You can�t deduct any service fees. Deductible as itemized deduction (points) amortized over term of mortgage.

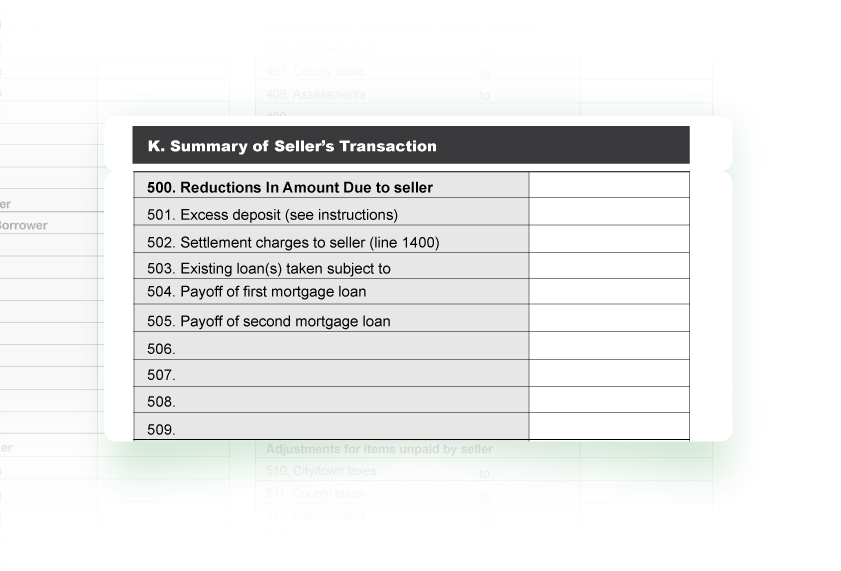

Gross amount due to seller this form is furnished to give you a statement of actual settlement costs.

Hud 1 tax deductions for buyer. No software to download or installation worries. The buyer of a principal residence may deduct interest, loan origination fees (typically referred to as “points,” also note that the irs allows the buyer to deduct these even if they came out of the seller’s funds) and real estate taxes. This document is required by law and should be given to your tax person the year you close on your home.this document is usually issued to you between 3 days to 1 hour prior to the closing.

Gross amount due from borrower c. The taxes due in 2020 for 2019 were $1,375. Deductible as itemized deduction (points) amortized over term of mortgage.

For better clarity, we will simply reference buyers and sellers as appropriate. Complete forms in as little as 10 minutes! You used the mortgage to buy or build a main home that secures the mortgage.

You can’t deduct any service fees. You can�t deduct any service fees. The taxes due in 2021 for 2020 will be $1,425.

The deduction for property taxes on your home is figured as follows. You can’t deduct any service fees. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.

For example, let’s say you close on march 15 th. Some of the more common. You used the mortgage to buy or build a main home that secures the mortgage.

You can deduct this cost on any primary or second home. Deductible as itemized deduction (points) amortized over term of mortgage. It also shows the portion of taxes the buyer must.

You can fully deduct points you paid on a loan to finance the purchase of a main home in the year you paid them if all of these apply: No crashing, reboots, lost or accidently deleted files, and 100% virus free. Insurance premiums aren�t tax deductible, but you can write off real estate taxes that you pay at closing, provided they are actually paid to the taxing authority before the end of the tax year.

Amounts paid to and by the settlement agent are shown. Most home buyers finance the purchase of their home with a mortgage, or home loan. At closing, the borrower pays a portion of the taxes due for the year.

Summary of borrower’s transaction 100. You used the mortgage to buy or build a main home that secures the mortgage. Amortized over term of mortgage.

Of course, capital gains may not be recognized if the property is a personal residence qualifying for the $ 250,000/$ 500,000 capital gain exclusion,. Gross amount due to seller this form is furnished to give you a statement of actual settlement costs. You’ll usually prepay interest for the remainder of the month that you are closing.

Total real estate taxes for the tax year $730 number of days in the tax year you owned the property 122 divide line 2 by 365. Instead, you add the $1,375 to the cost (basis) of your home. You can�t deduct any of the taxes paid in 2020 because they relate to the 2019 property tax year and you didn�t own the home until 2020.

For example, i read this article that says: