Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to. State tax laws and treatment may vary.

Previously, esas could be used for this, but contributions were capped at $2,000 per year.

Federal income tax deductions for educational expenses. Expenses that you can deduct include: The tuition and fees deduction was extended through the end of 2020. You can use it to pay for courses at a college, university, or trade school.

Those who paid education expenses (namely tuition) for themselves, their spouses, or their dependents can deduct up to $4,000. Your deductions must be more than the 2% of adjusted gross income (agi) threshold for miscellaneous deductions. The american opportunity tax credit (aotc) the lifetime learning credit (llc) the aotc and llc are both considered education credits and the irs has one form that allows you to apply for both of them.

Consult the lists of relevant articles, books, theses, conference reports, and other scholarly sources on the topic �income tax deductions for educational expenses.� next to every source in the list of references, there is an �add to bibliography� button. Tuition, books, supplies, lab fees, and similar items certain transportation and travel costs other educational expenses, such as the cost of research and typing Also, consider the fees and expenses associated with the particular plan.

When can i take this deduction? The lifetime learning credit is worth up to $2,000 per tax return. Income tax deductions for educational expenses.

Enter the lifetime learning credit. The tuition and fees deduction. It is a tax credit of up to $2,500 of the cost of tuition, certain required fees and course materials needed for attendance and paid during the tax year.

The federal education and textbook tax credits were eliminated in 2017. It allows you to deduct up to $4,000 from your income for qualifying tuition expenses paid for you, your spouse, or your dependents. An eligible educator can deduct up to $250 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers including related software and services or other equipment that the eligible educator uses in the classroom.

State tax laws may be different than federal. The tuition and fees tax deduction was brought back by congress in late 2019 for tax years 2018, 2019, and 2020. You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers.

These expenses include tuition for college, elementary, and secondary school. Previously, esas could be used for this, but contributions were capped at $2,000 per year. For example, if you attended two educational institutions in the year, the amount on each of your tax certificates must be more than $100.

4 the amount you can claim as an educator expense is capped at $250 for the 2021 tax year, however. Also, 40 percent of the credit for which you qualify that is more than the tax you owe (up to. You cannot claim the tuition amount on your tax certificate if any of the following applies to you:

Special schooling, evaluations, medical travel, supplies and equipment, special diets, legal expenses, and more. Open all + find out if you qualify for education benefits learn about claiming education credits deduct student loan interest from your taxes You can even use a 529 plan for your own education expenses.

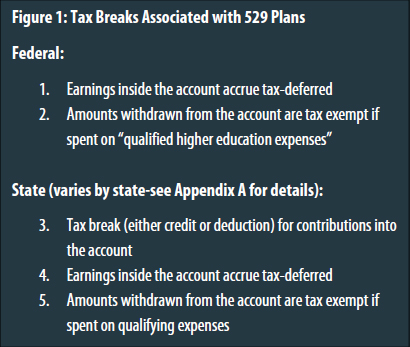

Education during in the year, or Here are the 2021 tax credits and deductions. State tax treatment of 529 plans is only one factor to consider prior to committing to a savings plan.

Is required to meet the minimum educational requirements in effect when you first got the job to deduct these, itemize deductions on schedule a. If you�re the parent of a child with special needs, there are some tax strategies to be aware of that can save your family money. To see if you are eligible to claim a provincial or territorial amount, go to income tax package.

But there�s another tax break you might be able to claim. State tax laws and treatment may vary. Relevant bibliographies by topics / income tax deductions for educational expenses / journal articles journal articles on the topic �income tax deductions for educational expenses� to see the other types of publications on this topic, follow the link:

To qualify, the fees you paid to attend each educational institution must be more than $100. Supplies for courses on health and physical education qualify only if. You can�t always claim your education expenses as a business deduction.

You can deduct qualifying expenses paid for: When you prepare your return on efile.com, simply enter the education expenses and the app will prepare the forms needed to claim either the education deduction or credit on your tax return. There are three ways that you may be able to use your education expenses to lower your federal income taxes:

Whether a state tax deduction is available will depend on your state of residence. But you can claim up to $4,000 in deductions on your taxes. To claim your tuition fees you must have received one of the following forms from your educational institution:

Form t2202, tuition and enrolment certificate