To claim a tithing tax deductible for cash and check donations, verify your tithing donation amount with one of the following: Tax deduction is given for donations made in the preceding year.

It applies to cash donations of up to $300, or $600 if you’re married and filing jointly.

Can you get tax deductions for donations. To claim a tax deduction for a gift or donation you make, it must meet the following four conditions. When you donate cash to a public charity, you can generally deduct up to 60% of your adjusted gross income. And who said that uncle sam wasn’t a compassionate guy?

Up to 100% of monetary donations can be potentially deducted, but actual allowances still depend on the classification of organizations you donate to and other factors on your own tax returns. You do not need to declare the donation amount in. It applies to cash donations of up to $300, or $600 if you’re married and filing jointly.

That�s right — you can theoretically eliminate all of your taxable income through charitable giving. In any single tax year, you’re allowed to deduct charitable donations totaling up to 50% of your adjusted gross income (agi). Donations to qualifying charity organizations are deductible on your tax return and may reduce your taxable income and overall tax bill, as long as you follow irs guidelines.

To claim a tithing tax deductible for cash and check donations, verify your tithing donation amount with one of the following: If you take the standard deduction on your income tax, you can�t deduct any charitable contributions for the year. Timely written acknowledgment from the church.

So if you gave to a gofundme campaign that wasn�t linked to a charity, it likely does not qualify (that�s no reason not to give, of course). You can deduct contributions of appreciated assets up to 20% of your agi. The taxpayer certainty and disaster relief act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021.

If you donate more than that, the irs will allow you to carry over these donations for up to 5 subsequent tax years. In 2020 and 2021, though, this limit has been raised to 100%. You can�t take the deduction for contributions of property, such as clothing or household items.

For example, if an individual makes a donation in 2020, tax deduction will be allowed in his tax assessment for the year of assessment (ya) 2021. According to the national philanthropic trust, americans gave $471.4 billion to charities in 2020, an increase of 5.1% over 2019 and proof that in good times and bad, the spirit of giving is strong. The internal revenue service requires that all charitable donations be itemized and valued.

This 100% limit doesn�t apply automatically, though. Federal tax deductions for charitable donations you may be able to claim a deduction on your federal taxes if you donated to a 5013 organization. During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions.

With proper documentation, you can claim vehicle or cash donations. Gifts to individuals are not deductible. The maximum saver’s credit available is $4,000 for joint filers and $2,000 for all others.

We suggest you contact your tax adviser or accountant or visit the irs website for more information. How much can you deduct for donations? Normally, you can deduct up to 60% of your adjusted gross income (agi) for gifts to charity.

You must also make your contributions to qualified charities. Tax deduction is given for donations made in the preceding year. The $300 deduction is for donations made in cash, which includes currency, checks, credit or debit cards, and electronic funds transfers.

However, if any of your cash donations were more than $250, you must have a receipt of the contribution from the church. But the 2017 tax cuts and jobs act substantially raised the federal income tax standard deduction. Use form 8880 and form 1040 schedule 3 to claim the saver’s credit.

To deduct donations, you must file a schedule a with your tax form. Claim a tax deduction your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to federal law. However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private operating foundations, and federal, state, and local governments.

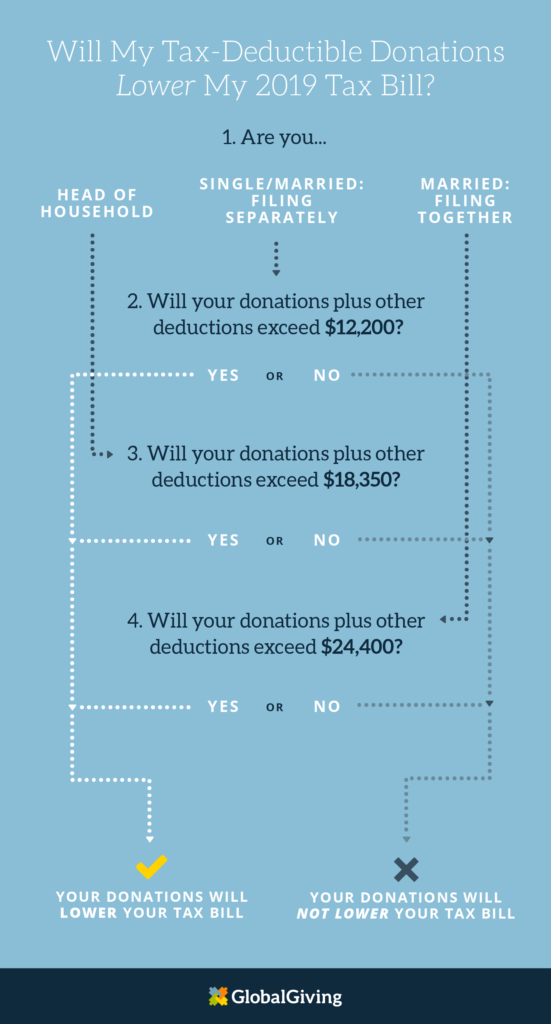

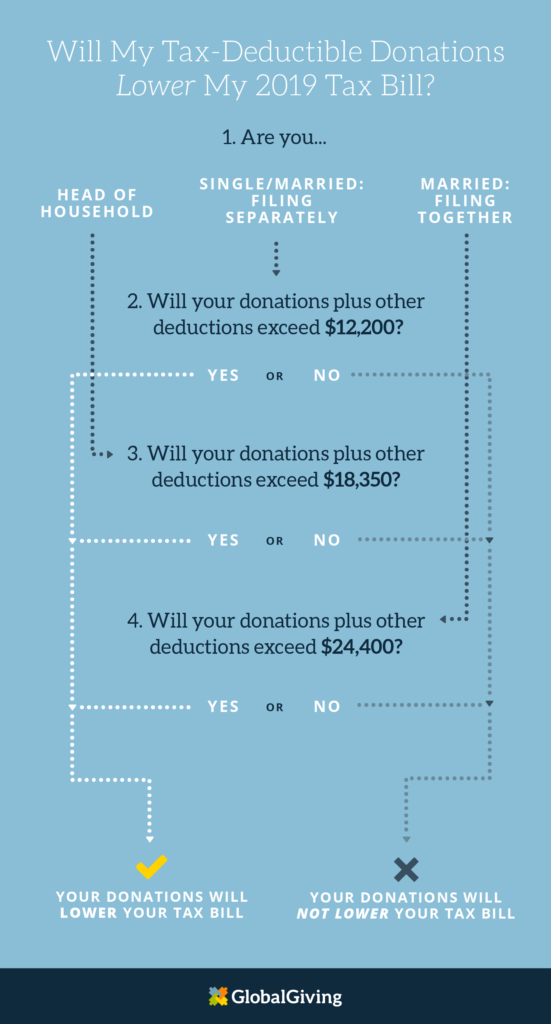

In order for your donation to be tax deductible, it must go to a group that has had 501 (c) (3) status conferred on it by the irs. Take a look at the different kinds of deduction ceilings depending on how you file your taxes and to whom you donate: Only donations actually made before the close of the tax year would be eligible.

If you itemize your deductions, you may be able to deduct charitable contributions of money or property made to qualified organizations. You can also look on many organizations� websites for a determination letter from the irs.