If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are legally blind, your standard deduction increases by.

The tax deduction can be claimed by individuals (whether.

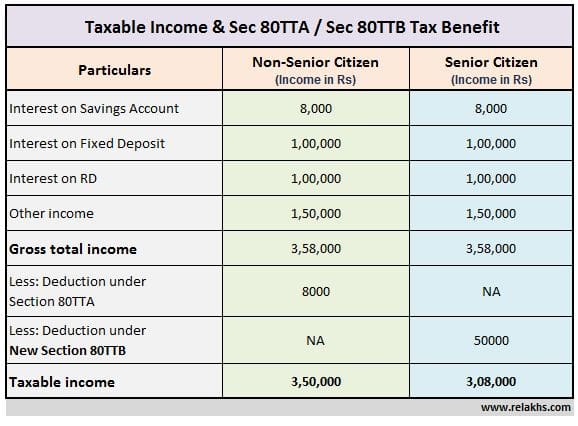

Income tax deductions for senior citizens. It’s a fantastic seniors’ tax credit that gives you a good reason to commit to those otherwise expensive, necessary improvements within your home. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. 50,000 on bank/post office as well as on interest on savings bank account (s).

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. Senior citizens are allowed a standard deduction of ₹50,000 on account of their pension income. Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve.

The limit is ₹ 25,000. 2022 senior citizen standard income tax deduction in the 2022 tax year (filed in 2023), the standard deduction is $12,950 for single filers and married filing separately, $25,900 for. Section 80ttb allows senior citizens to claim a deduction of up to rs.

Under section 80ccc income tax deduction for the contributions made in specified pension plans can be claimed. According to section 80d of the income tax act, senior citizens may avail a higher deduction of up to ₹ 50,000 for payment of premium towards medical insurance policy. The deduction under section 80u is available to resident senior citizens or super senior citizens who suffer from a disability or mental retardation.

Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve. Deduction for the premium paid for. Deductions of up to rs.50,000 per annum can be claimed by senior citizens towards their health insurance premium and/or medical expenses under section 80d.

Turbotax® makes it easy to find deductions to maximize your refund. Here are some tips to help prevent. Ad file 1040ez free today for a faster refund.

Turbotax® makes it easy to find deductions to maximize your refund. It is for any expenses towards the. If eligible, you may claim 25%.

The tax deduction can be claimed by individuals (whether. If you are legally blind, your standard deduction increases by. Income tax deduction under section 80ddb, a deduction of up to ₹40,000 is available to an individual or a huf below 60 years of age.

If you are legally blind, your standard deduction increases by.