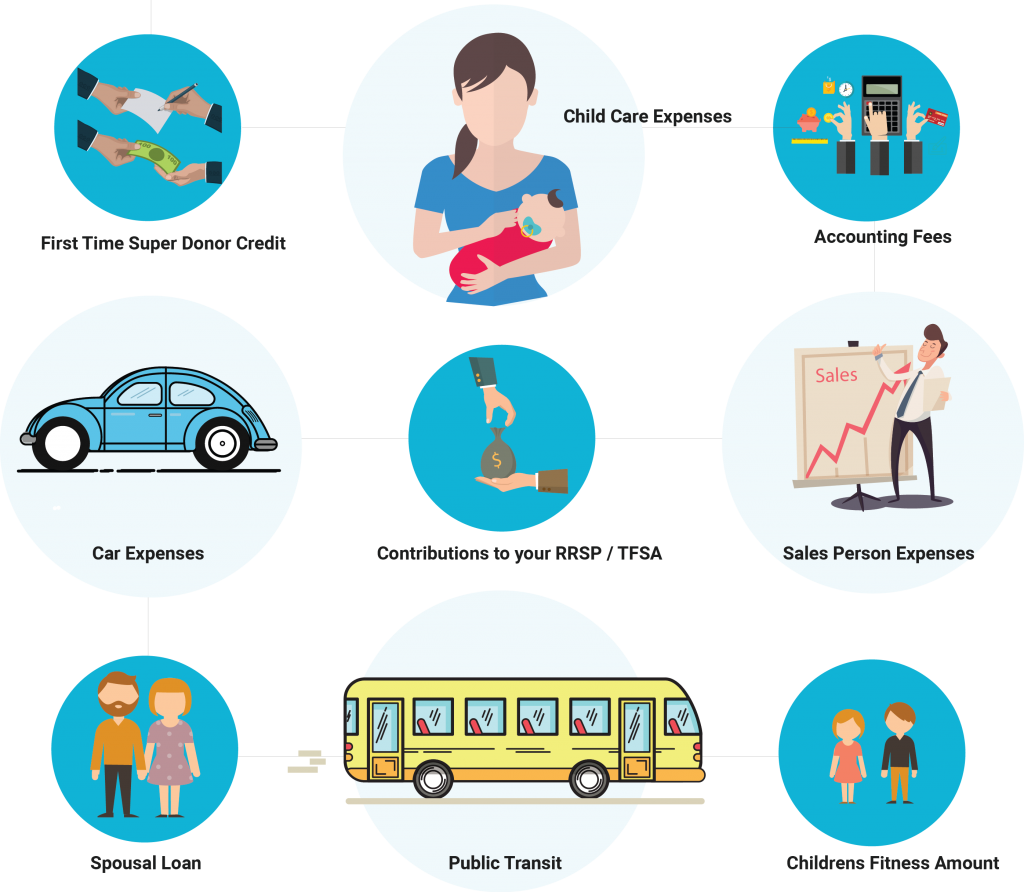

You can, for example, deduct rrsps, child care expenses, employment expenses, just to name a few. You can find this amount in the t778 form.

See the other tax credits and incentives section for more information.

Income tax deductions for dependents canada. When you’ve paid someone to look after your children so you can work, carry on a business, or go to school, you can claim child care expenses. You may be able to claim the amount for an eligible dependant if, at any time in the year, you supported an eligible dependant and met certain conditions and you did not claim an amount for the year on line 30300 of your return. The federal government also offers child tax credits.

Find out about provincial or territorial income. You can, for example, deduct rrsps, child care expenses, employment expenses, just to name a few. If an individual receives a $20,000 child tax credit or their taxes are reduced by $500, that person will get a $2,000 discount.

You can find this amount in the t778 form. Qualifying dependent has a job, but they are still required to receive at least half of their yearly support amount. Unlike countries that permit personal exemptions and allowances in determining taxable income, canada has adopted a system of tax credits.

The less wealthy may not receive a $200 discount. Child care expenses the most common deduction for parents is for child care. Line 30400 was line 305 before tax year 2019.

Carrying charges, interest expenses, and other expenses. 12 best tax deductions for 2021. See the other tax credits and incentives section for more information.

Find deductions, credits, and expenses you can claim on your tax return to help reduce the amount of tax you have to pay. Your total income minus these deductions equals your net income. To claim the credit, both of these criteria must be met:

Tax credits equal to a reduction in the amount of your tax bill if your bill is $10,000 and if you qualify for the maximum credit. The earned income tax credit reduces the amount of taxes owed by those with lower incomes. Therefore, working parents or parents actively pursuing employment for dependents under 13 can claim the child and dependent care credit.

$2,397 3% of your dependant�s net income (line 23600 of their tax return) note the maximum provincial or territorial amount you can claim for medical expenses may differ depending on where you live. Your taxable income can be reduced due to each child claiming a dependency exemption during tax years prior to 2018. Child and dependent care credit.

You do not need to itemize to claim the tuition and fees deduction. Deduction for cpp or qpp enhanced. How much do dependents reduce taxes canada?

Answer these 3 questions to find out if you can claim the amount for an eligible dependent. Add your child as family member in profile tab, enter the child care expense after selecting your child in dropdown in top panel and going to deduction tab. Then there are items you may be able to deduct from the net income to arrive at your taxable income on line 26000.

Qualify for help and may be employed, but their assistance needs to increase significantly. Claiming deductions, credits, and expenses. Claim this amount if, at any time in the year, you supported an eligible dependant and their net income (that is indicated on line 23600 of their return, or the amount it would be if they filed a return) was less than your basic personal amount (or your basic personal amount plus $2,273, if they were.

As a canadian taxpayer, you can claim up to 2/3rds of your earned income, to a certain maximum amount per child’s age. Child support payments are 100% not an allowable tax deduction in canada. The earned income tax credit (eitc) is a refundable tax credit of up to $3,618 for one dependent, $5,980 for two dependents, and $6,728 for three or more dependents for the 2021 tax year.

One of the larger credits, the eligible dependant credit can be up to approximately $12,000 (or more if your dependant qualifies for the canada caregiver amount). You can only claim the deduction if your gross income is $80,000 or less for single filers and $160,000 or less for joint filers. To claim the deduction, you need to complete two tax forms:

Here are some common dependant tax credits: Schedule 1 and form 8917, tuition and fees deduction. The maximum amount for a child under six is $6,765;

All qualified children who are under 17 can be partially credited with $2,000 of federal income taxes. Eligible deduction will be calculated automatically by our program once you enter the total expense details. This credit is another dollar for dollar reduction of your taxes for up to 35% of your expenses.

How much do you get for claiming a dependent?