How to claim charitable donations when you file your tax return. During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions.

Limits vary depending on the type of donation and the type of charity, so if you�re considering total donations that will exceed 20% of your agi, read up on the irs rules.

Charitable tax deductions for clothing donations. The deduction for charitable clothing donations is one of many that you can itemize, or list individually on your tax return. Donations that exceed irs limits for. How to claim charitable donations when you file your tax return.

The organization must give you a written acknowledgement. Key points if you made cash donations to eligible charities in. You must keep the records required under the rules for donations of more than $500 but less than $5,000.

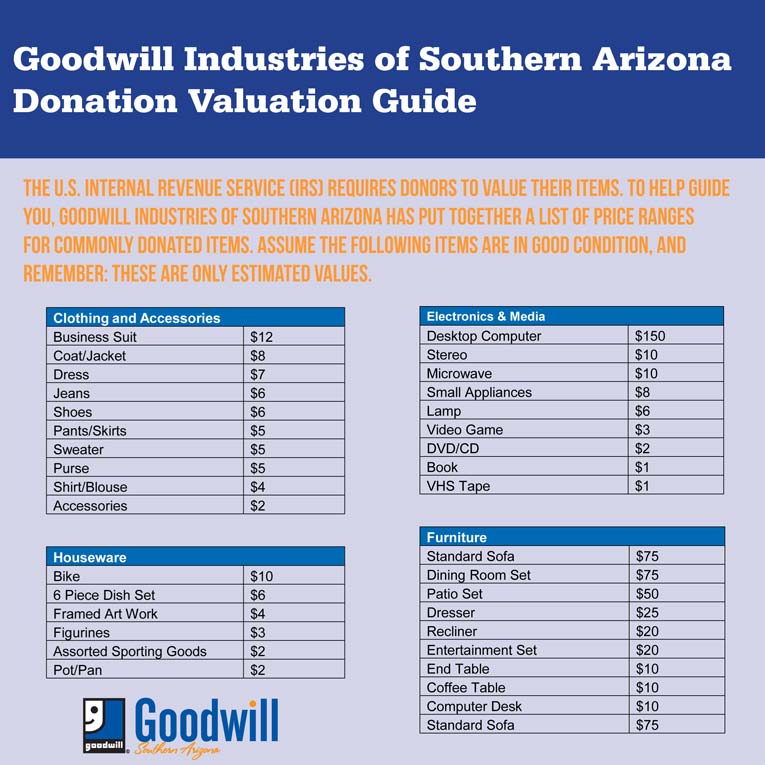

While it might be tempting to give away more ragged garments, charitable. To determine the fair market value of an item not on this list below, use this. For 2020, the charitable limit was $300 per “tax unit” — meaning that those who are married and filing jointly can only get a $300 deduction.

Donating your used clothing to a charity can make you feel good but it can also save you some money on your tax bill this year. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross. The irs allows taxpayers to deduct the fmv of food, clothing or household items such as furniture, furnishings, linens, appliances and electronics.

Normally, the maximum allowable deduction is limited to 10% of a corporation�s taxable income. If you’re calculating if a deduction. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

This may seem like a daunting task but it is actually quite easy. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Claim a tax deduction your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to federal law.

You can�t take the deduction for contributions of property, such as clothing or household items. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. How to calculate clothing donations for taxes.

Limits vary depending on the type of donation and the type of charity, so if you�re considering total donations that will exceed 20% of your agi, read up on the irs rules. If the taxpayer�s total itemized deductions add up to less than the standard deduction that the internal revenue service (irs) allows everyone to take, it does not make sense to itemize deductions. To receive a deduction, your donated items must be in good.

The taxpayer certainty and disaster relief act of 2020 waived this requirement in 2020 and the waiver still applies for tax year 2021. Generally speaking, you can deduct qualifying charitable donations totaling up to 20% to 60% of your adjusted gross income (agi) from your itemized tax return. In general, you can deduct up to 60% of your adjusted gross incomevia charitable donations (100% if the gifts are in cash), but you may be limited to 20%, 30% or 50% depending on the type of contribution and the organization (contributions to certain private foundations, veterans organizations, fraternal societies, and cemetery organizations come.

You must also make your contributions to qualified charities. The internal revenue service requires that. How much can i deduct for clothing donations 2021?

Only usable clothes should be donated. In most cases, the amount of charitable cash contributions taxpayers can deduct on schedule a as an itemized deduction is limited to a percentage (usually 60 percent) of the taxpayer’s adjusted gross income (agi). The irs says donated clothing and other household goods must be “in good used condition or better.” if you claim a deduction of $500 or more for a used item that’s not in good condition, the irs.

During most tax years, you are required to itemize your deductions to claim your charitable gifts and contributions. Cash donations to qualified charities the $300 deduction is for donations made in cash, which includes currency, checks, credit or debit cards, and electronic funds transfers. Qualified contributions are not subject to this limitation.

Donate items in good condition only. Any donated household item must be new or used but in good condition and as mentioned above, there is no fixed method for determining the value of these donated items. Irs guidelines if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

21 hours agodon�t miss this charitable donation tax deduction worth up to $300 per individual. When you donate clothing the irs will require you to determine their value since this value is what determines the amount you can deduct. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.

If you claim a tax deduction for a noncash contribution worth less than $250, the written acknowledgment from the charity should include its name, the date and location of your donation, and a.