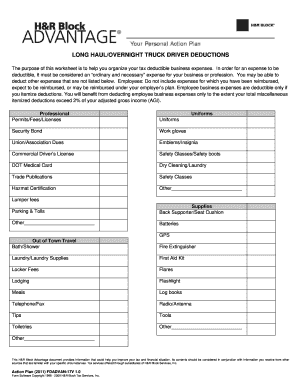

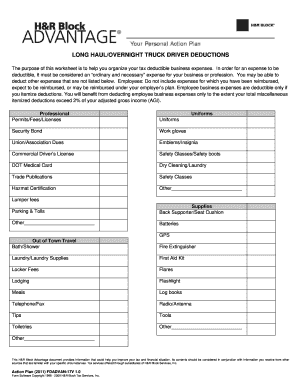

According to the irs, truck drivers can deduct “ordinary and necessary expenses of traveling away from home for your business, profession, or job.” the terms “ordinary and necessary” refer to the normal and essential expenses of the job, to the exclusion of anything lavish or luxurious as well as any personal expenses. 19 truck driver tax deductions that will save you money.

But exactly what business expenses can truck drivers claim on tax returns?

Federal tax deductions for truck drivers. 19 truck driver tax deductions that will save you money. To deduct actual expenses for the truck, your expenses can include (but aren’t limited to): If you need to stop to eat or for rest to be able to do your job, the cost of meals is a deductible expense.

So you’ve looked at your tax documents and found out you’re eligible. For 2021 tax returns, you can use the standard mileage rate to take a deduction of $0.56 per business mile. And $71 for travel outside the country.

You can also take 80% of the remaining $26 as a deduction. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. 1) meal expenses you can deduct the cost of your meals that you incur when you are at work, away from home.

You cannot legitimately deduct for downtime (with some minor exceptions…ask your tax pro). Truck drivers are allowed to deduct business expenses that are “regular and necessary” by the irs. While these expenses vary as per the individual, some expenses are standard.

Be confident you�re getting every deduction you deserve & your biggest refund, guaranteed. Fuel oil repairs tires washing insurance any other legitimate business expense The 2018 special standard meal allowance is $63/full day within the us, $68/full day outside the us, $47.25/partial day within the us, $51/partial day outside the us.

That said, there are common deductible business expenses that most owner operator truck drives can claim. Note that there is one important reason you may choose to receive per diem for your expenses. If you know how to repair your own truck and do its routine maintenance and cleaning yourself, you can still claim tax deductions for the costs of parts and supplies.

It is because the irs allows truck drivers to deduct about 80 percent of their total expenses. 22 rows tax deductions for truck drivers due to the tax cuts and jobs act, truck drivers that. It all depends on the type of business the trucking company is in and their vehicle operating expenses.

You can claim all available tax deductions for truck drivers. But exactly what business expenses can truck drivers claim on tax returns? And if your company offers you the maximum truckers’ per diem of $63, you will only need to pay taxes on 20 percent of this amount.

Calculating your per diem tax deduction tax preparers and most tax preparation software. Truck driver tax deductions vehicle maintenance. For this, you must save your meal receipts.

It is phased out for those rare truckers who might be making more than $163,000 per year (net of expenses) if single, or who file jointly and report more than $326,000 per year. Paying to become a member of a union or organization related to the trucking industry is. Fleet per diem savings per driver 2021 & 2022:

Whether you’re a truck owner/operator or an employee of another firm, you can deduct your cell phone charges, licensing fees, and other expenses from your declared taxable income. Alternately, you can use the actual expense method to deduct the business portion of costs like gas, repairs and maintenance, auto insurance, registration and car loan interest or lease payments. The irs generally allows truck drivers who are unable to stop home for meals and other necessities to claim the special meals and incidental expenses (m&ie) deduction of about $66 within the u.s.

However, if the trucking company pays you the federal per diem rate or higher, you cannot take a deduction. According to the irs, truck drivers can deduct “ordinary and necessary expenses of traveling away from home for your business, profession, or job.” the terms “ordinary and necessary” refer to the normal and essential expenses of the job, to the exclusion of anything lavish or luxurious as well as any personal expenses.