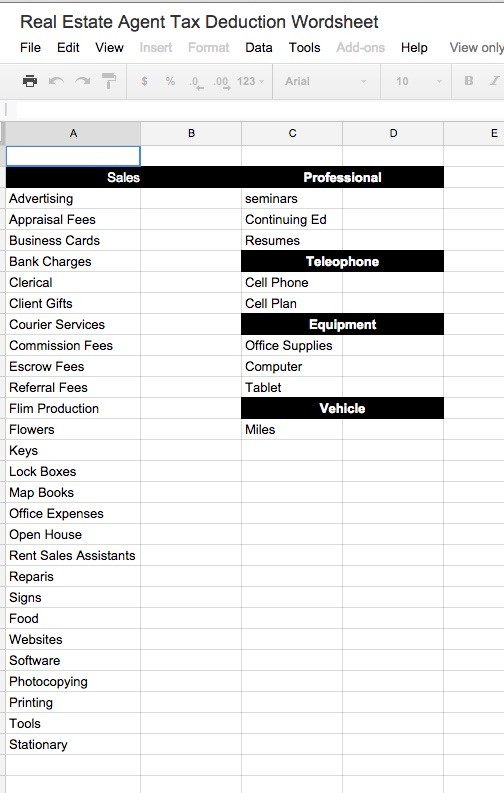

These transportation and petrol expenses that are necessary for your business are. Marketing tax deductions for real estate agents.

18 tax deductions for real estate agents.

Income tax deductions for real estate agents. Learn to file taxes as a real estate agent with this guide from the ce shop. Deduct lease payments or depreciation of purchases. Buy new lease a new car:

Tax tips for real estate agents. Tax deductions for real estate agents the irs allows for many different tax deductions, depending on the needs of your business. Of course, many real estate agents put so many miles on a car, the mileage limits may be an issue.

Realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive. Speaking very generally, business expenses are tax. Rather than doing your own taxes or using.

Deducting your office space one of the most popular real estate deductions. Most real estate agent marketing expenses will fall under the category of a tax deduction. Whether it’s sales and open.

Real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations. Deduction #4 show detail advertising expense the irs allows. As a real estate agent, you’ll likely need to drive to your clients and property viewings.

Add up the expenditures related. If you earn your income as a real estate employee, this information will help you to work out what: Begin checkout » toggle navigation.

Expenses for travel between business locations or daily. Above total does not include sales tax. These transportation and petrol expenses that are necessary for your business are.

18 tax deductions for real estate agents. Multiply the square footage of your office (up to 300 square feet) by the standard rate of $5. Marketing tax deductions for real estate agents.