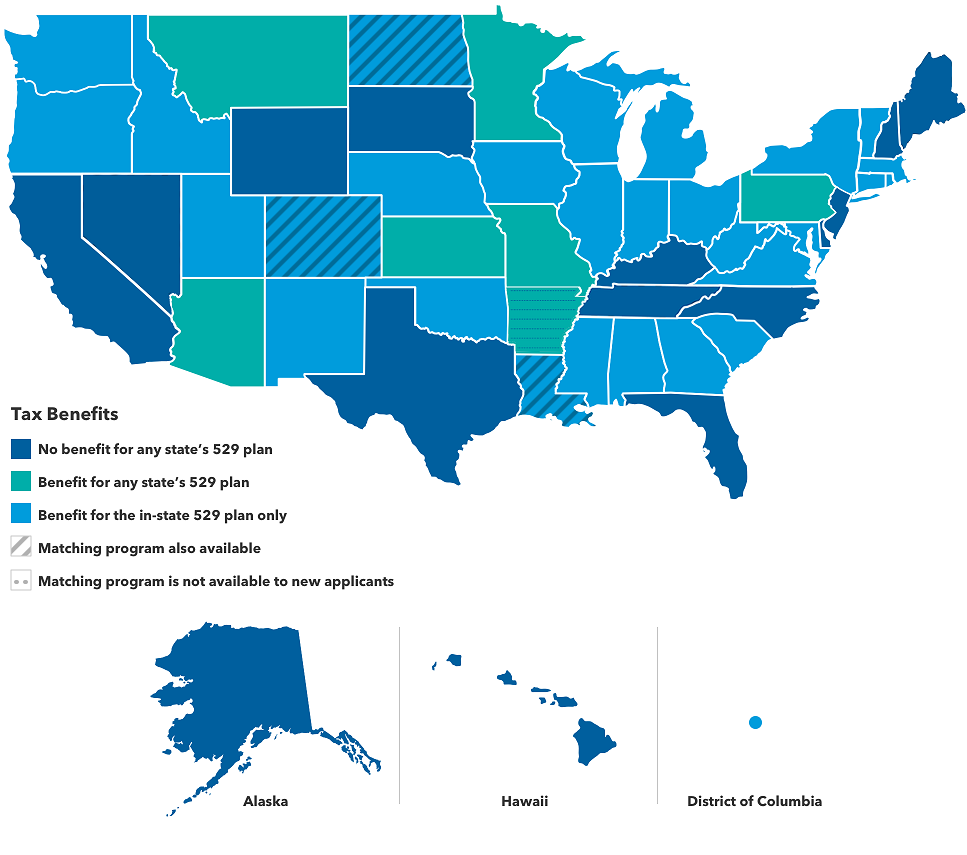

This provides a state of arizona income tax deduction for contributions made to 529 plan what are the qualifications? The state of arizona provides an annual arizona state income tax deduction for 529 plan contributions of up to $2,000 for individual tax filers, and up to $4,000 for married. The majority of states require taxpayers to contribute to their home state’s 529 plan to qualify.

Ad looking for arizona 529 tax deduction? Ad save for college in a 529 plan and enjoy tax deductions and other benefits. Unfortunately arizona does not offer any tax benefits.

8 rows state income tax deduction or credit for 529 plan contributions: Learn what you can expect from the vanguard 529 plan and how it can benefit you. Content updated daily for arizona 529 tax deduction

The incentive adds to the ongoing. Contributions arizona offers a state tax deduction for contributions to a 529 plan of up to $2,000 for single. Of the benefits, annuities, and pensions as retired or retainer pay of the uniformed services of the united states is exempt from arizona income tax (was capped at $3,500 in ty2020).

Because of gift tax laws, you will also need to complete form 709 when doing your taxes if you contribute more than $16,000 each year to a 529 plan. Access multiple 529 investment options. Ad among america�s best plans.

The plan is designed to pay for qualified expenses for fees, books,. A 529 plan can be a. Ad looking for arizona 529 tax deduction?

This tax incentive provides a state of arizona income tax deduction for contributions made to any state’s 529 plan. Content updated daily for arizona 529 tax deduction Ad learn what to expect when planning for college with help from fidelity.