Further, you must reduce the $25k by the personal use percentage. Gross vehicle weight can qualify for at least a partial section 179 deduction, plus bonus depreciation.

You can get a tax benefit from buying a new or new to you car or truck for your business by taking a section 179 deduction.

Business tax deductions for automobiles. Multiply the miles driven for business during the year by a standard mileage rate. To compute the deduction for business use of your car using the standard mileage method, simply multiply your business miles by the amount per mile allotted by the irs. So if you use your car for work 70% of the time, you can deduct 70% of the cost.

Renting to your business instead For tax year 2021, that. For tax year 2021, that amount is 56 cents per mile.

In the example above, the deduction turns out to be $2,800 (5,000 miles x $.56 = $2,800). This special deduction allows you to deduct a big part of the entire cost of the vehicle in the first year you use it if you are using it primarily for business purposes. Employees who use their car for work can no longer take an employee business expense deduction as.

Further, you must reduce the $25k by the personal use percentage. Gross vehicle weight can qualify for at least a partial section 179 deduction, plus bonus depreciation. For miles driven in 2021, the standard mileage deduction is $0.56 per mile.

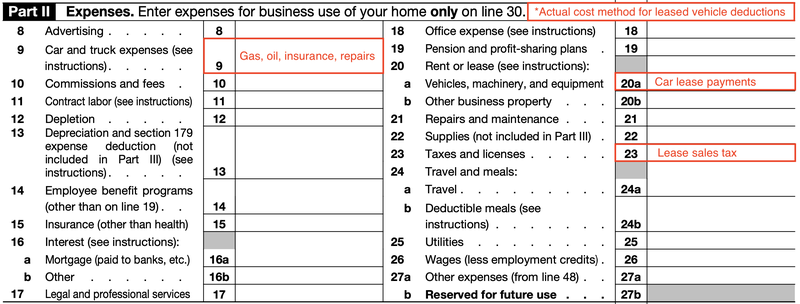

So that’s just a very quick overview of the vehicle tax deduction, but if you want to get a deeper dive. Oil and gas tires licenses tolls and parking fees lease or rental payments registration fees and taxes vehicle loan interest insurance garage rent. How section 179 deductions work

Qualifiable purchases depend on the purpose of the meal and. You can get a tax benefit from buying a new or new to you car or truck for your business by taking a section 179 deduction. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation.

You have two options for deducting car and truck expenses. Complete list of small business tax deductions. • obvious “work” vehicles that have no potential for personal use typically qualify.

Business insurance you can deduct the cost of. The irs allows you to deduct the following actual car expenses: While this is acceptable, it’s not nearly as good as the actual expense method in reducing your tax liability.

Therefore, her car is used 75% for business and 25% for personal purposes. Then make sure you check out this post on how to write off your dream car. Accelerating depreciation with bonus depreciation

Yeah, the biking to the grocery store is a nice counterargument. We would defer business owners to this method only if they can’t meet the 50% business mileage minimum using the actual expense method. It has to be used for business at least 50% of the time.

This is key because the more your vehicle weighs, the more you. 1 depreciation licenses gas oil tolls lease payments insurance garage. You can also deduct interest on an auto loan, registration and property tax fees, and parking and tolls in addition to the standard mileage rate deduction, as long as you can prove that they are business expenses.

There are two methods for deducting vehicle expenses, and you can choose whichever one gives you a greater tax benefit. To qualify as a “heavy” vehicle, an suv, pickup or van must have a manufacturer’s gross vehicle weight rating (gvwr) above 6,000 pounds. When it comes to deducting general car expenses, the business owner.

You can deduct $0.585 per business mile driven in 2022. The irs allows up to $25k up front depreciation (100%) for suv over 6,000 lbs plus 50% bonus depreciation for new vehicles which will get close to that figure. Car expenses as tax deductions.

However, if you use the car for both business and personal purposes, you may deduct only the cost of its business use. So if you have a business, you need a vehicle for business and you need more deductions, then you got to take advantage of the vehicle tax deduction, in general. To compute the deduction for business use of your car using standard mileage method, simply multiply your business miles by the amount per mile allotted by the irs.

In 2022, it is $0.585 per mile. In keeping with the business tax deductions that are disallowed, claiming your only automobile as 100% business use is a tough sell unless you have another automobile. The vehicle must be driven over 50% of the miles for business purposes.

If you use your car only for business purposes, you may deduct its entire cost of ownership and operation (subject to limits discussed later). You can claim the mileage you use for business driving, either by deducting the actual miles traveled for business, or by using the standard mileage deduction of $0.56 per mile driven. Note that the 179 deduction can’t be taken on vehicles used less than 50% for business.

Determine the standard mileage deduction the standard mileage deduction formula is: