The new coronavirus tax bill has 100% deduction for business meals and beverages in a restaurant that are incurred after dec. Proposed regulations issued earlier this year permit a taxpayer to deduct meal expenses if (1) the expense is not lavish or extravagant under the circumstances;

What business meals are tax deductible?

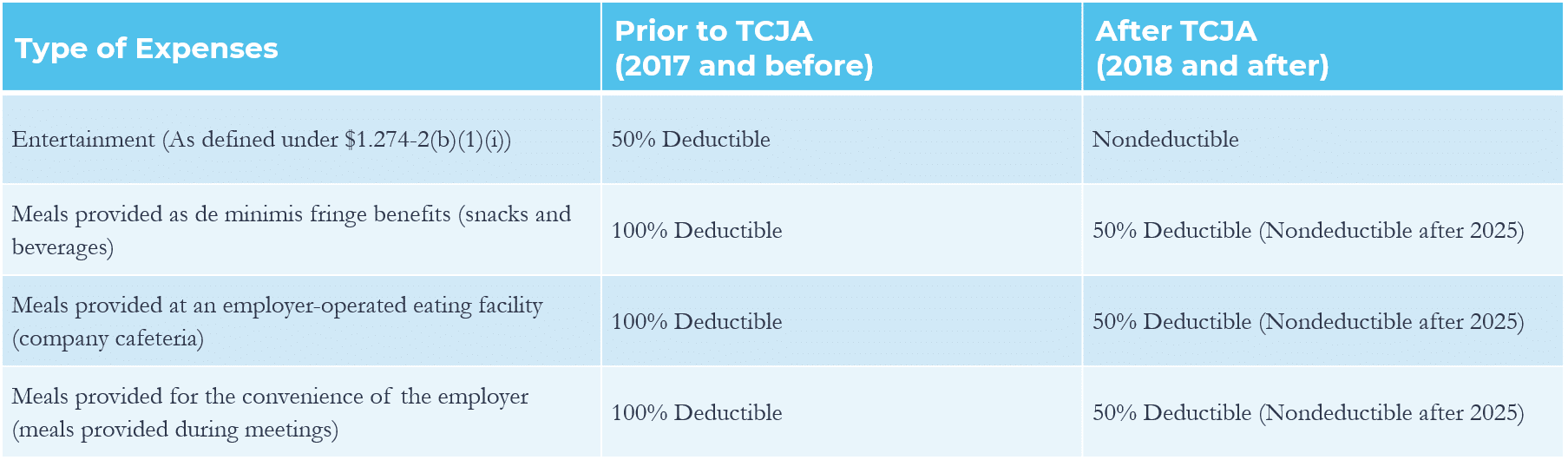

Business tax deductions for meals. Washington — the internal revenue service issued final regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja). Washington — the internal revenue service issued proposed regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja). Meal expenses by an employee during a business trip, and reimbursed to that employee, are still only deductible at 50 percent, even though the employee was reimbursed 100 percent for the cost of the meals.

This new law is for expenses incurred in 2021 and 2022. The business owner or employee is present. The expense must be an ordinary and necessary part of carrying on your business the meal cannot be lavish or extravagant under the circumstances the business owner or an employee must be present at the meal

What business meals are tax deductible? This means that every time you take out a client for dinner and drinks, you get to write off half of the bill. Reimbursements using per diem rates are always only 50 percent deductible.

And a 50% limit is in. The irs released guidance on thursday explaining when the temporary 100% deduction for restaurant meals is available and when the 50% limitation on the deduction for food and beverages continues to apply for sec. This broad change initially was interpreted to eliminate paying for meals or drinks at restaurants.

Meal expenses you can�t deduct. 31, 2020, and before jan. Qualifying for meal expense deductions.

However, you can not go around deducting meals indiscriminately. The new coronavirus tax bill has 100% deduction for business meals and beverages in a restaurant that are incurred after dec. Tax deductions for business meals contributed by sandy furuya · wednesday, may 30 th, 2018 in april of 2018 the aicpa asked the house committee on ways and means for an update to tax deductions for business meals with clients and prospects.

Proposed regulations issued earlier this year permit a taxpayer to deduct meal expenses if (1) the expense is not lavish or extravagant under the circumstances; Business meals you can generally deduct 50% of qualifying food and beverage costs. What are business meal expense deductions?

The irs has guidelines and tests that help you correctly deduct your meals. Food distributed free of charge to the public for free (this is still deductible) holidays and gatherings for the employee’s birthday or holiday (100% deductible); The following meals and supplies are deductible:

It’s important for a business owner to understand when the temporary 100 percent deduction applies and when the 50 percent limit is in effect. Under a provision in the consolidated appropriations act (caa), the usual deduction for 50% of the cost of business meals is doubled to 100% for food and beverages provided by restaurants for the 2021 and 2022 tax years. Irs updates guidance on business expense deductions for meals and entertainment.

Uncle sam is helping to pick up the tab for certain business meals in 2021 and 2022. The 2017 tcja eliminated the deduction for any expenses related. Ad uncover business expenses you may not know about and keep more of the money you earn.

Under the tax cuts and jobs act, which went into effect on january 1, 2018, business owners no longer can deduct the costs of business entertainment, amusement, or recreation. The meal is with a business contact. Expenses for business related meals are 100% tax deductible with the enactment of the federal consolidated appropriations act last december.

To be eligible for the deduction: Previously, business meals at restaurants were limited to a 50% deduction. The aicpa wanted to confirm that the tax cuts and job acts disallowance of entertainment as understood.

It’s important for a business owner to understand when the temporary 100 percent deduction applies and when the 50 percent limit is in effect. You can fully deduct the cost of business gifts up to a maximum of $25 per client per year if they’re: The 2017 tcja generally eliminated the deduction.

Note for the 2021 and 2022 tax years: To be deductible as a business meal, section 274 (k) provides that the food or beverages must not be lavish or extravagant under the circumstances and the taxpayer or an employee of the taxpayer must be present at the furnishing of the food or beverages. Irs issues final regulations on the deduction for meals and entertainment.

Client business meals, (100% deductible). Limited tax deduction for business meals. The good news is that business meals are 50 percent deductible.

Some meal and entertainment expenses may be fully deducted.