If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. 21 hours agodon�t miss this charitable donation tax deduction worth up to $300 per individual.

Keep a list of everything you give to charity and do research to calculate the.

How to get tax deductions for goodwill donations. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

Donate your car truck rv or boat to goodwill and receive an irs tax deduction. Noncash charitable contributions — applies to deduction claims totaling more than $500 for all contributed items. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

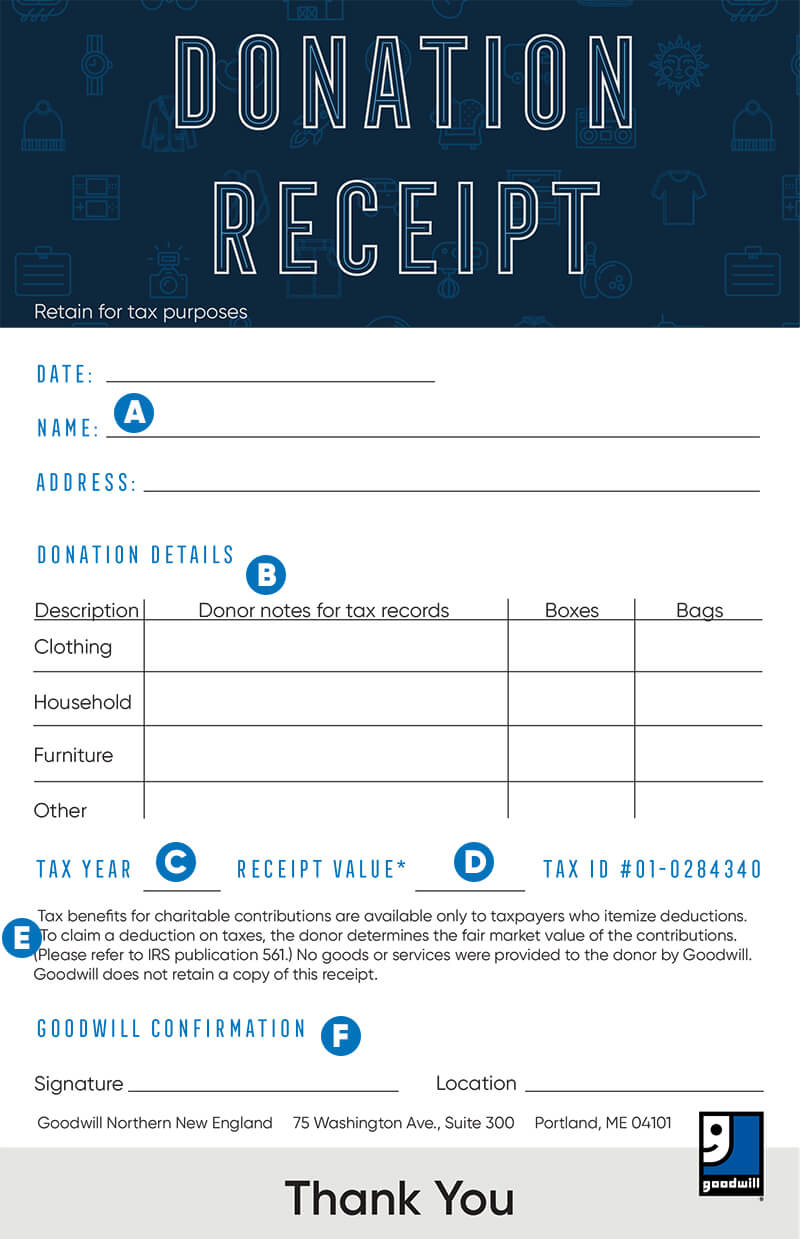

This form is available at the time of donation from our stores and donation centers in maine, new hampshire and vermont. You can input information about your donations throughout the year and print. How to get a tax deduction from your car donation know the irs rules for claiming tax deductions.

A donor is responsible for valuing the donated items and it’s important not to abuse or overvalue such items in the event of a tax audit. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. Ad get your taxes done right with support from an experienced turbotax® tax expert online!

For the 2021 tax year, you can deduct up to $300 of cash. A tax deduction is the amount of money you save on taxes because you donated. Donations of goods under $250 do not require a receipt;

Key points if you made cash donations to eligible charities in. And we make it easy for you to keep up with your donation records using our donation tracker! When you donate a car in good condition it will most likely be sold at an auction.

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. You must get a written acknowledgment or receipt from the organization for any gift you make for which you’re claiming a deduction of $250 or more. Vincent de paul, you may be eligible to receive a tax deduction for your donation.

General tax deductions for donations. For example, if you were in the 25% tax bracket, then your donation of $100 would save you $25 from taxes owed. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

What is the maximum goodwill deduction for 2019? You’ll also have to submit form 8283 for many of these items. 21 hours agodon�t miss this charitable donation tax deduction worth up to $300 per individual.

Should the fair market value of a single item, or group of similar items, exceed $5,000, you must provide a certified appraised value of the item and goodwill will complete part iv of section b of irs form 8283. The quality of the item when new and its age must be considered the irs requires an item to be in. Don�t know how to start filing your taxes?

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. If a donor is claiming over $5,000 in contribution value, there is a section labeled “donee acknowledgement” in section b, part iv of internal revenue service (irs) form 8283 that must be completed.

For the 2021 tax year, you can deduct up to $300 of cash donations per person without having to itemize, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. Itemizing deductions involves filling out schedule a on federal form 1040, with charitable deductions accounted for in the section on gifts to charity, lines 11 through 14. A goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on an individual’s taxes.

How much can you deduct for the gently used goods you donate to goodwill? Keep a list of everything you give to charity and do research to calculate the. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

Connect with an expert for unlimited advice The number on line 17. How much can i deduct for goodwill donations?