Hence, there are various deductions available on salary incomes which are applicable for pensioners as well.pension given to the officials of uno is exempted from taxes. Hence, there are various deductions available on salary incomes which are applicable for pensioners as well.pension given to the officials of uno is exempted from taxes.

Section 80ccd(1b) deduction can be claimed on and above the limit of rs 1.5 lakh under section 80c & section 80ccd(1).

Income tax deductions for pensioners. However, where a pensioner is in receipt of more than one source of income, the different sources of income are. Taxpayers who are eligible for both the general pension and annuity exemption and the trs pension exemption may take whichever one is most favorable to them. I have received many questions, and wanted to clarify that the exemption stands.

For more information, review the fyi income 25 guidance publication. Clarification from income tax department on standard deduction download: The deduction is $20,000 for a return filed as single or married, filing separately, or $40,000 for a return filed as married, filing jointly.

In that case, they can claim an additional deduction for up to rs 50,000 in a financial year under section 80ccd(1b). If you checked both boxes 22c and 22g your deduction is increased by $30,000. Except as otherwise provided, for an individual born after 1952, the deduction for pension or retirement benefits does not apply, and when he or she reaches the age of 67, the individual is eligible for a deduction of $20,000 for a single return or $40,000 for a joint return against

Hence all the annuity pensions and the pensions arrears paid to the retired employees are taxed while their payment is made. If you checked either ssa exempt box 22c or 22g from schedule 1, your deduction is increased by $15,000. Tax deductions (paye) on your pension or annuity.

As per section 2 of the un (privilege and immunities) act, 1947 salaries. Over the past few months, you may have seen some news about the income tax exemption for social security, pension, and annuity incomes. Who can claim (1) (2) (3) against �salaries� 16(ia) standard deduction [rs.

Beginning on january 1, 2019, connecticut stopped collecting income taxes on social security. For pensions there is a standard deduction of rs.50,000. Deductions include deduction against salaries, against ‘ income from house properties ‘, against ‘ profits and.

The total of all payments in the calendar year was more than $500 you deducted tax from any payment It falls under section 80d. Those who opt for voluntary federal income tax deductions can receive the tax deduction by completing form isp 3520, request for voluntary federal income tax deductions, which appear online.

According to the rules of taxation, an uncommuted pension is viewed as a salary under the income tax act, 1961, and is therefore taxable.however, section 89(1) has a number of deductions on salary income that is provided to pensioners who receive their salary through nationalised banks. Hence, there are various deductions available on salary incomes which are applicable for pensioners as well.pension given to the officials of uno is exempted from taxes. An individual can claim a maximum deduction of rs 2 lakh by making contributions to pension schemes.

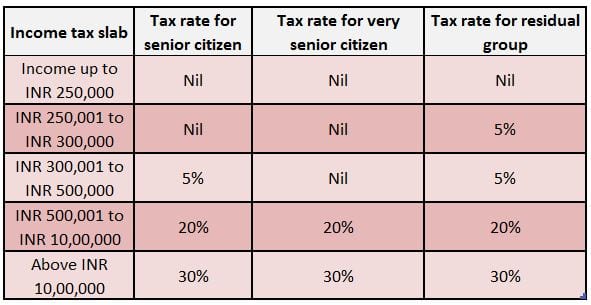

Income tax benefits for senior citizen and very senior citizen faqs on pension payment by banks can a pensioner draw his/ her pension through a bank branch? Income tax benefits for senior citizens Both the interest earned on saving deposits and fixed deposits are eligible for deduction under this provision.

Ct tax exemptions for pensions clarified. Section 80ccd(1b) deduction can be claimed on and above the limit of rs 1.5 lakh under section 80c & section 80ccd(1). The deduction is allowed for a maximum interest income of up to ₹ 50,000 earned by the senior citizen.

5 rows pension income and applicability of standard deduction u/s 16(ia) there are various types of. Taxpayers who are 65 years of age or older as of the last day of the tax year can subtract the smaller of, $24,000 or the taxable pension/annuity income included in federal taxable income. Entertainment allowance [actual or at the rate of 1/5th of salary, whichever is less] [limited to rs.

Income tax deductions for social security and pension income by: The payment of the canada pension plan is normally not subject to tax in canada for residents. You have to fill out the t4a slip, statement of pension, retirement, annuity, and other income, if you made any of the payments listed above and one of the following applies:

In this article we have discussed income tax deduction available to taxpayers from various sources of income for a.y. What are the taxation rules for pensions? Standard deduction is the greater of $1,100 or the earned income for the year plus $350 up to the standard deduction amount.

This is for pensions in the form of annuity payments which are taxable just like the salaried income.