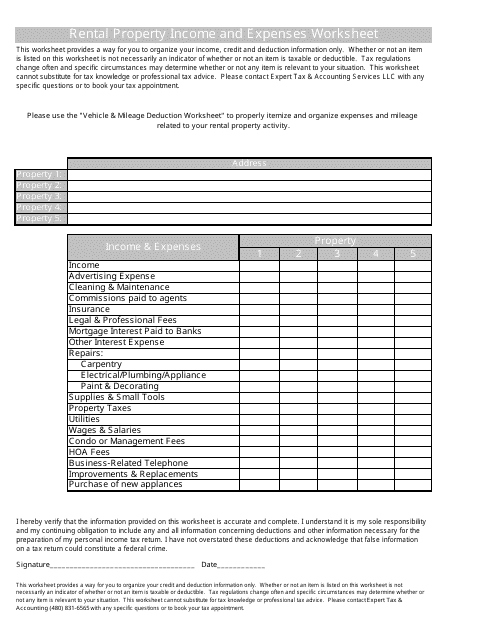

Real estate rentals you can generally use schedule e (form 1040), supplemental income and. One of the most advantageous things about investing in rental properties is the deductions you can take at tax time.

If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on.

Income tax deductions for rental properties. Only for a very limited amount of time each year if you want the chance to fully deduct losses on your rental property. Real estate by income deduction so, if you are making $100,0000 or less, you can write off up to $25,000 a year in passive rental real. In general, you can deduct expenses of renting property from your rental income.

From simple to complex taxes, filing with turbotax® is easy. Ad turbotax® makes it easy to get your taxes done right. You rent the property for 14 days or under during the year;

You do not have to pay tax on rental income as long as: There are numerous advantages to investing in vacation homes: Mortgage interest, property tax, operating expenses, depreciation, and repairs fall.

• business or rental income. If you own a rental property, the irs allows you to deduct expenses you pay for the upkeep and maintenance of the property, conserving and managing the property, and other. If you receive rental income from the rental of a dwelling unit, there are certain rental expenses you may deduct on.

According to the irs, take note that land can’t. You stay in the same property for 14 days or more during the. The occasional getaway, the passive income, even the extra space.

Other common investment property tax deductions. As long as you are using your investment. In addition to mortgage interest, you can deduct origination fees and points used to purchase or refinance your rental property, interest on unsecured loans used for improvements.

Tax deductions can be claimed for some rental expenses in relation to rental income. You can take this deduction by calculating the expected lifespan of the property. Losses from theft or casualty 2.

What deductions can i take as an owner of rental property? The qualified business income (qbi) deduction allows many rental property owners to deduct 20% of the income from a rental property business from the total taxable business income. The deduction can then be taken over multiple years.

21 tax deductions for landlords 1. One of the most advantageous things about investing in rental properties is the deductions you can take at tax time. The tax cuts and jobs act disallows the deduction for interest on home equity loans for the 2018 through 2025 tax years.

9 rental property tax deductions: Real estate rentals you can generally use schedule e (form 1040), supplemental income and. Washington state has a property tax relief program for homeowners with limited income.

If your state has rental licensing requirements, you can also deduct any accompanying landlord or vacation. But, perhaps the biggest perk is the many vacation. The tax implications for selling a rental property can be higher than when selling a primary residence, because it is considered a business investment by the irs.

Tax write off for rental property #1: