Different filing threshold the filing threshold is the income you must earn before being required to file a tax return. It was $7,637 last year.

If you are a senior, the following topics may be relevant to you:

Canadian income tax deductions for seniors. On this amount, you can claim a credit of up to $1,157 (15% of $7,713) since the minimum federal tax rate is 15% for. The limit is 7.5% of a taxpayer�s adjusted gross income (agi) for 2019 and 2020. If you owe money this year, you may be able to claim credits that will lower what you owe at tax time.

The cra has set the age amount at $7,713 for 2021. Since the only requirement for this credit is being above a certain age, it’s. The following tax tips were developed to help you avoid some of the common errors dealing with the standard deduction for seniors, the taxable amount of social security benefits, and the credit for the elderly and disabled.

Different filing threshold the filing threshold is the income you must earn before being required to file a tax return. In addition, you�ll find links below to helpful publications as well as information on how to obtain free tax assistance. If your net income was:

Premium payable under the québec prescription drug insurance plan. If your income is between $38,893 and $90,313, the cra will phase out your age tax credit at 15% of. Or $39,000, for a maximum tax credit of $13,650 per year (35% of $39,000), if you are claiming the credit for your couple.

Source deductions of income tax. Claim this amount if you were 65 years of age or older on december 31, 2021, and your net income ( line 23600 of your return) is less than $90,313. What is the standard tax deduction for seniors over 65?

Renovations that make homes safer or more accessible for seniors or the disabled may qualify for the home accessibility tax credit (hatc). If your 2021 net income is below $38,893, the cra will give you a complete $1,157 age tax credit. $38,893 or less, claim $7,713 on line 30100 of your return.

$19,500, for a maximum tax credit of $6,825 per year (35% of $19,500), if you are claiming the credit only for yourself; For your 2021 tax return, the age amount is $7,713. If you are a senior, the following topics may be relevant to you:

Your payment is valid both for you and your spouse, regardless of the status of them. 31, 2013, and your net income is less than $80,256. To qualify, your net income must be less than $89,422, and the amount you may claim varies depending on your income.

You can add $1,350 for each spouse who is age 65 or older if you’re married and file a joint return. A $1,300 increase in the standard deduction may be granted by seniors over 65 in 2019. Tax return for seniors, was introduced in 2019.

The form generally mirrors form 1040. This means that only those expenses in excess of 7.5% of a taxpayer�s agi are deductible. To qualify for this deduction, you must turn 65 by january 1 of the following tax year.

For the 2021 tax year, seniors get a tax deduction of $14,250 (this increases in 2022 to $14,700). If you are a senior or hold a valid disability tax certificate or are supporting a qualifying individual, you can claim up to $10,000 in expenses. Age amount you can claim this credit if you were 65 or older on dec.

Deductions are taken after calculating your total income on line 15000 of your tax return. Those numbers increase to $1,750 and $1,400 in tax year 2022. Generally, the payment amounts are calculated by taking into account your age, your residence in canada and your income eligibility.

For example, if someone�s agi is $100,000, only those medical and dental expenses above $7,500 (7.5% x $100,000 = $7,500) would be deductible. More than $38,893, but less than $90,313, complete the chart for line 30100 on the federal worksheet to calculate your claim. You can use this form if you are age 65 or older at the end of 2020.

Here�s what we talked about. Your total income minus these deductions. There is an automatic deduction of 45 if your income is less than $129,260 per year (the numbers fluctuate throughout the year).

Your taxes may also be increased by $2,600 if both you and your spouse are over 65 and each other is over 65. You can, for example, deduct rrsps, child care expenses, employment expenses, just to name a few. However, a different annual limit applies if you and/or your spouse is a dependent senior.

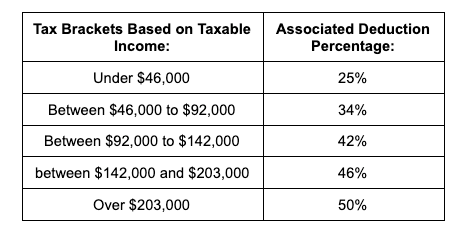

It was $7,637 last year. Deductions that reduce taxable income. The maximum claim is $6,854 federally.

Goods and services tax / harmonized sales tax credit. Taking the standard deduction is often the best option and can eliminate the need to itemize. As a senior, you may be eligible for benefits and credits when you file your return, such as the:

Related provincial or territorial benefits and credits.