The ato has just published the claims that they will take an interest in for the 2019 financial year. You can claim a deduction for tools and equipment if you use them to perform your duties as a truck driver.

Truck drivers often spend a good deal of time away from home so have expenses that quickly mount up.

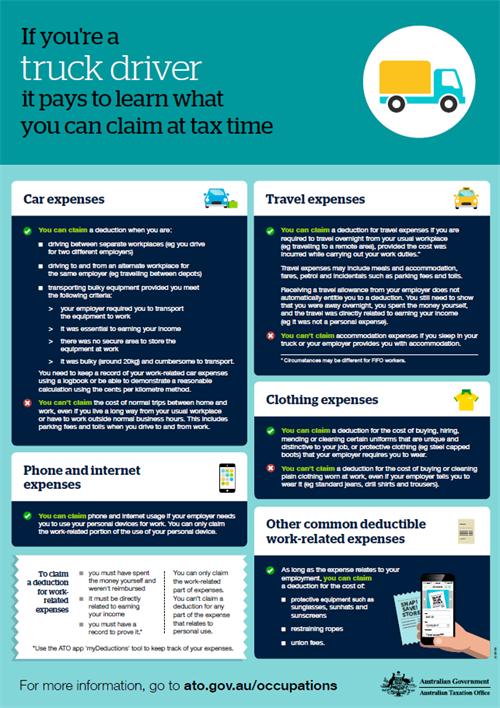

Ato tax deductions for truck drivers. The work related expenses which are the usual claims for truck drivers include :. Set up a free consultation with one of our experts. If the reimbursement by the employer is for the cost of a depreciable item (e.g., tools and equipment), a deduction is allowable to the truck driver for depreciation (see taxation.

Accounting services from $125 a month. Receive an overtime meal allowance paid under an industrial law or award, for example, the road transport and distribution award or the. Accounting services from $125 a month.

Truck drivers often spend a good deal of time away from home so have expenses that quickly mount up. What deductions can i claim? You cannot legitimately deduct the income lost as a result of deadhead/unpaid mileageonly the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would.

Truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Set up a free consultation with one of our experts. Luckily many of these expenses can be claimed as tax deductions on your annual.

Taxes and deductions that may be considered “ordinary and. Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and. You can’t claim a deduction for any part of an expense that is not directly related to earning your income or that.

You can claim a deduction for tools and equipment if you use them to perform your duties as a truck driver. The 2018 special standard meal allowance is $63/full day within the us,. Truck drivers who are independent contractors can claim a variety of tax deductions while on the road.

Oil changes, tire change, cleaning supplies,. The ato has just published the claims that they will take an interest in for the 2019 financial year. Any costs associated with washing and repairing your truck, provided this is not.

There is a wide range of deductions you can claim as a truck driver, such as: Protective equipment such as sunglasses, sunhats and sunscreens restraining ropes union fees.