(though butchering the meals and entertainment deduction is a big ouch.) but. Record separately, in the equipment purchases section, items.

Join the millions who file smarter.

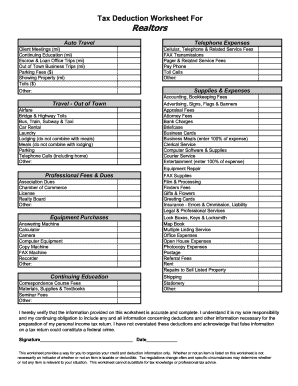

Income tax deductions for realtors. Marketing tax deductions for real estate agents. Let a tax expert take taxes off your plate. Join the millions who file smarter.

Deductible.) these deductions are subject to what is often called the “2 percent limit,” meaning that the expenses are not deductible if they total less than 2 percent of your adjusted gross. If a realtor uses part of their home exclusively and regularly for business, some mortgage, utility, tax and insurance expenses may also be deductible. Realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive.

Just remember that under the 2018 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got. Most of the real estate agents and realtors spend money in this category. Let a tax expert take taxes off your plate.

The major change made by the new tax law is that the entire deduction is capped at $10,000 per return ($5,000 for married filing separately). Another big advantage is the 20% personal services deduction subtracted from your gross income for 2021. Deduction #3 show detail legal & professional services real estate agents can deduct legal and professional fees to the extent they are an ordinary part of and necessary to operations.

(though butchering the meals and entertainment deduction is a big ouch.) but. Expenses for travel between business locations or daily. How you can fill out the real estate agent tax.

Record separately, in the equipment purchases section, items. You can claim a tax deduction for a second or third property as long as you live there for at least 14 days out of the year and it is not rented out longer than that. Ad with turbotax® on your side, get the expert tax help you need, when you need it.

Ad with turbotax® on your side, get the expert tax help you need, when you need it. Whether it’s sales and open. Join the millions who file smarter.

The new tax law makes some sweeping changes for business owners such as real estate agents. Generally, to be deductible, items must be ordinary and necessary to your profession and not reimbursable by your employer. An attorney or accountant can help you file all the.

In other words, if you paid $6,000 in. Most real estate agent marketing expenses will fall under the category of a tax deduction. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

Licences & fees your state license renewal, mls. If you are a cash basis.