Two home offices can look the same but have a different tax status. But here�s the real kicker:

For people filing for tax years before 2018 work from home deductions can be used.

Can i get tax deductions for working from home. They include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent. We explain changes in your tax refund and provide tips to get your biggest refund. If you have to buy any office assets out of your own pocket, including a desk, office chair, computer, monitor.

Get smarter about your money and career with our weekly newsletter Unfortunately, most employees working from home can’t claim any federal tax deductions connected to being a remote worker during the coronavirus pandemic, says sundin. Working as an employee and for yourself doesn’t necessarily disqualify you from taking these tax deductions.

While congress has made some changes in tax law due to the coronavirus, home office deductions and other miscellaneous itemized deductions were not included in recent legislation. Prior to the tax cuts and jobs act. Employees are not eligible to claim the home office deduction.

Expenses for working from home are not deductible for most employees since the 2017 tax reform law. There are certain expenses taxpayers can deduct. Who can claim the home office deduction?

Before the tax cuts and jobs act (tcja), salaried or hourly employees who worked from a home office could claim the home office deduction. The short answer is, probably not. This included any home business.

That means your depreciation deduction is $200,000 x 10% x 2.461%. If the home office is 200 square feet, for example, the deduction would be $1,000. The home office deduction form 8829 is available to both homeowners and renters.

But here�s the real kicker: For people filing for tax years before 2018 work from home deductions can be used. Taxpayers must meet specific requirements to claim home expenses as.

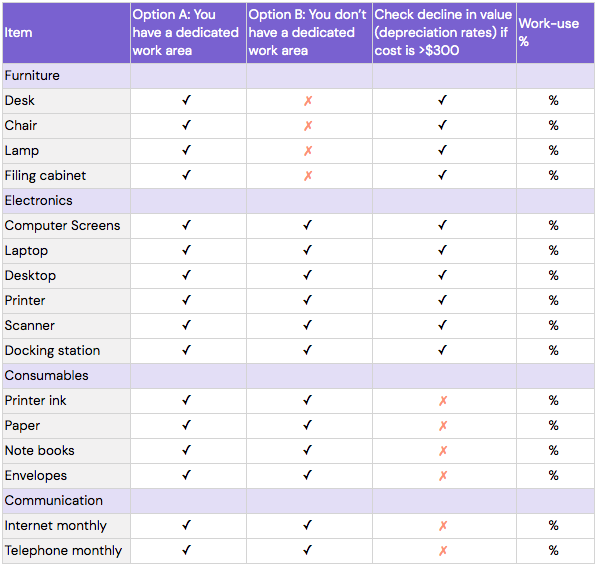

If you’re an employee filing taxes between 2018 and 2025, you cannot claim the deduction, she said. If you kit out your home office with furniture such as desks, shelving and cupboards, you can claim a deduction for the decline in value of that furniture to the extent that it relates to your work activity. And 10% is dedicated to office space.

Two home offices can look the same but have a different tax status. Also, the current limitation on deductions is set to expire in 2025, so after that tax year expenses for working from home will again be deductible for many employees. Although there are tax deductions in place for people working from home, they won’t apply to most remote employees during this pandemic.

Prior to passage of the 2017 tax cuts and jobs act, employees could possibly include unreimbursed. However, you can only deduct costs tied directly to your work and to. 4 so, let’s say you have a home valued at $300,000 ($200,000 for the home and $100,000 for the land).

But the tcja ended the deduction for employees working from a home office for the convenience of their employer. For taxpayers who worked from home regularly in 2021, the irs allows a deduction for associated expenses, including repairs, utilities, rent, a security system and renters insurance. Like many others who are lucky enough to be able to do their jobs from home, you might now be wondering if you can claim a federal income tax deduction for home office expenses.

Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve. The current irs depreciation table allows you to deduct 2.461% of your home’s market value (excluding the value of land). Though millions are now working from home due to the coronavirus, only a subset of them can claim the deduction.