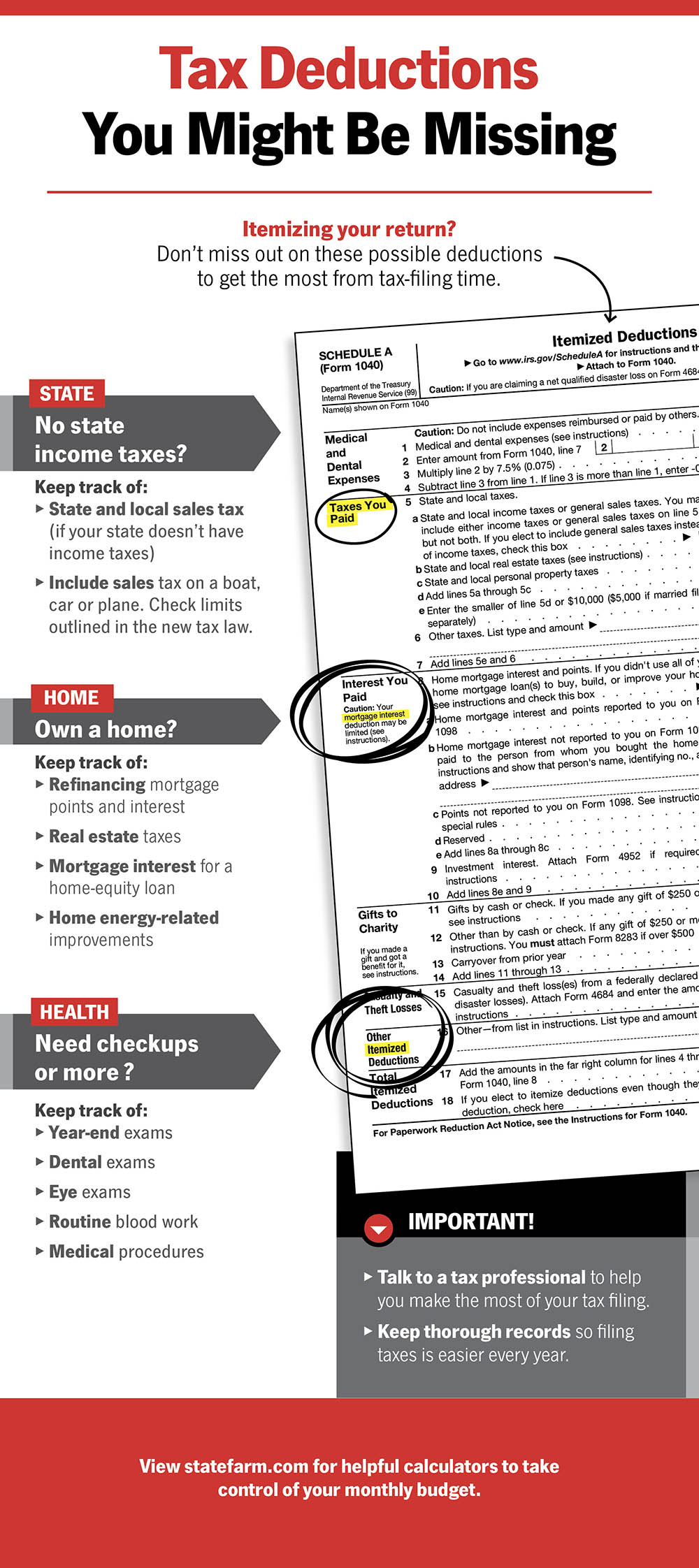

A tax deduction will reduce your amount of taxable income for the year. To deduct expenses of owning a home, you must file form 1040, u.s.

The mortgage interest on your primary residence, as well as on a second residence.

Income tax deductions for new homeowners. This is the biggest deduction available for homeowners. The maximum saver’s credit available is $4,000 for joint filers and $2,000 for all others. $12,550 for single filers and married individuals filing separately, up $150 from the prior year.

You just have to shell out the money. One exception, though, is if you make medically necessary improvements—adding an accessible entrance or installing support bars, for example. To deduct prepaid mortgage interest (points) paid to the lender if you must meet these qualifications:

According to the new law of 2018, you can only deduct certain taxes on your property. (there are limits, but relatively few. To deduct medical expenses on your income tax return, your medical.

The irs standard deduction for 2018 is $24,000 for married couples and $12,000 for singles or married couples filing separately. Claiming new doors on your tax return any entry, interior, and garage doors you installed this past tax year are eligible for a tax deduction. Obamacare hasn’t been completely killed off by the current administration.

The following can be eligible for a tax deduction: This section explains what expenses you can deduct as a homeowner. If you itemize, you can’t take the standard deduction.

You may be able to deduct these costs as medical expenses. Use form 8880 and form 1040 schedule 3 to claim the saver’s credit. Homeowners can deduct interest expenses on up to $750,000 of mortgage debt from their income taxes, though when they itemize these deductions, they forgo the standard deduction of $12,550 for individuals or married couples filing individually, $18,800 for head of household & $25,100 for married filing jointly.

If you were a new jersey homeowner or tenant, you may qualify for either a property tax deduction or a refundable property tax credit. Ad turbotax® makes it easy to get your taxes done right. If you’re filing jointly with your spouse, the maximum property tax deduction available is $10,000 per.

The ptc tax credit is available if your household income is below 400% of the federal poverty line, based on the size of your family. Each month, part of your mortgage payment goes toward the principal (the amount. There are other tax breaks.

An additional $1,300 deduction is available for elderly or blind taxpayers in 2018, and that amount increases to. More information is available on the credit/deduction. From simple to complex taxes, filing with turbotax® is easy.

New for tax year 2022 the new jersey college affordability act created three new income tax deductions for taxpayers with gross income under $200,000: Like with new windows, they must meet the standards of energy star. Each mortgage payment includes an interest.

To decide whether to itemize, add up homeowners and other. A tax deduction will reduce your amount of taxable income for the year. The mortgage interest on your primary residence, as well as on a second residence.

$18,800 for heads of households, up $150. This amount is limited to $10,000 per person. Answer unfortunately, most of the expenses you paid when buying your home are not deductible in the year of purchase.

The standard deduction for heads of households was $18,650. To deduct expenses of owning a home, you must file form 1040, u.s. Income tax return for seniors, and itemize your deductions on schedule a (form 1040).

For the taxes filed in april 2018, this limit is $11,880 for individuals and $4,140 per additional family member in your household. The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest (points). You may claim 10% of the total cost, up to a maximum of $200, for new windows.

Tax deductions and tax credits. Discover tax deduction new home purchase for getting more useful information about real estate, apartment, mortgages near you. Deductions can reduce the amount of your income before you calculate the tax you owe.

Any amount over $10,000 is not deductible; Tax deductions for homeowners mortgage interest. Selling a house and claiming an appropriate deduction for property taxes.

There are two types of tax breaks available to you: Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. For the most part, home improvement expenses aren�t tax deductible.

7 tax deductions for homeowners 1. Don’t forget to include any taxes you may have reimbursed the seller for. A range of tax credits for new home construction can alleviate some of the associated costs.

For most people, it makes sense to stick with the standard deduction. The drop in the mortgage deduction limit is another way donald trump screwed homeowners in expensive areas.