Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income. List the total value of your donated goods on line 17,”gifts to charity.” complete form 8283 for goods valued at over$500.

According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and.

Calculating tax deductions for clothing donations. During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. Non cash charitable contributions / donations worksheet. If you are using a tablet or mobile device, you cannot enter any data.

The amount of the deduction for a donation of a remainder interest in real property is the fmv of the remainder interest at the time of the contribution. Work clothes are among the miscellaneous deductions that are only deductible to the extent the total exceeds 2 percent of your adjusted gross income. Potential dollars you may be able to deduct from your taxes as a donation.

According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Cash gifts and mileage driven on behalf of a charity are also deductible, but always remember to record your contributions and get receipts for them. Fill out schedule a of form 1040.

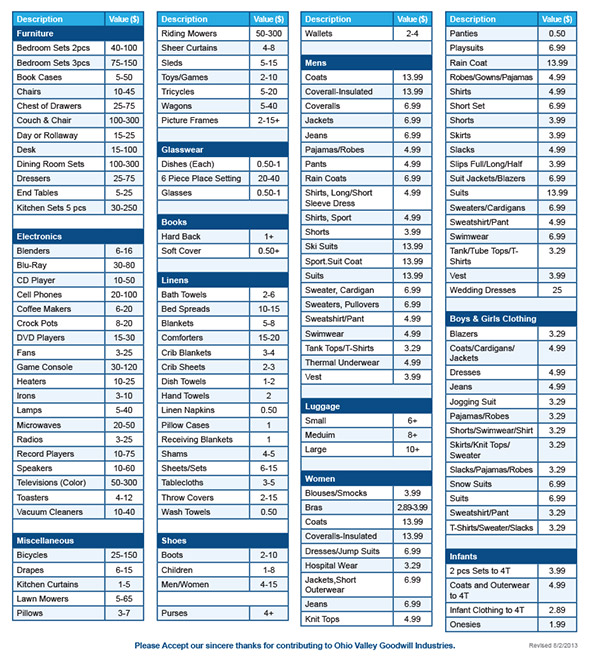

The value of clothing donations to charity are based on published lists of retail values or current thrift store prices. 1457 and 1458 contain these factors. Below is a donation value guide of what items generally sell for at goodwill locations.

Vincent de paul, you may be eligible to receive a tax deduction for your donation. * for informational purposes only. Determining used goods donation value.

How much can i deduct for clothing donations 2021. Turbotax® itsdeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. Insert tax year ===> insert date given ===> enter items not provided for in the above categories.

How to claim clothing donations? Fair market value is the price a willing buyer would pay for them. However, you can browse the sheet to find values.

Hours of programs and services to place people into new jobs and careers. List the total value of your donated goods on line 17,”gifts to charity.” complete form 8283 for goods valued at over$500. The donation impact calculator is a great way to see how your donations support your goodwill’s programs and services.

Call your local donation center or visit its website to find out the hours of operation and what items are allowed. The irs says donated clothing and other household goods must be “in good used condition or better.” if you claim a deduction of $500 or more for a used item that’s not in good condition, the irs. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant.

Simply select the types of clothing, household and/or electronics items donated, and instantly see how that translates into hours of programs and services provided to people in the community. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. You can list the total amount for your donated items, adjusted to be the fair market value, on line 17, “gifts to charity.” if you have an item or collection of items that you are donating that is worth over $500, you will need to fill out another form as well.

A clothing tax donation receipt serves as documentation of a charitable clothing donation which the donor can use to claim as a deduction against their state and/or federal taxes. Form 8283 is the form that you’ll be looking for. Get the most from your charitable contributions anytime.

Internal revenue service (irs) requires you to value your donation when filing your return. To determine this value, you must know the fmv of the property on the date of the contribution. To determine the fair market value of an item not on this list, use 30% of the item’s original price.

You can look up clothing, household goods furniture and appliances. List your donation values on the form 8283 with the help of turbotax in this video on filing annual taxes. Learn how to estimate the value of clothing for irs tax deductions as charitable donations.

Schedule a free pickup online Receive a donation receipt for your taxes and rest assured that you have helped us do the most good in your community. Potential pounds of goods diverted from landfills.

Standard guidelines, such as a fixed percentage of an item’s original value, can help to. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and. Please work with a certified tax service to determine the.

Ad donate your used clothing, furniture & appliances. Since donated clothing is often secondhand, it is up to the donor to estimate the clothing’s values. How to claim charitable donations when you file your tax return.

Multiply this value by the appropriate factor. Keep a list of everything you give to charity, and do research to calculate the fair market value of the things you donate. The taxpayer certainty and disaster relief act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021.

You can then follow a link to read how an individual benefited from. Drop off your items at the donation center near me.