When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe. Income tax deductions for utah.

Deductions can reduce the amount of your income before you calculate the tax you owe.

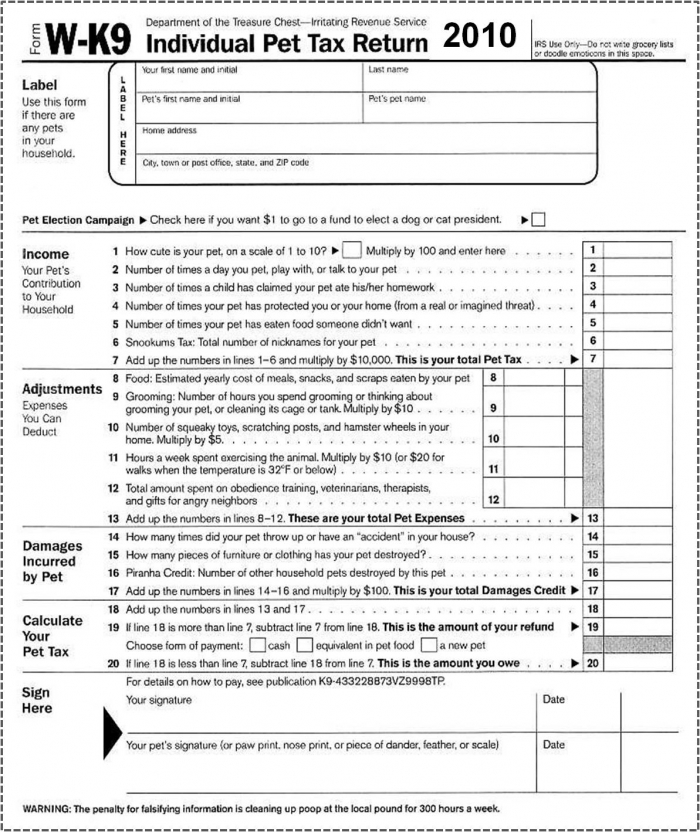

Income tax deductions for pets. Deductions can reduce the amount of your income before you calculate the tax you owe. When your pet generates income for you, you may be able to deduct some or all of your expenses. I’m going to dip into the “something you don’t hear every day” file with an interesting bit of information:

Ab 150 calculates the tax to be paid by a qualified entity by multiplying the entity’s qualified net income by a tax rate of 9.3%. Such a large standard deduction. For tax year 2021, the credit is 0.7% of the lesser of $43,333 or the south carolina qualified earned income of the taxpayer with the lower qualified income for the taxable year.

Usually pet expenses will not hold up should the irs audit you. Income tax deductions for utah. Humanity and pets partnered through the years act ~ happy act hr 3501 ih 111th congress 1st session h.

It’s important to note that adoption fees to a rescue shelter are not tax deductible. You may be able to get a tax deduction for pet expenses if your pet helps you in a medical capacity or performs certain services. For example, if an employee earns $1,500 a week, the person`s annual income is 1,500 x 52 = $78,000.

This elective tax is in addition to. The standard deduction has been raised from $12,200 in tax year 2019 to $12,400 in 2020 for single filers, and from $24,400 to $24,800 for married filing jointly. A tax credit of $1000.00 per qualified pet, per household for those using the standard deduction on your tax return, for medical expenses defined as pet insurance premiums, special diets/vitamins prescribed by a licensed veternarian and deemed necessary, medicine and medical supplies for an illness or condition deemed necessary by a licensed veternarian, office visits,.

In general, deducting pet expenses on your tax return can get you into hot water with the internal revenue service (irs). To calculate an annual salary, multiply the gross salary (before tax deductions) by the number of pay periods per year. If your esa animal helps you in the treatment of a medically diagnosed mental or physical need, you may deduct the costs involved with taking care of the pet.

However, specific cases exist that allow you to. Although the above pet tax return is not for real, there is. Utah has had a flat tax rate of 4.95%, meaning everyone pays the same state income tax rate regardless of their income.

A personal itemized deduction for pet care would be limited to $3500 per year. Credits can reduce the amount of tax you owe or increase your tax refund, and some credits may give you a refund even if you don�t owe any tax. Expenses that may be covered include purchasing, training and maintenance of the animal which.

Yearly medical expenses must be greater than 7.5 percent of your adjusted gross income to meet the criteria for this deduction. Our pets can save us some serious cash. If you have a physical disability or are hearing or visually impaired, you can deduct medical expenses for your pets if they are certified service animals.

If you foster pets for a nonprofit, they will usually cover the cost of food and veterinary care. If you qualify, your pet’s expenses are tax deductible. Most states levy income taxes on employees` wages and salaries.

The entity’s qualified net income is the sum of the pro rata or distributive shares of income for any of the entity’s qualified taxpayers. For example, pets that are used in advertisements or movies, show animals, breeding your pets and selling their offspring, or if your pet’s social media accounts fetch you ad revenue. If you foster animals, you may be eligible for a tax reduction on your income tax return.

3501 this bill wants the internal revenue code of 1986 to be amended in order to allow a deduction for pet care expenses. Any pet that works for you or earns money, which you will report on your tax return, can qualify for tax deduction purposes, if they meet. You can claim your pet on your taxes, but only in specific situations that generally apply to service animals and business income.

To qualify, your medical expenses paid during the year must exceed 7.5% of your adjusted gross income. If you have a service animal, you may get a tax break under the medical expense deduction. When you claim federal tax credits and deductions on your tax return, you can change the amount of tax you owe.

If the animals are from a qualifying nonprofit, you may be eligible to deduct all of your expenses for caring for foster animals as charitable contributions. There are different tax deductions for pets you may qualify for, which would allow you to write off pet expenses such as: