Tax deductions are different from tax credits. There�s no limit on the.

The first $9,950 is taxed at 10% the remaining $5 is taxed at 12% if you earn $80,000:

Common tax deductions for single filers. Child tax credit (ctc) 4. Tax deductions are different from tax credits. For single filers, the standard deduction is $12,950 in the 2022 tax year and $25,900 for joint filers.

You can deduct up to $2,500 of the interest you paid on your student loans. Single parents that meet the eligibility requirements are rewarded with a lower tax rate and standard deduction compared to single filers and married filers. Married filing jointly and surviving spouses:

53 tax deductions & tax credits you can take in 2022. You can take this deduction off your adjusted gross income instead of taking it as an itemized deduction. Ad answer simple questions about your life and we do the rest.

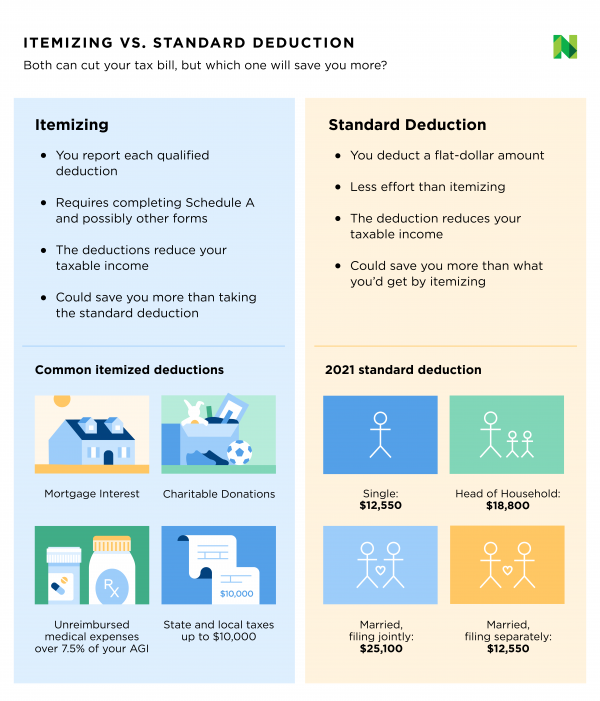

A tax deduction decreases your taxable income, whereas a tax credit lowers the amount of taxes you owe the irs. The standard deduction is a specific dollar amount that reduces your taxable income. For the 2021 tax year, the standard deduction is $12,550 for single filers and married filing separately, $25,100 for joint filers and $18,800 for head of household.

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Since tax year 2020, the standard deductions have been: Is it better to claim 1 or 0 on your taxes?

If your magi is more than $70,000 as a single filer ($140,000 if you’re married filing jointly), you may not qualify for part or all of the deduction. When it comes to 2021 taxation season, the standard deduction was $12,550 for single filers, $25,100 for combined filers and $18,800 for minds of home. Calculating your adjusted gross income

This means single filers can deduct. If you paid interest on your student loans, you can deduct up to $2,500 in interest payments if you earned less than $70,000 for single filers. The irs began paying the third coronavirus stimulus check (also called an economic impact payment) in march 2021.

Credit for sick leave for. 4 rows deduction for state and local taxes. For single filers and partnered people that submit individually, the standard deduction will increase by $400, from $12,550 to $12,950.

The first $9,950 is taxed at 10% the remaining $5 is taxed at 12% if you earn $80,000: Many people go for the standard deduction because it amounts to more than the total value of their itemized deductions. You can deduct up to $2,500 in paid student loan interest each year per tax return.

You may deduct up to $10,000 ($5,000 if married filing. 12 most popular tax deductions. Traditional ira and 401k contributions.

You can choose to have taxes taken out. What is the standard tax deduction for a single person? As of 2015, the standard deduction is $6,200 for single filers, $12,400 for married filers and $9,100 for head of household filers.

Deductions can reduce the amount of your income before you calculate the tax you owe. In 2020, the limit for joint filers was $24,800 and $12,400 for single filers. However, this deduction is gradually reduced and eventually eliminated as a taxpayer’s modified adjusted gross income reaches the annual limit.

There�s no limit on the. From simple to complex taxes, filing with turbotax® is easy. $12,400 for single filers $24,800 for joint filers $18,650 for head of household if you take the standard deduction, you can’t itemize your deductions.

The first $9,950 is taxed at 10% the balance up to $40,525 is taxed at 12% the remaining balance over $40,525 is taxed at 22% the standard deduction for a single filer is $12,550 for tax year 2021.