1,50,000 12 is the aggregate of the deduction that may be claimed under sections 80c, 80ccc and 80ccd. 1,50,000 12 is the aggregate of the deduction that may be claimed under sections 80c, 80ccc and 80ccd.

2,500 can be levied as professional tax on any person per financial year.

Income tax deductions for professionals in india. Life insurance premium on the life of oneself, spouse, or any child. 16(ii) entertainment allowance [actual or at the rate of 1/5th of salary, whichever is less] [limited to rs. According to cleartax, for professionals, government has introduced a new scheme of presumptive taxation (section 44ada), under which professionals can file their return declaring 50% of their gross receipts (which must be up to rs 50 lakhs) as income, and after deducting section 80 deductions, professionals need to pay tax on balance total income.

Therefore, a deduction of 1,20,000 ( 6,00,000 × 20%) shall be allowed. 2,500 can be levied as professional tax on any person per financial year. Taxability of income of professionals under income tax law.

This maximum limit of rs. The limit is capped at ₹1.5 lakh (aggregate of 80c, 80ccc, and 80ccd). 1,50,000 12 is the aggregate of the deduction that may be claimed under sections 80c, 80ccc and 80ccd.

The objective of section 80jjaa is to encourage entities to make recruits and add fresh employees at regular intervals. ₹187500 + 30% of total income exceeding ₹15,00,000. In case of individual and huf, tds is required to be deducted only if last year turnover is greater than rs.

Profession tax is deductible under section 16 (iii) of the income tax act according to section 16 (iii) of the income tax act 1961, the profession tax paid by an employee is allowed as a deduction from his/her gross salary income. A deduction from income is available of up to inr 150,000 for investments made in the tax year in certain eligible schemes in india, namely: Tax deductions under section 80ccd are categorised in three subsections:

Income tax exemptions for defence personnel Deduction is limited to whole of the amount paid or deposited subject to a maximum of rs. Section 80hhc(4) of income tax act.

For senior citizens or dependent parents, deductions of up to rs.50000 may be claimed. However, under old tax regime the basic income threshold exempt from tax for senior citizen (aged 60 to 80 years) and super senior citizens. After you claim the reasonable.

From rs 8.8 lakh, rs 2.5 lakh would be deducted rs 10 lakh minus rs 7.5 lakh) and the tax would be computed on 15% from point 4 in the mentioned table. Income tax changes in union budget 2021. The sums paid or deposited need not be out of income chargeable to tax of the previous year.

To continue paying taxes at the current tax rates. 1.5 lakh annually from their total income. In this new regime, taxpayers have the choice of either:

Rs 37,500 will be your tax liability. To pay income tax at lower rates under the new tax regime in exchange for foregoing certain allowed exemptions and deductions available under income tax. The tax amount would be rs 25000 (10% of 2,50,000).

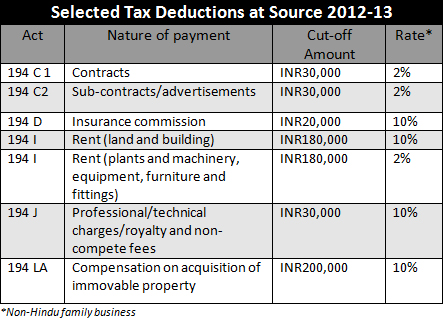

Yes, the income that the professionals receive is paid after deducting tds @ 10% under the provisions of section 194j of the income tax act. ₹262500 + 30% of total income exceeding ₹15,00,000. 50 lakhs in case of profession.

Contribution to public provident fund/national pension system (nps). Deductions available for professionals 1) all reasonable expenses incurred in connection with the earning of your professional income will be allowed as. The last amendment was made, and the section was applicable w.e.f april 4 2017.

The only change was the interest earned on contribution of more than rs 2.5 lakh in a year through epf or vpf would be added to. The maximum limit on these deductions is rs.25000 for the self or family. 2) your professional income will be subject to tds @ 10%.

New tax regime slab rates are not differentiated based on age group. Easy way to switch new to old income tax scheme for taxpayers. Contribution by employee to recognised provident fund.

There was no major changes in income tax in budget 2021. According to section 29, the profits and gains of a profession are to be computed in accordance with the provisions contained in sections 30 to 43 d. 1 crore in case of business or gross receipts are more than rs.

According to section 80d, salaried professionals can claim deductions on medical insurance premiums paid for the self or dependants. Since mother of the individual is not a specified person as per section 80c, no deduction would be available. It must, however, be remembered that in addition to the specific allowances and deductions stated in sections 30 to 36, the act further.

Only individuals and hufs can avail of a maximum tax deduction of rs. Also, there are a bunch of other deductions one can avail under the. Under it, employers of new or existing entities can claim 30% of their expenses incurred for recruiting an additional employee as tax deduction.

Employee contribution under section 80ccd (1):