The new child tax credit was made fully refundable in 2021 and increased to up to $3,600 per year per child through age 5, and up to $3,000 per year for. Your hair stylist tax deduction checklist.

The new child tax credit was made fully refundable in 2021 and increased to up to $3,600 per year per child through age 5, and up to $3,000 per year for.

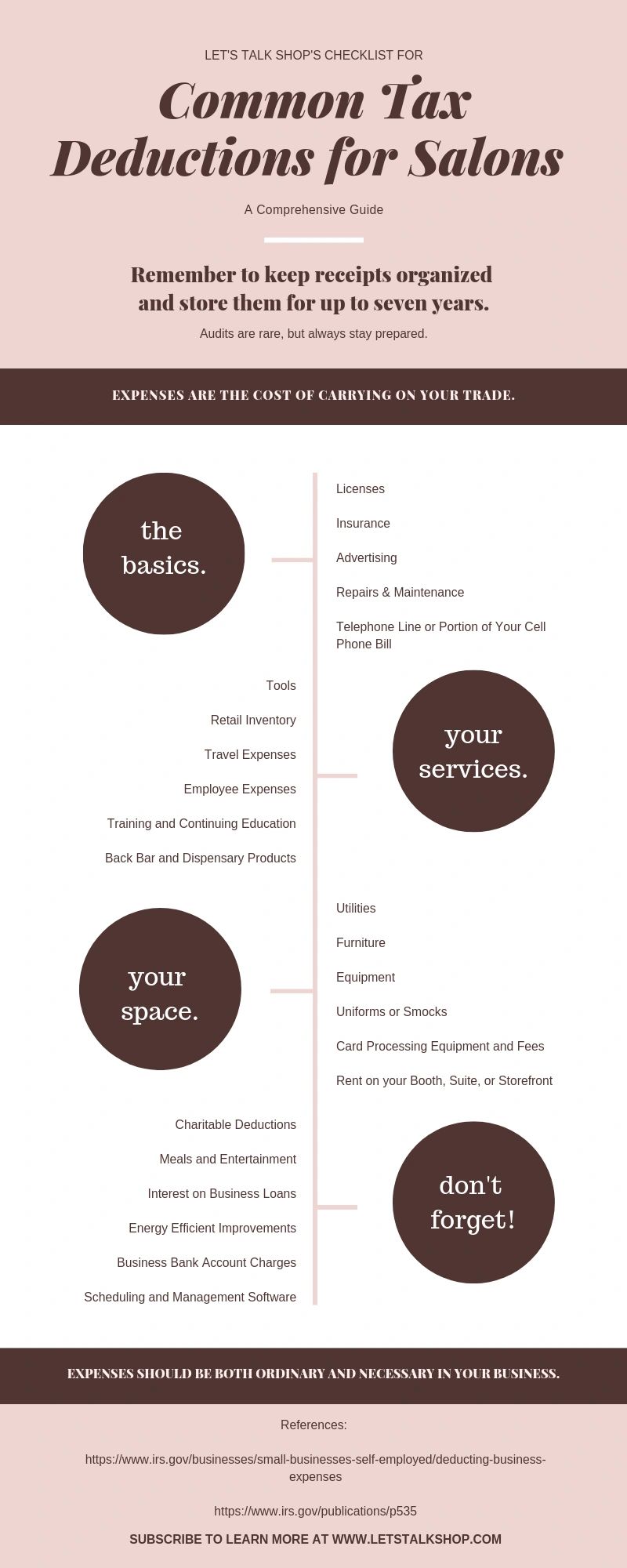

Best tax deductions for hairdressers. Any hairdresser will know how important it is to have the right tools of the trade. Your hair stylist tax deduction checklist. Car expenses like petrol, repairs and maintenance, and even the very purchase of your car can be seen as.

6 often overlooked tax breaks you wouldn�t want to miss. The amount you qualify for depends on your filing status. From basics, such as scissors, shampoo and a hairdryer, to more specialised colouring and styling.

The new child tax credit was made fully refundable in 2021 and increased to up to $3,600 per year per child through age 5, and up to $3,000 per year for. As a hair stylist, you can deduct business expenses that are both ordinary and necessary in the words of the irs. Salon employee tax credits hairstylists who work as an employee for a salon can apply the lifetime learning tax credit of up to $2000 per tax return.

Ppe expenses are deductible this year, many of your receipts are likely. Expenses are ordinary if they�re standard for a professional stylist. See the top 10 tax apps for seniors.

Ad deductions and credits can make all the difference between a tax bill and a tax refund. The standard deduction for 2021 (the taxes you file in early 2022) is $12,550 for single filers and $25,100 for joint filers. 5 tax deductions every barber or hair stylist should claim 1) supplies and equipment.

Mileage you can deduct home office to. Here are some tax deductions that you need to know (and use to your advantage) as a salon or spa owner this year: If you’re a hair stylist, here are 14 deductible expenses you should keep track of throughout the year.

Employee expenses • salon owners with. Get instant recommendations & trusted reviews The state and local tax.

Money spent on tuition and supplies. Ad see the top 10 ranked tax apps for seniors in 2022 & make an informed purchase.