Get a personalized recommendation, tailored to your state and industry. Browse & get results instantly.

Ad dedicated customer support & room for 5x more users with easy to use premium apps.

Best tax deductions for small business. Ad download the tax 101 tip sheet for an overview on the types of taxes businesses must file. Findresultsnow can help you find multiples results within seconds. Ad find out what tax credits you qualify for, and other tax savings opportunities.

There are a variety of taxes that are deductible, such as corporate income taxes (also referred to in some states as franchise taxes even though no franchise is involved),. Meals provided at office parties and picnics. The amount you can claim depends.

Top 10 small business tax deductions: Cleaning charges, such as dry cleaning and. The amount you qualify for depends on your filing status.

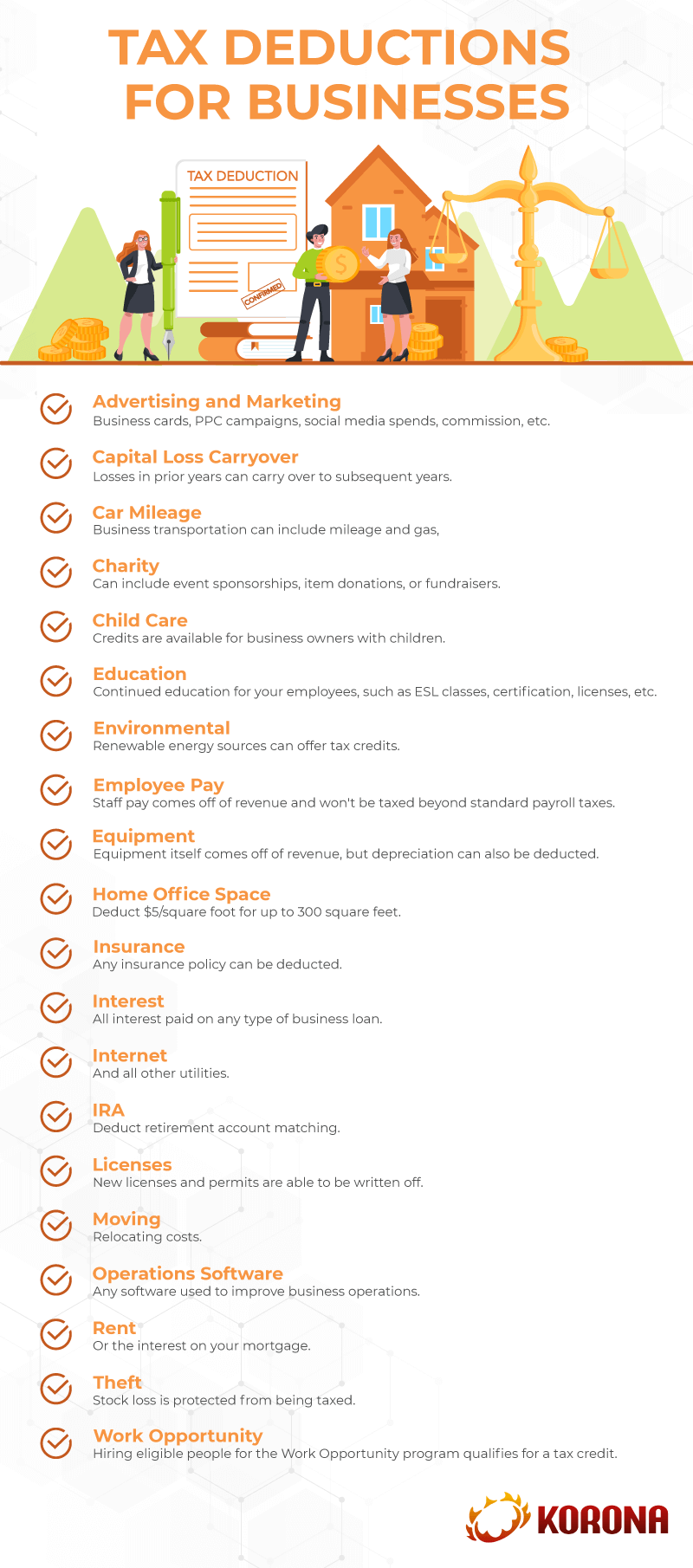

For 2020, the quality mileage rate is 57.5 center per mile driven for business use, down from 58 cents per. For 2020, the quality mileage rate is 57.5 center per mile driven for business use, down from 58 cents per. According to new simplified irs guidelines for home office expenses, small business owners who work at home offices can deduct $5 per square foot of the portion of.

Deductions for business meals for 2020, business owners can generally deduct 50% of qualifying food and beverage costs. Get a personalized recommendation, tailored to your state and industry. Ad dedicated customer support & room for 5x more users with easy to use premium apps.

Ad dedicated customer support & room for 5x more users with easy to use premium apps. The top small business tax deductions include:. Browse & get results instantly.

You can deduct 100% of the cost of providing meals to employees, such as buying pizza for dinner when your team is working late. To be eligible for the deduction, the expenses must. Deduct a typical rate on each “business” mile driven for the year.

Business communication expenses, such as business calls, faxes, and computer rental fees can also be deducted. The following business expense deductions are a. Ad search for info about best tax deductions for small business.

Small businesses can write off a number of expenses as tax deductions to help lower the amount they owe on their income tax. Download tip sheets on managing taxes from aarp�s small business resource center. Deduct a typical rate on each “business” mile driven for the year.

If your business spends money on advertising and promotion, make sure you keep track of these expenses.