Deductible moving expenses the cost of transportation and storage (up to 30 days after the move) of household goods and personal effects. Temporary lodging while you are en route to your new.

However, you can’t claim the cost of meals during the move.

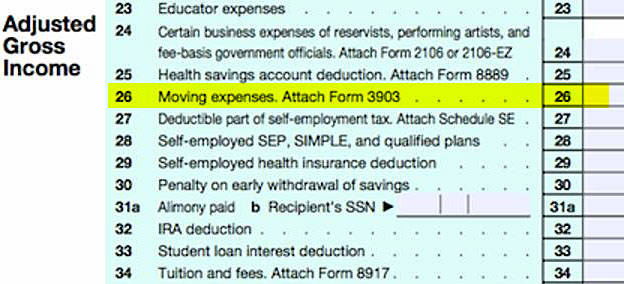

Income tax deductions for moving. For tax years prior to 2018, federal tax laws allow you to deduct your moving expenses if your relocation relates to starting a new job or a transfer to a new location for your present employer. According to the irs, the moving expense deduction has been suspended, thanks to the new tax cuts and jobs act. This includes mover’s costs, transportation, and lodging along the way.

Answer you are eligible to claim a deduction for moving expenses. The only exception is for active military in certain circumstances. Up to 10% cash back you can only deduct the cost of one trip as a moving expense.

What moving expenses are tax deductible? Meeting the time and distance tests. Expenses that are not considered eligible moving expenses.

You can deduct your unreimbursed moving expenses for you, your spouse, and your dependents. However, you can’t claim the cost of meals during the move. Citizen or resident alien for the entire tax year.

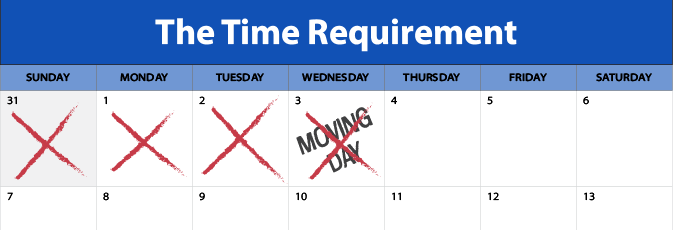

To qualify for the deduction, your new work location must be a sufficient distance from your old home and you must begin working shortly after you arrive. Income from which you can deduct eligible moving expenses, carry forward, and expenses paid after the move. Qualifying for a moving expense deduction on your federal return to take the moving expense deduction on your federal income tax return, the irs says your move must meet three requirements:

Deductible moving expenses the cost of transportation and storage (up to 30 days after the move) of household goods and personal effects. Travel is limited to one trip per person. If married, the spouse must also have been a u.s.

However, each member of the household can move separately and at separate times. Fill out the rest of your federal return to determine your federal taxable income, which you�ll need to do your north carolina taxes. Most of the rules for qualifying for this deduction as a military member are the same as those that applied to other taxpayers before 2018.

Starting in 2018, congress did away with the federal tax deduction for moving expenses, with few exceptions. With the republican tax cut & jobs act (tax reform) that was signed in to law in late 2017, the moving expense tax deduction no longer exists for 2018 and beyond, until the law expires in 2025. Citizens or resident aliens for the entire tax year for which they�re inquiring.

Travel expenses for yourself and family members traveling with you. The tool is designed for taxpayers who were u.s. Fees incurred for turning off utilities at your previous home.

You may be able to deduct your costs if you move to start a new job or to work at the same job in a new location. Moving expenses are not tax deductible for most people. This aspect of the tax code is pretty straightforward:

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. Read expenses you can deduct and expenses you cannot deduct. Armed forces and you had to move because of a permanent change of station.

Hawaii did not adopt the federal provision that suspended the deduction for moving expenses, except for members of the armed forces, for tax years 2018 through 2025. Unreimbursed employee moving expenses can�t be deducted by the employee as miscellaneous expenses. This means that only those expenses in excess of 7.5% of a taxpayer�s agi are deductible.

For example, if someone�s agi is $100,000, only those medical and dental expenses above $7,500 (7.5% x $100,000 = $7,500) would be deductible. Types and amounts of moving expenses. You must satisfy two additional criteria to qualify for counting these expenses as tax deductions:

Effective from 2018 through 2025, all employee moving expenses paid to employees by your business are taxable to the employee. In addition, the irs states that “employers will include moving expense reimbursements as taxable income in the employees’ wages.”. The tax cuts and jobs act of 2017 eliminated the deduction just until january 1, 2026.

But there’s serious talk about making the elimination permanent. Travel, including lodging, from the old home to the new home. You can only deduct the cost of lodging at the old place for one day if you had to stay elsewhere because your furniture had been moved.

The irs offers the following tips about moving expenses and your tax return. When filing in 2022 for the 2021 tax year, the standard tax deduction that you can claim based on your filing status is: Amount you paid to pack and store your household goods and personal items amount it costs to travel from your old home to your new home.

It must relate closely to the start of a job. Shipping your vehicle to your new home. You can�t deduct expenses that are reimbursed or paid for directly by the government.

You can deduct these moving expenses: Deductible moving expenses include the costs of moving the contents of your home, as well as lodging on your route, but not meals. The move must closely relate to the start of work.

You don�t have to itemize your deductions to claim moving expenses. You can only deduct moving expenses incurred within one year of the day you started your job. Temporary lodging while you are en route to your new.

In order to deduct moving expenses, your move must meet three requirements: Your business can still deduct these payments as business expenses. The limit is 7.5% of a taxpayer�s adjusted gross income (agi) for 2019 and 2020.

Moving expenses are an adjustment to income, not an itemized deduction. Just to be absolutely clear: Due to the tax cuts and jobs act (tcja) passed in 2017, most people can no longer deduct moving expenses on their federal taxes.

Your expenses also must be reasonable to claim this deduction. Eligible moving expenses, including legal fees.