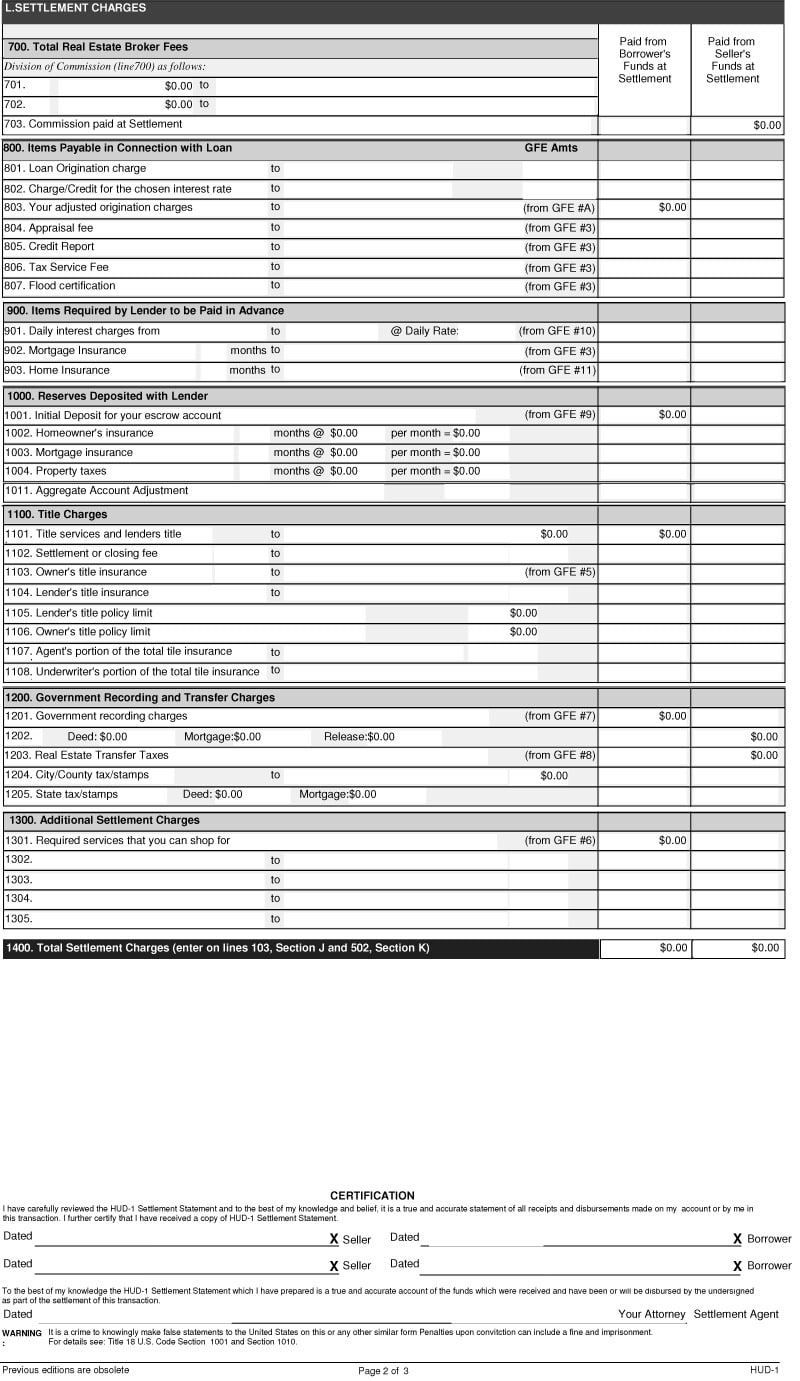

Creditors or their closing agents use this form to create an itemized list of all charges and. It is still used in reverse mortgages, loan transactions that allow sellers to pull equity out of their home.

Summary of borrower’s transaction 100.

Hud 1 tax deductions for seller. Gross amount due from borrower c. That�s because the seller�s settlement charges are deducted from the purchase price, rather than credited against the purchase price as on the buyer�s side. This document is required by law and should be given to your tax person the year you close on your home.this document is usually issued to you between 3 days to 1 hour prior to the closing.

Summary of borrower’s transaction 100. Amounts paid to and by the settlement agent are shown. Creditors or their closing agents use this form to create an itemized list of all charges and.

Deductible as itemized deduction (points) amortized over term of mortgage. Amortized over term of mortgage. You used the mortgage to buy or build a main home that secures the mortgage.

Accommodation request for persons with disabilities: The credit amount, which is typically negotiated before the close of escrow, may exceed the actual amount needed to pay those items that are tax deductible, such as mortgage interest, points and real estate taxes. $244 under these facts, you can deduct.

Deductible as itemized deduction (points) amortized over term of mortgage. It is still used in reverse mortgages, loan transactions that allow sellers to pull equity out of their home. It�s important to understand which of these items can be deducted for federal.

Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments. Gross amount due to seller this form is furnished to give you a statement of actual settlement costs. Some of the more common.

The total of those itemized. You can fully deduct points you paid on a loan to finance the purchase of a main home in the year you paid them if all of these apply: Mortgage interest, loan points and real estate taxes.

Total real estate taxes for the tax year $730 number of days in the tax year you owned the property 122 divide line 2 by 365.3342 multiply line 1 by line 3. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments. You�ll find the seller�s settlement charges on line 502, where they�re subtracted from the gross amount due to seller on line 420.

If the property taxes were paid out of your proceeds/cash at closing, you may be able to deduct these expenses. You can’t deduct any service fees. As a seller of a home, if you gave a credit to the buyer during the closing of a house, are you able to claim that on your taxes to reduce your adjusted cost basis?

Of course, capital gains may not be recognized if the property is a personal residence qualifying for the $ 250,000/$ 500,000 capital gain exclusion,. Some of the more common examples of deductible expenses include loan origination fees, mortgage insurance premiums, and real estate tax payments.