You may be able to. Up to $4,000 of your tuition and fees expenses can

(2) the date of the contribution;

Income tax deductions for lawyers. (3) a description of the property in sufficient detail under the circumstances (taking. The amount of the credit is based on how much a taxpayer has increased its r&d expenses over a base. Lawyers with $157,500 or less of taxable income get the full deduction ($315,000 or less for a joint return).

Any amounts over $5,000 may be deducted over the first 60 months you are in business. 1 day agothe ahmedabad bench of the income tax appellate tribunal (itat) headed by rajpal yadav (vice president) and waseem ahmed (accountant member) has held that the assessee was eligible for an income. You may be able to.

There are a wide array of available tax deductions that are outside the scope of this guide, but we�ve provided information on the most common types and how they work. People with higher incomes may not be allowed to deduct as much (or claim the deduction at all). If you earn your income as a lawyer this information will help you to work out what:

More workers and working families who also have investment income can get the credit. They help reduce your taxable income, meaning you’ll pay less in taxes and preserve more of your earnings. The r&d credit is complex.

In addition to a tax deduction for r&d expenses, a tax credit is available. Since taxable income is less than $315,000, l can take a deduction of 20% of $250,000 or $50,000. Tax deductions refer to the allowable deductions as outlined by the irs that permit taxpayers to assess against their ultimate adjusted gross income (agi) in order to get to their tax liability.

Income and allowances to report. Starting in tax year 2021, the amount of investment income they can receive and still be eligible for the eitc increases to $10,000. If you�re fortunate enough to be able to provide pro bono legal services, you may be wondering whether federal law allows any income tax deductions for your good work in that regard.

If your taxable income is over $415,000/$207,500, you get no deduction. Advertising, entertainment and promotional costs. Lawyers with taxable incomes within these ranges will get a partial deduction.

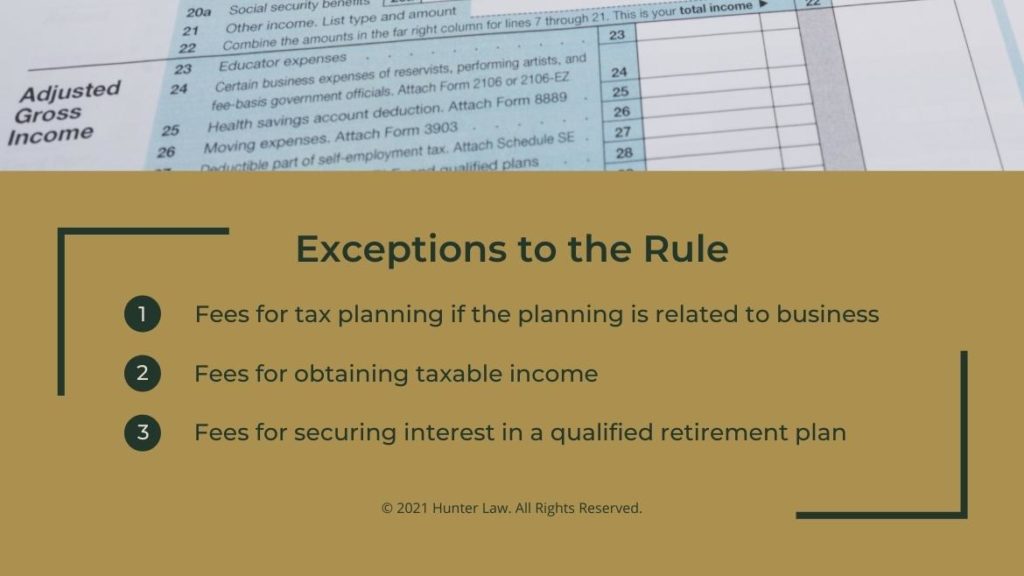

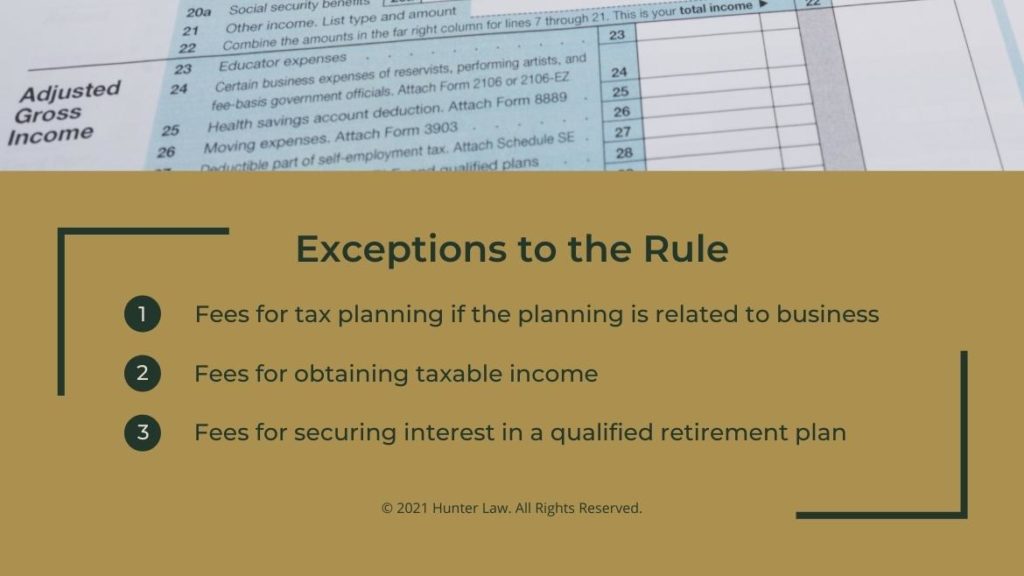

New law changes expand the eitc for 2021 and future years. “[t]he legal fees in issue which represented the cost to petitioner of producing monthly alimony payments, which were included in her gross income, are deductible under section 212(1) as ordinary and necessary expenses paid or incurred during the taxable year for the production or collection of taxable income.” (2) the date of the contribution;

(1) the name and address of the charity; The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (qbi), plus 20 percent of qualified real estate investment trust (reit) dividends and qualified publicly traded partnership (ptp) income. Home office expenses if this includes you, and your main office is your main place of business.

Records you need to keep. The new thresholds took effect in 2019, rising from (1) $50,000 to $75,000 for single filers and married people filing separately and (2) $60,000 to $100,000 for joint filers and heads of household. Up to $4,000 of your tuition and fees expenses can

The taxable income limitations is $60,000 (i.e., $300,000 x 20%). 16(ii) entertainment allowance [actual or at the rate of 1/5th of salary, whichever is less] [limited to rs. Income tax deductions for lawyers for 2020 1.

If you hire a lawyer to help you start a business—for example, to form a corporation or limited liability company—the cost is currently deductible up to $5,000. Thus, a single lawyer with taxable income in excess of $207,500 is denied the deduction (in excess of $415,000 on a joint return). More precisely, the question is whether the value of your time, services, and incidental expenses incurred providing pro bono legal services can qualify as a charitable contribution.

Tax deductions lower the amount of income that’s subject to taxation by the irs. For those who qualify, the deductions include: