Couples filing jointly as well as individuals filing other statuses will be able to receive this amount of $600 per tax return for 2021. If you itemize deductions, you may claim a tax break for unreimbursed medical expenses that exceed 7.5% of your adjusted gross income, she said.

Do i have to itemize if my spouse itemizes?

Common tax deductions for married couples. Those who paid education expenses (namely tuition) for themselves, their spouses, or their dependents can deduct up to $4,000. Do i have to itemize if my spouse itemizes? The $250,000 limit still applies just as if they were still single.

What is the standard deduction for married couples? In addition, if you take the standard deduction in 2020, you can deduct up to $300 per qualified cash contribution you made. Below are some of the most common deductions and exemptions americans can take.

Common schedule 1 deductions for 2021 are: For a single person, the standard deduction for your 2015 return is $6,300. Irs tax brackets for married couples filing jointly:

From simple to complex taxes, filing with turbotax® is easy. Not only will you receive a deduction for claiming your kids, several doors open to other credits that will reduce or even eliminate your tax debt. Couples filing jointly receive a $24,800 deduction in 2020, while heads of household receive $18,650.

If you itemize deductions, you may claim a tax break for unreimbursed medical expenses that exceed 7.5% of your adjusted gross income, she said. 35%, for incomes over $209,425 ($418,850 for married couples filing jointly); Traditional ira and 401k contributions.

More than 99,000 returns claimed. For 2020, the standard deduction is $12,400 for single filers and $24,800 for married couples filing jointly. This assumes that you own the house and have lived in it for at least two of the five years prior to the sale.

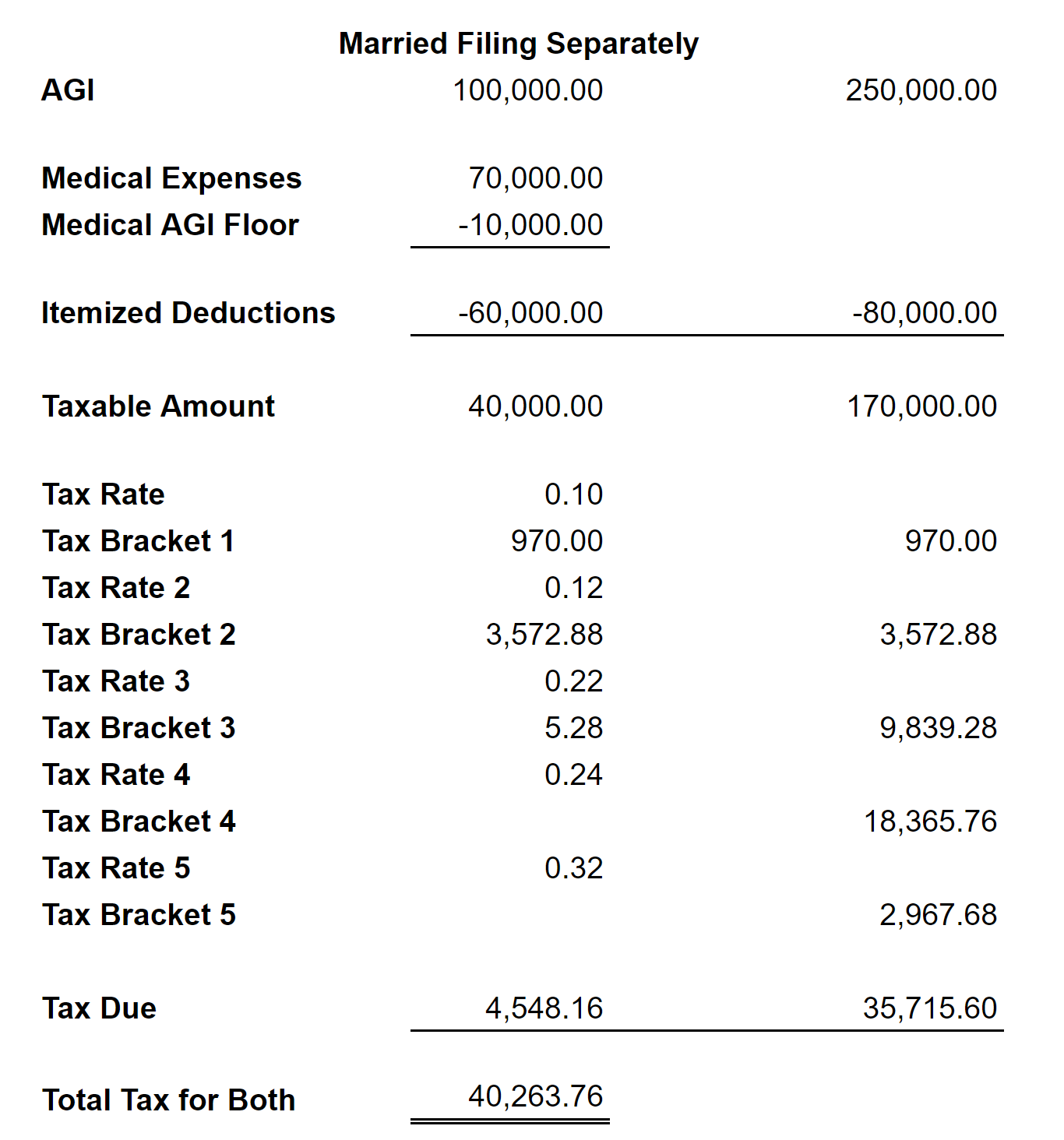

The maximum credit allowed is $210 for one child or $420 for two or more children. Even though there may be specific reasons for filing separately for some couples, depending on one’s medical expenses, miscellaneous expenses or other contributions, it may be a better option. You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers.

For example, with an adjusted gross income of. This doubles to $12,600 when you’re married. This means single filers can deduct.

For the 2021 tax year, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers and $18,800 for head of household. Ad turbotax® makes it easy to get your taxes done right. 2 hours agoby filing separately, couples record their incomes, exemptions, and deductions separately, to avoid having one tax return.

You cannot claim this credit if your filing status is married filing separately. For 2010, the standard deduction for married couples filing a joint return is $11,400. The internal revenue service takes the cost to raise a child into consideration when charging taxes on your income.

For 2021, it is $12,550 for singles and $25,100 for married couples. 32% for incomes over $164,925 ($329,850 for married couples filing jointly); What tax deductions do married couples get?

But what if your spouse sold their house before the wedding? The charitable contribution deduction for married couples is greater. Couples filing jointly as well as individuals filing other statuses will be able to receive this amount of $600 per tax return for 2021.

You can deduct up to $2,500 in paid student loan interest each year per tax return. Couples who have one person earning all of the income will notice the most improvement from the standard deduction when they get married. The standard deduction for individual taxpayers and married couples filing separate returns is $5,700.

Married couples who have kids have quite the advantage when tax time rolls around. 24% for incomes over $86,375 ($172,750 for married couples filing jointly); 4 rows for the 2021 tax year, you may be able to deduct $300 per person (those married filing jointly.