Can both 80d and 80ddb be claimed? Type of accounts eligible for 80ttb deduction you can avail of a tax deduction on the below type of accounts:

Ad compare your 2022 tax bracket vs.

Income tax deductions for ay 2021 22. 10 lakhs as given u/s 115bbda is of no effect. Below is the checklist of irs (internal revenue service) standard deductions for 2020 to be submitted on the following year of 2021, based upon your declaring status: The modification is developed as a forecast, however it should not be away from the future launches:

40,000 or actual expenses incurred whichever is lower and for senior citizens, the limit is rs. From simple to complex taxes, filing with turbotax® is easy. In computation of taxable income, the depreciation rate as per income tax act will be allowed as deduction while depreciation as per book profit is added back.

The maximum exemption limit in the section is ₹1.5 lakh. Can both 80d and 80ddb be claimed? Single| taxpayers get $12,550 of deductions, which is a raising from $12,400 in the past year.

Single taxpayers get $12,400 of deductions, which is a raising from $12,200 in the previous year. It is advised to compare your tax liability under both tax regimes and then choose the one. Ad turbotax® makes it easy to get your taxes done right.

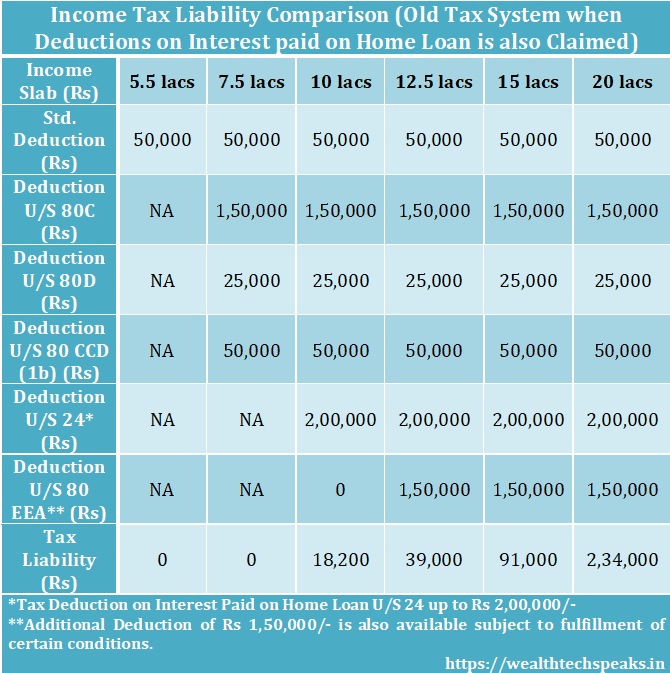

Individuals and hufs can opt for the existing tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the taxpayer opting for concessional rates in the new tax regime will not be allowed certain exemptions and deductions (like 80c, 80d,80ttb, hra) available in the existing tax regime. Type of accounts eligible for 80ttb deduction you can avail of a tax deduction on the below type of accounts: Income tax deduction under section 80c this is the most important section for deductions for every taxpayer.

Standard deduction in place of a and b (c) 40,000. 1.5 lakh annually from their total income. 1,00,000 or actual expenses incurred whichever is lower.

Ad compare your 2022 tax bracket vs. In this article we have. Discover helpful information and resources on taxes from aarp.

Your 2021 tax bracket to see what�s been adjusted. Only individuals and hufs can avail of a maximum tax deduction of rs. Interest on post office deposits.

Listed below is the list of irs standard deductions for 2021 to be submitted in the next year of 2022 based on your declaring status. Depreciation is allowed as deduction under section 32 of income tax act, 1961. Income tax deduction & exemption is available under the old system for the salaried individuals.

Income from salary (income from salary after standard deduction of rs.40000.) income from salary (income from salary after standard deduction of rs.50000.) income from salary (income from salary before exemptions/deductions. 14 rows maximum deduction allowed is 10% of salary (in case of taxpayer being an employee) or 10% of gross. Section 80 of the income tax act allows several tax deductions to salaried employees.