Let turbotax® find every realtor deduction to maximize your refund. Standard auto deduction or standard mileage deduction.

You cannot deduct it if you can’t track it.

Best tax deductions for realtors. Join the millions who file smarter. Here are some ideas for staying better organized: Standard auto deduction or standard mileage deduction.

Licences & fees your state license renewal, mls. The irs section 179 depreciation allows businesses. Realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive.

Join the millions who file smarter. Evernote is an easy way to keep. 6 often overlooked tax breaks you wouldn�t want to miss.

Let a tax expert take taxes off your plate. This means you can now deduct your mileage and the business use of. Ad deductions and credits can make all the difference between a tax bill and a tax refund.

Let turbotax® find every realtor deduction to maximize your refund. Expenses for travel between business locations or daily. Sales and open house signs and flyers;

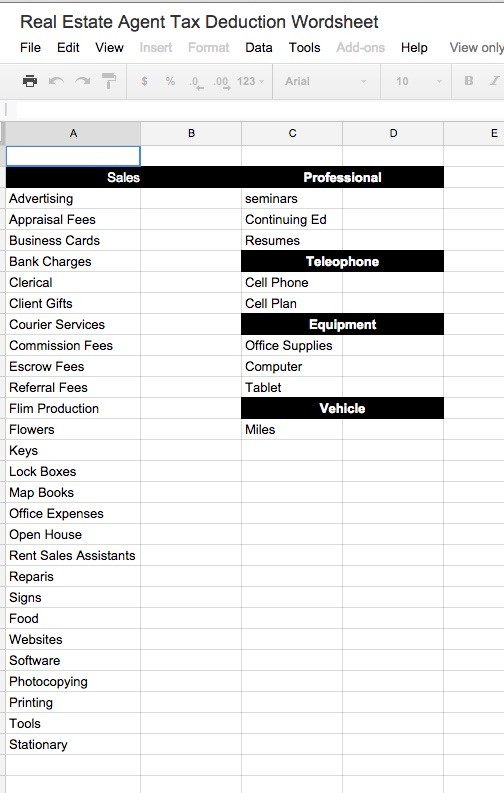

Here is a list of common tax deductions for realtors and loan officers to help get you started: Your auto expense is based on the number of qualified. As a real estate agent, your time and expenses from being on the road for business are business expenses.

Because the salt deduction is limited to $10,000, your total itemizable deduction would be $19,000. You’re only going to be 1099’d for the portion you received so this is a. Ad taxes can be complex.

So, you have two options: Let turbotax® find every realtor deduction to maximize your refund. Level 1 · 18 hr.

Since your standard deduction is $24,400,. Paid $6,000 in real estate taxes. Tax deductions for realtors february 28, 2018 / 0 comments / in tax central / by fiducial.

Find out whether it would benefit you more to write off your mileage or your expenses and go from. Buying and owning a vehicle can be a great option for your business when it comes to tax deductions for real estate agents. Here are some of the most common real estate agent and broker deductions:

Advertising and marketing billboards/bus stop ads brochures/flyers business cards copy. You cannot deduct it if you can’t track it. Let a tax expert take taxes off your plate.

Ad taxes can be complex. Deduction #3 show detail legal & professional services real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations.