You can find more information about home office deductions, in the irs’ “business use of your home.” For example, the following home improvements would qualify as being required medically:

You should maintain a record of those costs;

Federal income tax deductions for home improvements. Solar electric property solar water heating property fuel cell property small wind energy property geothermal heat property this credit has no dollar limit for many property types. The credit is 30 percent of the purchase cost, up to $500 per 0.5 kilowatts of power. Deductions can reduce the amount of your income before you calculate the tax you owe.

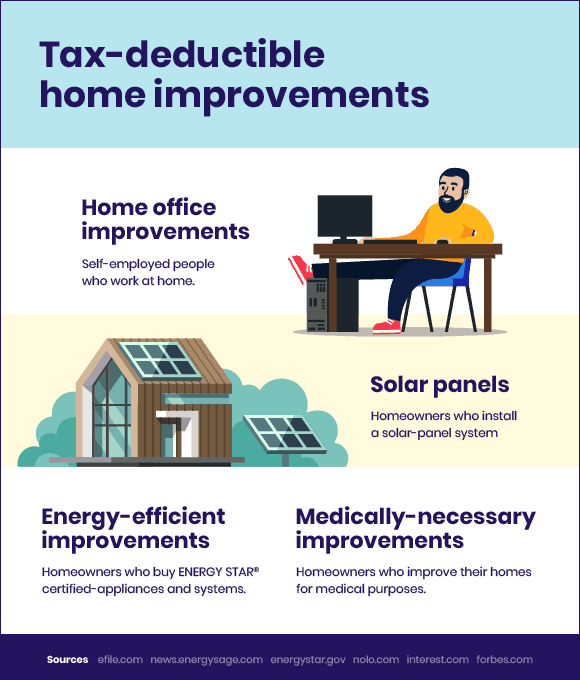

Home improvements on a personal residence are generally not tax deductible for federal income taxes. There are a few exceptions, however. In order to claim a tax deduction on repairs necessary due to a natural.

So, if you painted your entire home at a cost of $600, about 13% of that cost would be tax deductible. However, installing energy efficient equipment may qualify you. In this case, it’s about 13%.

You can deduct only the amount of eligible medical and dental expenses that is more than 7.5 percent of your adjusted gross income. So, if the irs defines some home improvements as tax deductible, which projects make. The cost of installing entrance or exit ramps, modifying bathrooms, lowering cabinets, widening doors and hallways and adding handrails, among others, are home improvements that can be deducted as medical expenses.

Tax deductible home improvement & repairs for 2022. Costs incurred to implement accessibility modifications in your home are an eligible medical deduction on your federal income tax under “medical and dental expenses”. Home improvements on a personal residence are generally not tax deductible for federal income taxes.

Sure, you may remember way back to 2018 and its new tax code—aka the tax cuts and jobs act. This one gets a bit tricky. Credits for individuals family and dependent credits income and savings credits homeowner credits health care credits

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Entrance or exit ramps bathroom modifications lowering cabinets widening doors and hallways adding handrails You should maintain a record of those costs;

If you�re building a new patio in your backyard or revamping the kitchen in your home, don�t expect to get a tax break. In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year (subject to the overall credit limit of $500). Get tax credits for the way you generate energy.

Either way, you will need to track your expenses for any home improvement. Making improvements for medical reasons. The tax credits for residential renewable energy products are now available through december 31, 2023.

This tax deduction cannot be used when you spend the money, but it can reduce your taxes in the year you decide to sell your house. Improvements based on medical care. Home improvements on a personal residence are generally not tax deductible for federal income taxes.

But, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house. You can find more information about home office deductions, in the irs’ “business use of your home.” The answer could be yes or no.

What types of home improvements are tax deductible? Renewable energy tax credits for fuel cells, small wind turbines, and geothermal heat. What home improvements are tax deductible?

When you make a home improvement, such as installing central air conditioning or replacing the roof, you can�t deduct the cost in the year you spend the money. There are home improvements you can also make that technically count as medical. However, installing energy efficient equipment on your property may qualify you for a tax credit, and renovations to a home for medical purposes may qualify as a tax deductible medical expense.

You may be wondering if there are tax deductions when selling a home. Homeowners can claim 30% of the cost of alternative energy equipment installed in or on their homes for the following things: If your repairs were made in the aftermath of a natural disaster, or if they were made to a rental property or a home office then they may be considered tax deductible.

Some home repairs may be eligible to be claimed as medical expenses you can deduct them from your income if you are making medically required repairs. Improvements to your home can also be deducted from your income as medical expenses if they are medically necessary. Tax deductions for energy efficient commercial buildings allowed under section 179d of the internal revenue code were made permanent under the consolidated appropriations act of 2021.

For example, the following home improvements would qualify as being required medically: