Generally speaking, you can deduct qualifying charitable donations totaling up to 20% to 60% of your adjusted gross income (agi) from your itemized tax return. Answer a few questions to get a free estimate of your 2022 tax refund!

Calculate the value of any tangible items you received in return for your donation.

How to calculate tax deductions for donations. Calculate the value of any tangible items you received in return for your donation. The donation impact calculator is a great way to see how your donations support your goodwill’s programs and services. Her federal tax credit is therefore (15% × $200) + (29% × 200) = $88.

This deduction was first offered last year as part of the cares act. Enter the number of items you donate in the qty columns. By multiplying the taxable gross wages based on your pay periods per year, you will calculate how much money you earn on each pay.

This means that if you donate $10,000 worth of stock. Answer a few questions to get a free estimate of your 2022 tax refund. How to calculate clothing donations for taxes.

Answer a few questions to get a free estimate of your 2022 tax refund! However, if when you enter a quantity field, you get an error. According to the internal revenue service.

Thankfully, it was extended into 2021. Tax information if you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. If you receive something in return for a charitable donation, you can only deduct the amount of your donation minus the fair market value of the gift or benefit you received.

Simply select the types of clothing, household. You determine how much to deduct for a contribution of capital gain property by its fair market value on the day of the sale. 1.your deduction for charitable contributions generally can�t be more than 60% of your adjusted gross income (agi), but in some cases 20%, 30%, or 50% limits may apply.

Generally speaking, you can deduct qualifying charitable donations totaling up to 20% to 60% of your adjusted gross income (agi) from your itemized tax return. Claiming charitable donations as an itemized deduction. Just keep the information with your personal tax records and put the total contribution amount on your schedule a, itemized deductions (or your computer software will.

The federal charitable tax credit rate is 15% on the first $200 and 29% on the remaining $200. Internal revenue service (irs) requires you to value your donation when filing your return. 2 hours agohelping business owners for over 15 years.

You’ll be able to receive a tax deduction only if you donate to a tax. Simply change the quantity to 0. Also, your totals will reset when you do.

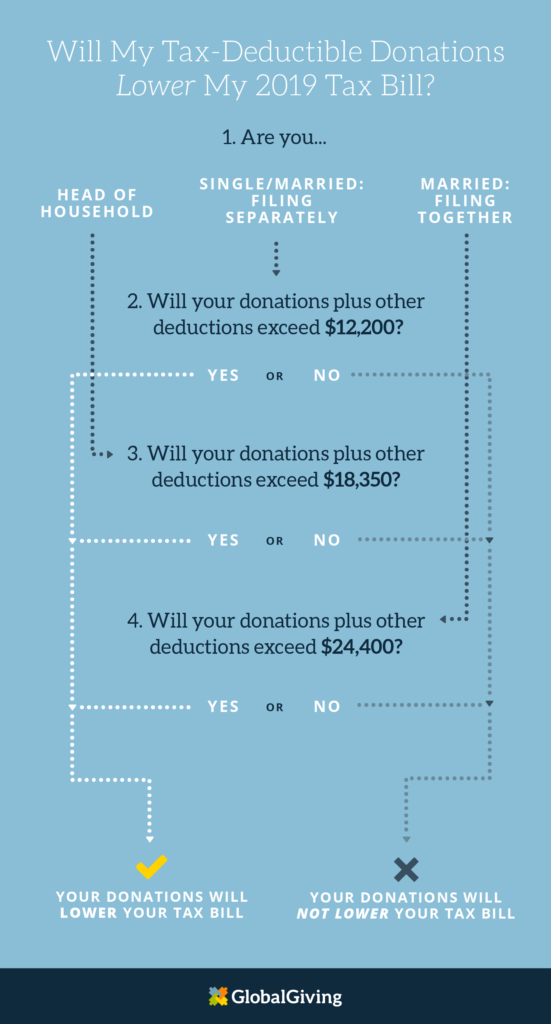

Get started with our donation valuation guide, which features estimates for the most. With the reduction of many federal tax deductions, charitable giving is one of the only levers you can easily adjust to surpass the standard deduction and increase your tax savings.