Ad participating companies are eligible to receive significant tax breaks & cash grants. For those unfamiliar, tax deductions are kind of important as they can reduce your adjusted.

Ready to wine and dine your clients?

Business tax deductions for 2021. Beginning on january 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: Additionally, you should anticipate some new deductions on your taxes for 2021. You already know that providing amazing goods and services isn’t enough to make your business succeed.

In the 2021 and 2022 tax years, any. Bank fees maintaining a business. Ad participating companies are eligible to receive significant tax breaks & cash grants.

Ad participating companies are eligible to receive significant tax breaks & cash grants. So, for 2019 and 2020, the amount of interest expenses businesses can deduct on. Here�s one special consideration to keep in mind:

With many families and businesses struggling to. 56 cents per mile driven for business use, down 1.5. The tax code saw some major overhauls in 2021 amid the pandemic.

For those unfamiliar, tax deductions are kind of important as they can reduce your adjusted. 2021 has been a hard year for us all as we worked to recover as a nation in the midst of a pandemic. Under prior law, the deduction for business meals was limited to 50% of the cost.

Discover the right location, the best talent, & all of the incentives available to you. Ready to wine and dine your clients? Do not just include 100% as it will damage your credibility in an audit.

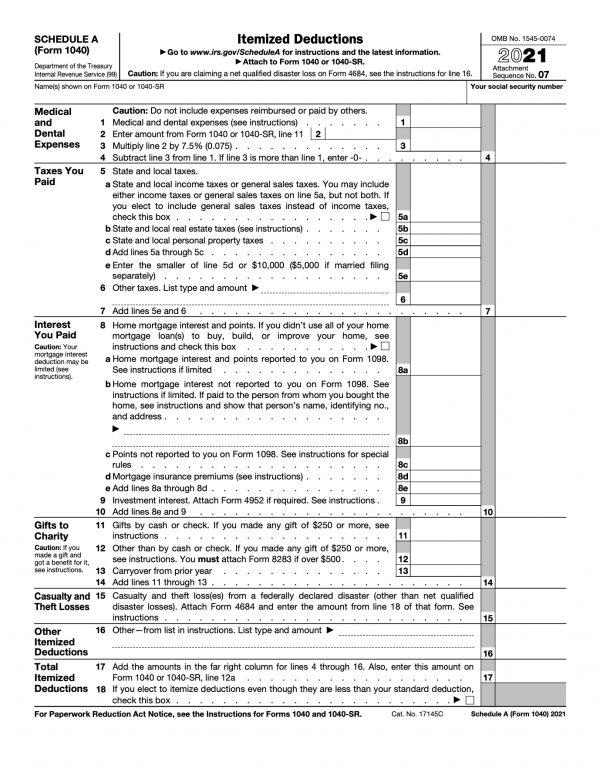

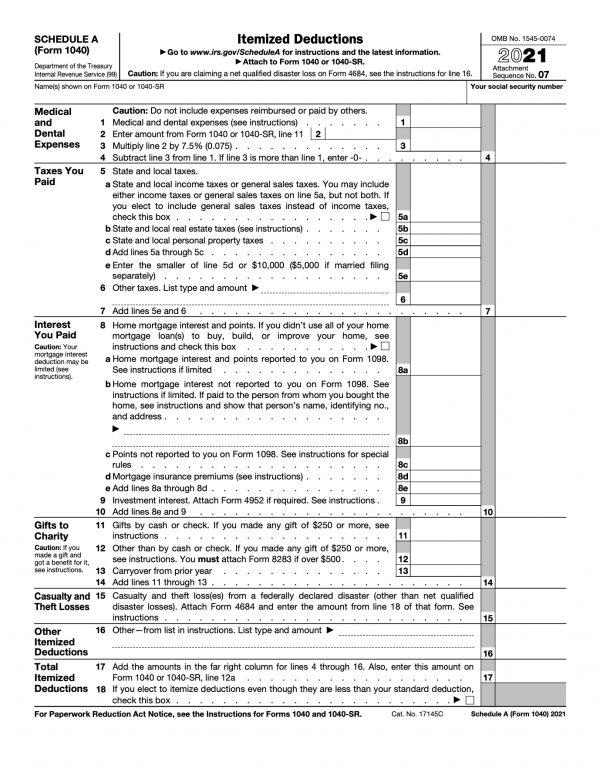

Discover the right location, the best talent, & all of the incentives available to you. Common schedule 1 deductions for 2021 are: Businesses are able to increase business interest expense deductions on tax returns.

For those age 65 and. As with all telephone expenses, this deduction must clearly break out business from personal use. Complete list of small business tax deductions.

The temporary 100% deduction for restaurant meals. Standard small business tax deductions. Each state has its own standard deductions, but the irs automatically sets the federal standard deductions for 2020 taxes to be filed in 2021:

The standard deduction for 2021 is $12,550 for individuals and $25,100 for married people filing jointly, up from $12,400 and $24,800, respectively, in 2020. It’s important for a business owner to understand when the temporary 100. Some of the common small business tax deductions include:

Claim these 2021 tax breaks now, before they�re gone. There are many things to buy for a business startup in an office setting, from. In addition, you can deduct your lodging and meals attributable to business travel.

For example, accounting services used in 2021 for 2020 taxes, that service can be written off in 2022 when 2021 tax returns are filed.