The irs allows for any. According to the irs, business expenses must be both ordinary and necessary.

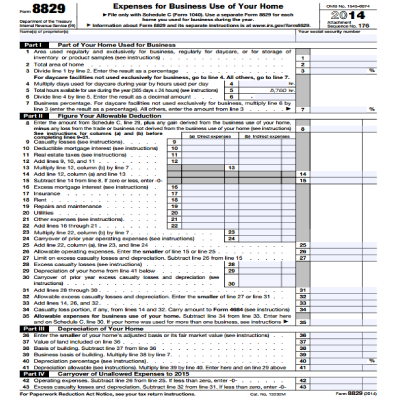

The simplified option is to take the standard deduction of $5 per square foot of home used for business (maximum 300 square feet).

Income tax deductions for home based businesses. Multiply $5 by the area of your home used for business purposes (up to 300 square feet). You can still claim allowable home. You can typically deduct home office expenses in one of two ways:

Homeowners/renters insurance homeowner association fees cleaning services and office supplies used in the. The irs allows for any. The irs allows you to make a simple calculation for small office spaces.

The maximum deduction under this. Ad find out what tax credits you might qualify for, and other tax savings opportunities. Find the square footage of your home office space and multiply that by $5 a square foot.

There are two ways to deduct home office. With your business at home, you can deduct various federal, state, local, and foreign taxes if they are directly related to your business and its expenses. The maximum size for this option is 300 square feet.

One of the most significant deductions unique to home businesses is for the cost of the rent or mortgage in proportion to the area in your home where you work. That mean you can deduct. The simplified option is to take the standard deduction of $5 per square foot of home used for business (maximum 300 square feet).

Talk to an accountant right now, or schedule a free consultation. To take this deduction, you’ll need to figure out the percentage of your home used for business. Ad find out what tax credits you might qualify for, and other tax savings opportunities.

There are restrictions, but if you use part of your home exclusively as a work office,. Talk to an accountant right now, or schedule a free consultation. In this example, the expenses total $22,000 for the fiscal year.

If you use a home office for your business, you may be able to deduct a portion of your housing expenses against business income. And the expense for that place is a legitimate business expense, deductible on your business tax return. The simplified option has a rate of $5 a square foot for business use of the home.

According to the irs, business expenses must be both ordinary and necessary. Deductible business use portion (total * 5%) $1,100. Simplified (in which you multiply a specified rate by the square footage you use for your business) and.

Small business owners who work from their homes can claim a tax. For example, if your home business space is 15% of your total home space, you can deduct 15% of the cost of utilities. 3 simplified calculation method the simple method is.

At the federal level, you can. If you use your home or car for business purposes, you may be able to deduct some of your living expenses. Say your home office occupies 10% of your house.

The optional deduction is capped at $1,500 per year.