Traditional ira and 401k contributions 3. Here is a list of categories that often qualify for tax deductions.

Use form 8880 and form 1040 schedule 3 to claim the saver’s credit.

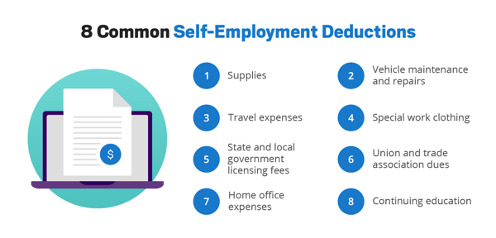

Common tax deductions for office workers. The government announced in its may 2016 budget that it intends to scrap the “10% test”. Just be aware that supplies are only deductible if used exclusively for your business, so keep. Anything you buy to keep your business running—from common office supplies like pens, paper, and envelopes to things like doggie poop bags for dog walkers, bottles of water for rideshare drivers, or cleaning supplies for housekeepers—could be deductible.

Traditional ira and 401k contributions 3. Depreciating belongings you can often claim business assets that depreciate over time, including machinery, equipment, buildings, vehicles, and furniture. The regular method, which is more complex, involves adding up the actual cost of your home office, whereas the simplified method involves multiplying the number of square feet in your home office by $5, with a maximum of 300 square feet.

If your office takes up 10% of your home, your deduction will amount to $2,400. Here is a list of categories that often qualify for tax deductions. For tax year 2020, this type of deduction was available to taxpayers whose taxable income fell below $163,300 for individuals or $326,600 for joint returns, as well as certain taxpayers with higher business income.

Rental property expenses itemized tax deductions 1. As an alternative, you can use the simplified method, which lets you deduct $5 per square foot of office space up to. Take the standard deduction or itemize deductions.

You can deduct common expenses such as tools and materials, and even certain other items that come in handy in your business or on the job. If you�re an employee for a construction company, rather than an independent contractor, and your employer doesn�t reimburse you for expenses on the job, you can usually deduct them for tax years prior to 2018. A tax deduction is money that you subtract from your earned income, that will lower the amount of money you are taxed and the amount of tax you may possibly owe.

The standard deduction, which the irs refers to as the “simplified” option aims to help taxpayers avoid making complex calculations based on allocations of space and time. Private car use (read our blog on car expenses for full details on how and what to claim) bridge and road tolls; Instead, it simplifies the process by letting you deduct $5 per square foot of your home office, up to 300 square feet.

The standard tax deduction for 2021 and 2022 the standard deduction. Fsa and hsa contributions 4. The maximum saver’s credit available is $4,000 for joint filers and $2,000 for all others.

Tax season is just right around the corner and i�ve had a handful of clients before that had been office workers for many years but never maximised the tax d. State and local taxes 3. Generally, there are two ways to claim tax deductions:

A writing workshop if you are responsible for the company newsletters etc. Use form 8880 and form 1040 schedule 3 to claim the saver’s credit.