If you, your spouse, or your dependent is in a nursing home primarily for medical care, then the entire nursing home cost (including meals and lodging) is deductible as a medical expense. Vehicle mileage & travel expenses #1:

You also cannot claim any contributions you may make to staff social clubs.

Federal tax deductions for nurses. If you itemize your expenses, you can usually write off any expenses associated with your job. If you do not have a permanent residence in one state, the irs will classify you as transient, which will disqualify you from being. There are a lot of potential tax deductions that nurses can make, including depreciating properties.

If you, your spouse, or your dependent is in a nursing home primarily for medical care, then the entire nursing home cost (including meals and lodging) is deductible as a medical expense. Take advantage of these 5 strategies to lower your taxes. Although the recent tax law has practically removed many itemized deductions that were claimed by nurses before 2018, you are required to show receipts that were used to calculate deduction in the past years.

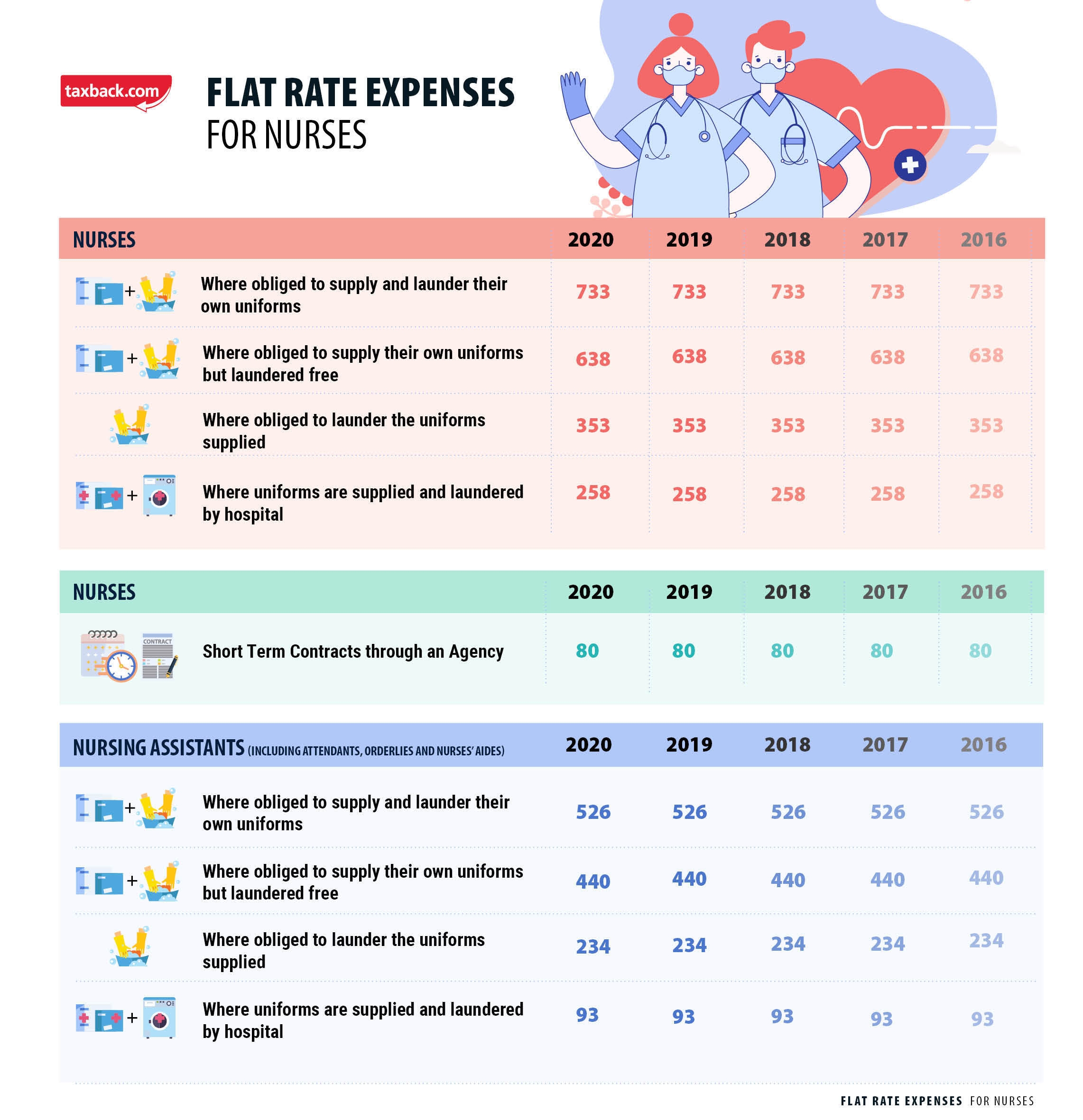

Or, visit www.taxreturnsfornurses.com uniforms and equipment Malpractice insurance the costs of your uniforms, including dry cleaning and laundry costs Standard deductions or itemized deductions.

With a good tax accountant or an aptitude for reading the tax filing instructions, you could find plenty of deductions—continuing education, licensure fees, uniform expenses, unreimbursed mileage, liability insurance, tuition and more. However, tax laws change a lot and what was allowed once may no longer be applicable so it is best to discuss your options with a tax advisor. Vehicle mileage & travel expenses #1:

It’s always a good thing to have a permanent residence. Nurses can claim a deduction on the annual fees they may pay for membership to unions or professional associations/bodies, although a deduction on joining fees is not available. A stipend is a lump sum or a fixed amount that.

Knowing which deductions or credits to claim is challenging, so we created this handy list of 53 tax deductions and tax credits to take this year. You can deduct the fees you pay for your state nursing license, as well as costs associated. If your employer paid, don’t claim it.

Here is one area where keeping your receipts is very important. The more money you put into your retirement, the lower your income and fewer taxes you are likely to pay. Most people do not have the opportunity to write off their work clothing, but nurses do to an extent.

Its credits equal $10,145, which include the $10,000 in qualified leave wages plus $145 for the eligible employer’s share of medicare tax (this example does not include any qualified health plan expenses allocable to the qualified leave wages). Remember, legitimate ato tax deductions for nurses only include expenses you’ve paid for yourself where you haven’t received a reimbursement. Filing taxes for travel nurses, are subject to different due dates.

Tax breaks for ongoing nursing education both employees and independent contractors in the nursing field can get tax breaks for continuing education. Max out your retirement plan contributions. This may include agency income paid with a form 1099.

That adds up quickly, but don’t lose heart—you can deduct half of your se taxes on your federal tax return, which brings your total back down a bit. Tax deductions for nurses general business expenses. Yes, in certain instances nursing home expenses are deductible medical expenses.

5 deductions you won’t want to miss #1: These include the costs of. In the 2021 tax year (filed in 2022), the standard deduction is $12,550 for single filers and married filing separately, $25,100 for married filing jointly and surviving spouses, and $18,800 for the head of household.

List of potential tax deductions for nurses. Posted on january 13, 2010. Deductions, expenses | as you prepare for this tax season, be sure to consider, at a minimum, this list of potential deductions.

Work clothes (uniform only, i.e. As of april 2, 34 states, washington dc, and puerto rico are following the federal government and have extended the filing date to july 15, 2020: What can travel nurses claim on taxes?

Especially because the ato is remarkably good at detecting mistakes with this and you could be penalised later. Tax deductions for nurses the basics. Educational costs include those payments made towards earning your nursing degree, as well as any continuing.

You also cannot claim any contributions you may make to staff social clubs. Furthermore, you will need to file your federal tax reports to consider all the tax deductions for travel nurses that you may access. List of common deductions afforded to nurses there are two choices when it comes to federal tax deductions:

Several business deductions are available to any qualified person. Common tax deductions for nurses. Add more to your health savings or flexible savings account.

Many states are still expecting residents to file by april 15th and still assessing penalties for those who file late.