It helps property owners keep track of. It helps property owners keep track of.

Fixing a plumbing leak, repairing a light socket that’s shorting out, and unclogging the kitchen disposal are examples of tax deductible repair expenses on a rental property.

Example of tax deductions for rental property. In addition to deducting utility expenses, there are a variety of other rental property tax deductions a landlord may be able to claim to reduce taxable. Every plumbing, heating, electrical or carpentry repair could be a deduction reducing your rental income. That�s because, in the eyes of the.

Rental properties can be declared as being qualified for deduction if the expenses, including installation of appliances, repairs, and remodeling, are deductible. This is a rental property tax deduction rule that only applies to investment property. For example, if you paid for a new roof or installed a fence around.

Rental property is depreciated over 27.5 years. Ad we�ll search hundreds of tax deductions to get every dollar you deserve. Additionally, becoming a landlord offers multiple tax benefits such as deductions, depreciation, interest, and more.

7 rows for example, if you earn $10,000 from one rental property and have an $8,000 loss on another,. Different deductions are available from the irs. Mileage expense examples that can be claimed for rental business purposes include:

There is no law that says that if something in your rental property is broken it has to be replaced. Traveling to your property to deal with tenants, maintenance, repairs traveling to your. However, remember that the irs says.

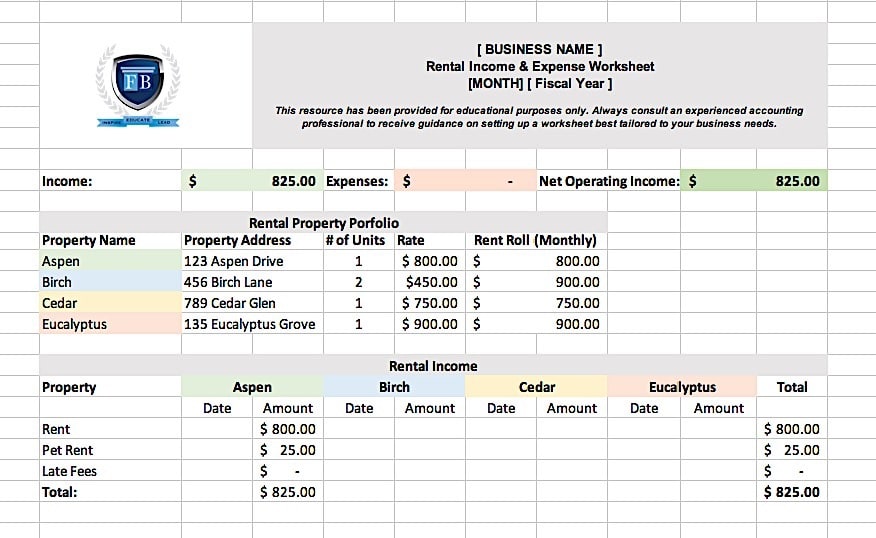

Other rental property tax deductions. Turbotax® premier is the resource needed to file your investor taxes easily & confidently. A rental property spreadsheet is a document that keeps all of your property expenses and income data in one safe, verifiable place.

Under the terms of the lease, your tenant doesn’t have. A replacement is almost always an improvement—not a repair—for tax deduction purposes. For example, if you bought a rental property and purchased a new central air system, the system’s cost would be depreciated, but the servicing each year, incl.

Here are five big ones that tax pros say should be on your radar if you’re. Fixing a plumbing leak, repairing a light socket that’s shorting out, and unclogging the kitchen disposal are examples of tax deductible repair expenses on a rental property. Tax write off for rental property #1:

There are rental property tax deductions available to help you out with running your business, though. So, in your example, the gross rents for the year are about $750 * 12 = $9000 (this assumes no vacancy loss). In addition to mortgage interest, you can deduct origination fees and points used to purchase or refinance your rental property, interest on unsecured loans used for improvements.

It helps property owners keep track of. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real. For example, your tenant pays the water and sewage bill for your rental property and deducts it from the.

That said, let’s go over some of the most common rental. Homeowners cannot claim depreciation as a tax deduction. You can deduct the expenses if they are deductible rental expenses.

For example, if you buy a $300,000 rental and spend $25,000 adding a fourth bedroom, you may not get to deduct the $25,000 that year. Mortgage interest is usually the single largest. Your tenant pays the water and sewage bill for your rental property and deducts the amount from the normal rent payment.

Generally speaking, any expense incurred directly for the purpose of earning rental income is usually deductible. Owning a rental property can generate some extra income, but it can also generate some great tax deductions.