You can claim the american opportunity tax credit for each eligible student. You do not have to itemize your deductions to claim this.

The total of all miscellaneous deductions needed to exceed 2% of adjusted gross income in order to be deductible, and if the taxpayer was subject to alternative minimum.

Income tax deductions for college professors. 2 one spouse can�t claim $300 while the other spouse claims $200 for the $500 total. Tax deductions reduce your taxable income. Phil murphy revived the incentive program in the summer of 2018, after the program was put on hiatus for several years.

Tax tips for college professors research expenses. My alternate minimum tax turned out to be somewhat larger than my regular tax, so i had to pay that. The loss of this deduction highlights how useful a 529 college savings plancan be for saving money on college expenses.

The deduction for tuition and fees expired on december 31, 2020. Under the way things used to be, a college professor could potentially take a deduction for research expenses or expenses for classroom supplies as a miscellaneous itemized deduction. Massachusetts offers a regular tax deduction for tuition payments that exceed 25 percent of the taxpayer’s income.

You can each claim up to $250 in expenses for a total of $500 on a joint tax return if both you and your spouse are educators. The educator expense deduction allows eligible educators to deduct up to $250 worth of qualified expenses from their income. Supplies for courses on health and physical education qualify only if.

For example, for a person in the 24% income tax bracket, a $1,000 tax deduction would lower their tax bill by approximately $240, or 24% of $1,000. You can claim the american opportunity tax credit for each eligible student. Ad turbotax® makes it easy to get your taxes done right.

If the credit reduces your tax liability to zero, the irs refunds 40% of the. Each spouse�s qualifying expenses are capped at $250. Income tax deductions for out of pocket expenses for professors.

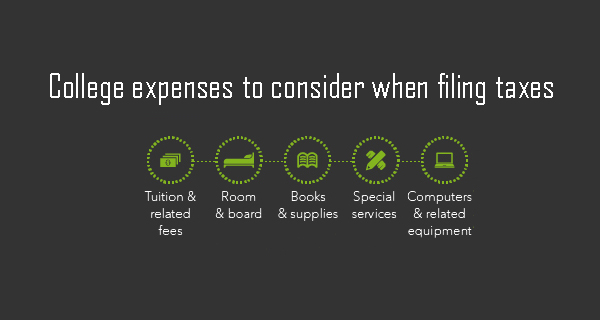

The lifetime learning credit is for 20% of education expenses up to $10,000, or a maximum credit of $2,000. As in new york (see above), arkansas provides this benefit in the form of an itemized deduction. Qualified expenses include purchases such as:

You add these deductions up, then subtract 2 percent of your adjusted gross income. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe. The tuition and fees education tax deduction expired on dec.

August 18, 2006, 8:43:00 pm ». An eligible educator can deduct up to $250 of any unreimbursed business expenses for classroom materials, such as books, supplies, computers including related software and services or other equipment that the eligible educator uses in the classroom. The total of all miscellaneous deductions needed to exceed 2% of adjusted gross income in order to be deductible, and if the taxpayer was subject to alternative minimum.

If professor are employed by college then they are the employee of the college and salary received by them will be taxed under the head salary. In 2019, the secure act added student loans to the 529 plan qualified expense list. Furthermore, one can get hit with an alternate minimum tax if your schedule a deductions are too large.

If setting and checking papers are of the college itself and connected with such employment then any sum they get will be taxed under salary. The irs says that research expenses, including travel costs, are a valid 2 percent deduction for. If you’re an eligible educator, the internal revenue service (irs) may let you deduct some of these expenses from your taxes this year.

Deductions can reduce the amount of your income before you calculate the tax you owe. Four states (arkansas, massachusetts, new york, and wisconsin) offer tax deductions to assist with tuition payments. You can use up to $10,000 (lifetime) to pay off any unpaid student loan balances.

How credits and deductions work. The actual tax savings depends on your tax bracket. You do not have to itemize your deductions to claim this.

Answer simple questions about your life and we do the rest. This deduction is allowed as a direct reduction to adjusted gross income and can be taken regardless of whether or not the teacher takes itemized deductions. Basically, no deduction is available to you.

Here are two tax deductions applicable to college expenses. Up to $2,500 tax deduction. 31, 2020, and has not been renewed for 2021.

The deduction was up to $4,000 above the line, but barring new legislation, it is no longer available. Sabbaticals have long been one of the most highly regarded perks of an academic career. However, taxpayers who paid qualified tuition and fees in 2018, 2019 and 2020 could claim a maximum deduction of $4,000.

Incase they do this for university exam then it is application of professional expertise so. For the 2022 tax year, the amount for each educator increases to $300. Tax planning and sabbatical leaves.

In late december of 2017, congress passed the largest tax reform bill in over 30 years. On schedule a one can only deduct expenses that exceed 2% of gross income. The tax reform act of 2017 has eliminated the miscellaneous deduction, for the most part, on the federal return.

Only self employed persons can deduct any expenses relating to work. If you qualify, you could get a credit for 100% of the first $2,000 of qualified education expenses that you paid, plus 25% of the next $2,000, for a total of $2,500 per student. Check with an accountant in your state.

Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund.