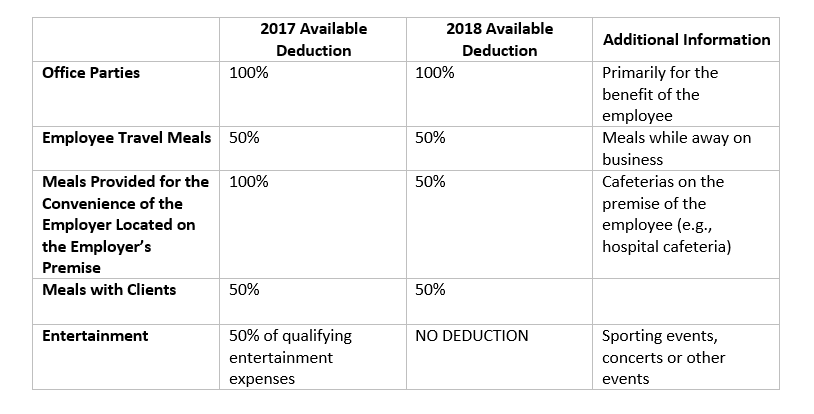

The 2017 tcja eliminated the deduction for any expenses related. These final regulations address the disallowance of the deduction for expenditures related to.

And for these businesses, you should not use the boat for entertainment purposes, or else it will invalidate the business transport deduction.

Business tax deductions for entertainment. Often times, entertaining the aforementioned parties can help you win business, expand your network and show your appreciation for those you work with. Know what you can and cannot get a deduction on The section 179 deduction allows business owners to deduct up to $1,080,000 of property placed in service during the tax year.

The 2017 tcja generally eliminated the deduction for any expenses related to activities generally considered entertainment, amusement or recreation. Washington — the internal revenue service issued proposed regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja). Those businesses that provide food, including restaurants and catering firms, are 100% eligible.

The long answer starts with one crucial question: Meals provided for the convenience of the employer (such as meals for occasional employee overtime) 100% deductible in 2021 and 2022 if the meals are provided by a restaurant Building relationships with your employees, contractors, vendors, advisors, competitors, etc.

It’s also a good idea to keep a record of every expense and activity of your business. You can deduct insurance, fuel, repairs, crew salaries, depreciation, and hurricane storage. Entertainment expenses for recreational or social activities for your employees, such as a holiday party or a company picnic.

Tax deduction for entertainment a business expense is tax deductible. That is the short answer. Is key to being a successful entrepreneur.

Ad uncover business expenses you may not know about and keep more of the money you earn. If your only use of the vacation home is for business meetings, you deduct 100 percent of the vacation home. With this change, the costs of treating a client to a game of golf, trip to the theater, sporting event, or any other entertainment became nondeductible.

These final regulations address the disallowance of the deduction for expenditures related to. Unless entertainment is subject to fbt, then entertainment is deductible nevertheless. The section 179 deduction is limited to the business’s taxable income, so claiming it cannot create a net loss on your return.

In order to deduct expenses in your trade or business, you must show that the expenses are “ordinary and necessary.” an ordinary expense is one which is customary in your particular line of work. Further, the entertainment facility deduction is not available for meetings where your principal purpose is to reward your employees or agents. And gst follows whatever happens for income tax purposes.

Entertainment expenses that are reported on your tax return as taxable compensation to your employees. Irs updates guidance on business expense deductions for meals and entertainment. However, taxpayers may still deduct business expenses related to food and beverages if certain requirements are met.

The 2017 tcja eliminated the deduction for any expenses related. And for these businesses, you should not use the boat for entertainment purposes, or else it will invalidate the business transport deduction. Meals during entertainment that are not listed separately on the invoice the following types of expenses are 50% deductible in 2020: