If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. For 2021, it is $12,550 for singles and $25,100 for married couples.

The standard deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income.

Income tax deductions for seniors. If you are legally blind, your standard deduction increases by $1,700 as well. Learn more about the age amount here. To be eligible for some of these tax deductions and exemptions, you need to be over the age of 65.

If you fit the requirements, the credit for the elderly or the disabled could really brighten your tax day. Changes to the earned income tax credit for the 2022 filing season. 1, 2021, after he or she reached the age of 67, the deduction for that those benefits would not apply and he or she would be eligible for a deduction of $25,000 for a single return or $50,000 for a joint return;

Here�s a list of the top tax deductions for those over 50. Most people age 70 are retired and, therefore, do not have any income to tax. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350 each.

Under the 2018 tax law, many itemized deductions were. Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve. For 2020, the standard deduction is $12,400 for single filers and $24,800 for married couples filing jointly.

Do you have to pay income tax after age 70? You can claim up to $10,000 in retirement income deductions. In order to calculate the income tax for a senior citizen, all the income is taken into consideration along with the.

The deduction would be available against all types of income and would not be restricted to income from retirement or pension benefits. The standard deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income. As a senior, you may be eligible for benefits and credits when you file your return, such as the:

Every taxpayer can either take the standard deduction or itemize his or her personal deductions on irs schedule a. If you owe $4,000 in taxes before the credit and you get a $3,750 credit, your tax bill will be just $250. As per the latest changes in the income tax act, the standard deduction for senior citizens is ₹50,000.

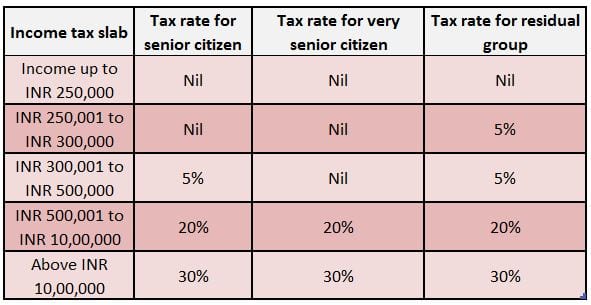

For 2021, it is $12,550 for singles and $25,100 for married couples. However, the senior citizen receives higher exemption limit compared to individuals who are below 60 years old. You can get an even higher standard deduction amount if either you or your spouse is blind.

2022 senior citizen standard income tax deduction in the 2022 tax year (filed in 2023), the standard deduction is $12,950 for single filers and married filing separately, $25,900 for married filing jointly and surviving spouses, and $19,400 for the head of household. A single tax payer can have gross income of up to $14,250 before required to file a tax return in 2021. In addition to no taxes on social security, those over 65 are also able to deduct up to $10,000 in retirement income, from pensions, iras and the like.

For your 2021 tax return, the age amount is $7,713. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. What is the personal exemption for 2021?

If both you and your spouse are 65 or older, your standard deduction increases by $2,700. If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. (see form 1040 and form 1040a instructions.)

If you are married filing jointly and you or your spouse is 65 or older, your standard deduction increases by $1,350. A good way to make sure you aren’t missing out on deductions is to get professional guidance. Since the only requirement for this credit is being above a certain age, it’s one of the easier tax deductions for seniors in canada to claim.

Furthermore, you can be exempt from tax if you are considered partially or totally blind. If you are legally blind, your standard deduction increases by $1,700 as well. 2022 senior citizen standard income tax deduction in the 2022 tax year (filed in 2023), the standard deduction is $12,950 for single filers and married filing separately, $25,900 for married filing jointly and surviving spouses, and $19,400 for the head of household.

Turbotax® makes it easy to find deductions to maximize your refund There are free tax preparation services available to seniors through the irs and aarp. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household.

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are legally blind, your standard deduction increases by $1,700 as well.

Retirees can make use of many benefits by moving to georgia and taking advantage of their tax deductions and exemptions. The income tax for senior citizens is calculated based on the basic salary, house rent allowance, fixed allowances, and other sources of income. Also, those with income under $69,000 per year.

The standard deduction is used by individuals and families who do not itemize or who have itemized deductions less than or near the standard deduction. This tax credit ranges from $3,750 to $7,500, depending on your income and filing status. To qualify, your net income must be less than $89,422, and the amount you may claim varies depending on your income.

Benefits of tax deductions for seniors. What is the tax rates for 2022? Goods and services tax / harmonized sales tax credit related provincial or territorial benefits and credits if you owe money this year, you may be able to claim credits that will lower what you owe at tax time.