So if you use your car for work 70% of the time, you can deduct 70% of the cost. It has to be used for business at least 50% of the time.

Write off car with section 179 vehicle tax deduction

Business tax deductions for cars. Before the tax cuts and jobs. • obvious “work” vehicles that have no potential for personal use typically qualify. For tax year 2021, that.

Oil and gas tires licenses tolls and parking fees lease or rental payments registration fees and taxes vehicle loan interest insurance garage rent. To calculate how much you can deduct for your personal car being driven for business purposes, multiply that amount times the number. Whether a personal or business lease, you get a deduction for hauling supplies from your office to a client or.

Note that the 179 deduction can’t be taken on vehicles used less than 50% for business. Complete list of small business tax deductions. In 2022, it is $0.585 per mile.

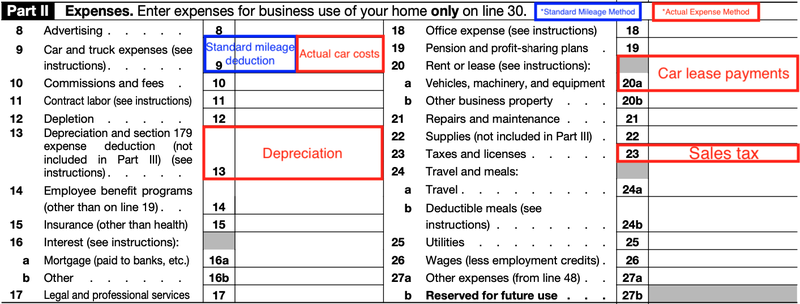

For miles driven in 2021, the standard mileage deduction is $0.56 per mile. In the example above, the deduction turns out to be $2,800 (5,000 miles x $.56 = $2,800). Business owners can deduct expenses for the use of a car for business purposes, for their own driving, and for employee driving.

If you use your car for business activities, such as driving to see a client or going to the store to buy office supplies, the costs may be tax deductible as long as you keep track of the mileage. In 2021 and under irc § 168 (k), your business may have qualified for a federal income tax deduction up to 100% of the purchase price of a new nissan truck or van purchased and placed in service in 2021. If your car use is mixed between business and personal reasons, you can only deduct costs that are related to the business usage of the vehicle.

The irs allows you to deduct the following actual car expenses: The business use of your car — owned or leased — is a deductible business expense. As a small business owner you are always looking for ways to lower your taxes.

And then you have the actual expenses deduction which allows you to write off the direct costs of the vehicle including depreciation. Write off car with section 179 vehicle tax deduction Qualifiable purchases depend on the purpose of the meal and.

This special deduction allows you to deduct a big part of the entire cost of the vehicle in the first year you use it if you are using it primarily for business purposes. What cars can you write off on taxes? Employees who use their car for work can no longer take an employee business expense deduction as.

You can claim the mileage you use for business driving, either by deducting the actual miles traveled for business, or by using the standard mileage deduction of $0.56 per mile driven. To compute the deduction for business use of your car using the standard mileage method, simply multiply your business miles by the amount per mile allotted by the irs. Buying a vehicle that is 6000 pounds or more is an excellent tax write off.

For 2022, the rate is $.585 per mile driven for business use. For tax year 2021, that amount is 56 cents per mile. It has to be used for business at least 50% of the time.

So if you use your car for work 70% of the time, you can deduct 70% of the cost. You have the standard mileage rate deduction which calculates how many business miles you have driven and gives you a deduction based on that. This includes a nissan titan and nv cargo van.

The deductible mileage rate for 2021 is $.56 per mile. You can get a tax benefit from buying a new or new to you car or truck for your business by taking a section 179 deduction. You or your business leases or owns the car you can’t deduct a car you don’t own or lease.

Multiply the miles driven for business during the year by a standard mileage rate. Gross vehicle weight can qualify for at least a partial section 179 deduction, plus bonus depreciation. Gross vehicle weight can qualify for at least a partial section 179 deduction, plus bonus depreciation.

How to qualify for business car tax deductions 1. The car can be owned by the business or employee, and you can use a standard mileage or actual expenses deduction to determine the amount of the deductions. Make sure the car’s title.

To compute the deduction for business use of your car using standard mileage method, simply multiply your business miles by the amount per mile allotted by the irs. When it comes to deducting general car expenses, the business owner has two options to choose from: 1 depreciation licenses gas oil tolls lease payments insurance garage.

There are two methods for deducting vehicle expenses, and you can choose whichever one gives you a greater tax benefit. Qualifying vehicles must have had a gross vehicle weight rating of over 6,000 lbs. Accelerating depreciation with bonus depreciation