An item of clothing that is not in good used condition or better for which you take a deduction of more than $500 requires a qualified appraisal and form 8283, section b. An item of clothing that is not in good used condition or better for which you take a deduction of more than $500 requires a qualified appraisal and form 8283, section b.

The irs requires an item to be in good condition or better to take a deduction.

Charitable tax deductions for clothes. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross. Gifts of donated property, clothing, and other noncash items have long been an important source of revenue for many charitable organizations and a popular deduction for taxpayers. Deducting charitable donations of clothing and household items taxslayer editorial team january 3, 2021 the tax laws say that you can deduct charitable contributions worth up to 60% of your agi.

Any donated household item must be new or used but in good condition and as mentioned above, there is no fixed method for determining the value of these donated items. Donating your used clothing to a charity can make you feel good but it can also save you some money on your tax bill this year. Vincent de paul, you may be eligible to receive a tax deduction for your donation.

No deduction is allowed for a charitable contribution of clothing or household items unless the clothing or household item is in good used condition or better. The main change for 2021 was allowing all taxpayers to deduct up to $300 in charitable contributions ($600 for joint filers) without itemizing their deductions. To get the deduction, you must file form 1040, the form you use for an individual or joint income tax return.

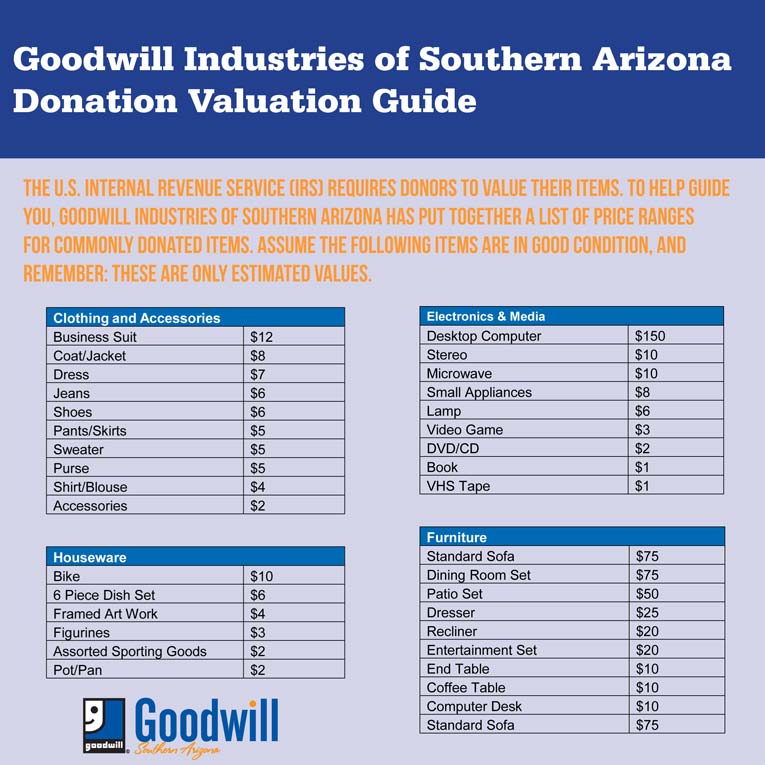

Qualified contributions are not subject to this limitation. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Keep a list of everything you give to charity and do research to calculate the.

You’ll also have to submit form 8283 for many of these items. Normally, you can deduct up to 60% of your adjusted gross income (agi) for gifts to charity. How much can you deduct for donations?

This 100% limit doesn�t apply automatically, though. Donating food, clothing, and household items the irs allows taxpayers to deduct the fmv of food, clothing or household items such as furniture, furnishings, linens, appliances and electronics. When you donate cash to a public charity, you can generally deduct up to 60% of your adjusted gross income.

When you donate clothing the irs will require you to determine their value since this value is what determines the amount you can deduct. If the taxpayer�s total itemized deductions add up to less than the standard deduction that the internal revenue service (irs) allows everyone to take, it does not make sense to itemize deductions. But special rules do apply, depending on what you donate.

The federal tax code allows individuals and businesses to make noncash contributions to qualifying charities and to claim deductions for these contributions on their tax returns. Tax information if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. You must get a written acknowledgment or receipt from the organization for any gift you make for which you’re claiming a deduction of $250 or more.

You cannot take a deduction for clothing unless it is in good used condition or better. At present, there will not be a $300 charitable deduction in 2022. These limits typically range from 20% to 60% of adjusted gross income (agi) and vary by the type of contribution and type of charitable organization.

How much can i deduct for clothing donations 2021. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. In most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi).

The irs is authorized by regulation to deny a deduction for any contribution of clothing or a household item that has minimal monetary value, such as used socks and undergarments. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. An item of clothing that is not in good used condition or better for which you take a deduction of more than $500 requires a qualified appraisal and form 8283, section b.

The irs requires an item to be in good condition or better to take a deduction. For the 2021 tax year, you can deduct up to $300 of cash donations per person without having to itemize, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. That�s right — you can theoretically eliminate all of your taxable income through charitable giving.

The deduction for charitable clothing donations is one of many that you can itemize, or list individually on your tax return. The irs says donated clothing and other household goods must be “in good used condition or better.” if you claim a deduction of $500 or more for a used item that’s not in good condition, the irs. This may seem like a daunting task but it is actually quite easy.

The receipt must be signed by the charity and must be in your hands no later than the filing date of your return* with the exception of publicly traded securities most donations over 5 000 require a written appraisal* charity name/address date of donation appliances guideline 20. Normally, people who use the standard deduction can’t take any charitable contribution deductions. In 2020 and 2021, though, this limit has been raised to 100%.

Individuals who do itemize may claim a deduction for charitable cash contributions made to qualifying charitable organizations, subject to certain limits. Donated and whether any goods or services were provided to you in return for the donation. See deduction over $500 for certain clothing or household items, later.