$18,800 for head of household taxpayers Note that small business tax deductions will also have to be calculated quarterly and not annually if you file quarterly.

But whether you take the standard deduction or itemize for the 2021 tax year, here’s what deductions you can take, including what has changed.

Best business tax deductions for 2021. For miles driven in 2021, the standard mileage deduction is $0.56 per mile. Ad uncover business expenses you may not know about and keep more of the money you earn. Ad participating companies are eligible to receive significant tax breaks & cash grants.

Track all of the costs of operating the. For 2020, this is $0.575 per mile driven for business. Ad discover 19 reasons why you should form a nevada llc.

In order to do this, you must claim a section 179 deduction, which allows business owners to deduct up to $1,020,000 from new or used property in service during the tax year. As a small business, you can deduct 50 percent of food and drink purchases that qualify. Note that small business tax deductions will also have to be calculated quarterly and not annually if you file quarterly.

As with all telephone expenses, this deduction must clearly break out business from personal use. The 21 best 1099 tax deductions for self employed contractors if you can take a careful record of all of your business costs throughout the year then you will save yourself a lot of money. Ad participating companies are eligible to receive significant tax breaks & cash grants.

Ad discover 19 reasons why you should form a nevada llc. Low taxation, privacy, and more. The deduction limit for 2021 is $1,040,000.

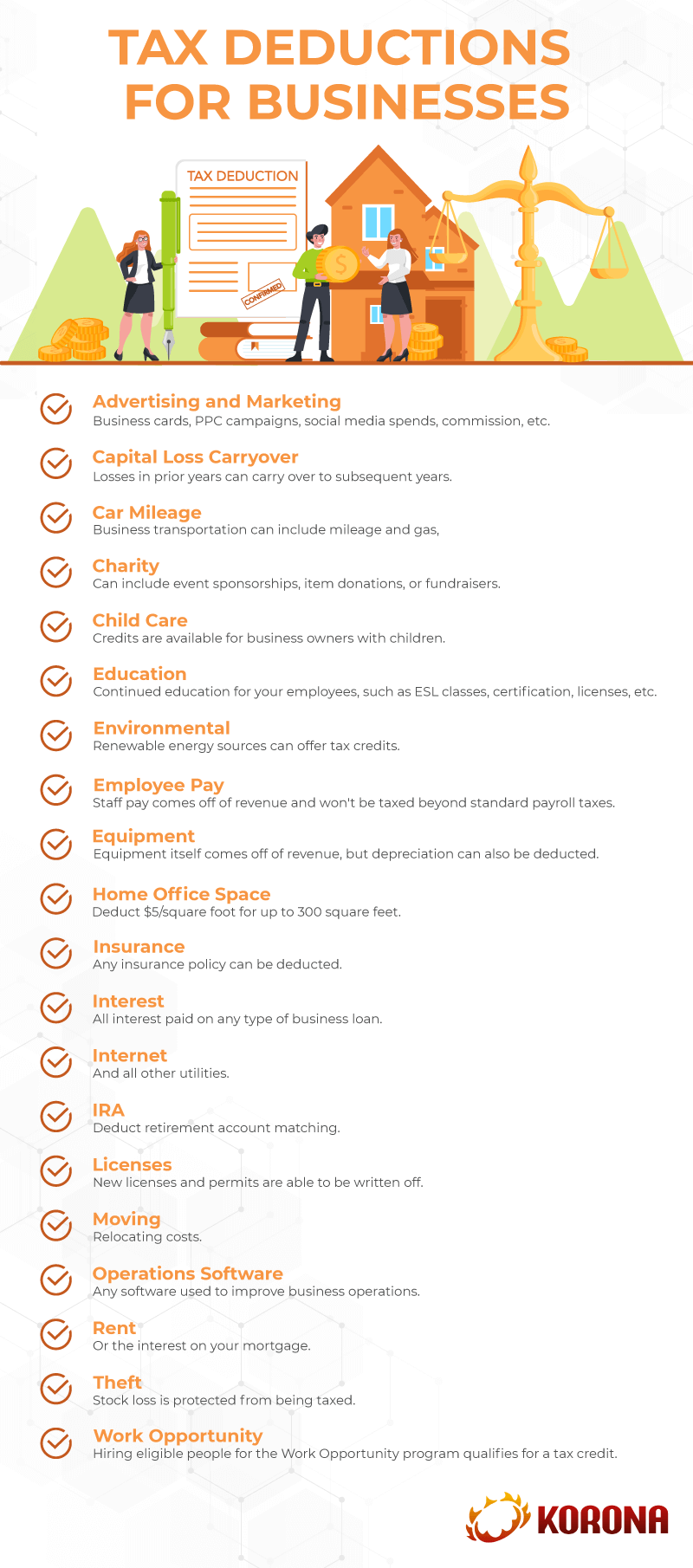

For those unfamiliar, tax deductions are kind of important as they can reduce your adjusted. Here are a few ways. Top deductions if you�re a small business owner, you don�t want to miss the best tax deductions available in 2021.

Do not just include 100% as it will damage your credibility in an audit. Webce is the trusted source for professionals in the insurance, tax &. Ad uncover business expenses you may not know about and keep more of the money you earn.

Best small business tax deduction 2021: So, if you drove 10,000 miles for work in 2020, you would get a tax deduction of. The experts at webce list the five best and most common tax deductions for small business owners in 2021.

The first quarterly filing date for those filing a form 1040. Another useful deduction for small businesses is bonus depreciation. The top small business tax deductions include:

For llc and sole prop you’ll take the standard irs mileage rate of.56 for 2021on every mile driven for business. Each state has its own standard deductions, but the irs automatically sets the federal standard deductions for 2020 taxes to be filed in 2021: Additionally, you should anticipate some new deductions on your taxes for 2021.

$12,550 for single and married filing separate taxpayers; The tax cuts and jobs act of 2017 doubled bonus. $18,800 for head of household taxpayers

Discover the right location, the best talent, & all of the incentives available to you. In 2022, it is $0.585 per mile. That drops to $0.56 per mile drive in 2021.

For the 2021 tax year (filed in 2022), the standard deduction amounts are: Low taxation, privacy, and more. But whether you take the standard deduction or itemize for the 2021 tax year, here’s what deductions you can take, including what has changed.

Discover the right location, the best talent, & all of the incentives available to you.