You cannot legitimately deduct the income lost as a result of deadhead/unpaid mileageonly the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would. Common truck expenses truck drivers can deduct their costs for things like fuel, new tires, routine maintenance, repairs,.

It is phased out for those rare truckers who might be making more than.

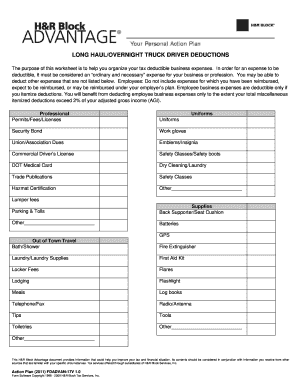

Income tax deductions for truck drivers. The 2018 special standard meal allowance is $63/full day within the us,. Tax rules for truck drivers allow many daily, necessary expenses to be deducted from overall tax liability. Common truck expenses truck drivers can deduct their costs for things like fuel, new tires, routine maintenance, repairs,.

However, local truck drivers typically cannot. Tax deductions for professional truckers. We are a nationwide team of accountants and small business tax experts.

Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and union dues are some of the tax deductions available. This can vary even on an individual level, but some expenses are generally. The irs generally allows truck drivers who are unable to stop home for meals and other necessities to claim the special meals and incidental expenses.

Up to $5,250 of tuition reimbursement or employer student loan repayment can be deducted from your taxable income. To deduct actual expenses for the truck, your expenses can include (but aren’t limited to): The standard deduction for the 2020 tax year is:

Knowing which expenses can be deducted (and which can’t) helps to. If you’re not sure of what applies to you, reach out to a cpa or tax. After computing their adjusted gross income (agi), taxpayers can itemize their deductions (from a list of allowable items) and subtract those itemized deductions (and any applicable personal.

It is phased out for those rare truckers who might be making more than. $12,400 for single taxpayers $12,400 for married taxpayers filing separately $18,650 for heads of households $24,800 for. Here’s a tax deduction list for truck drivers to consider.

You cannot legitimately deduct the income lost as a result of deadhead/unpaid mileageonly the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would. Fuel oil repairs tires washing insurance any other legitimate business expense Truck driver tax deductions truckers are allowed to deduct “ordinary and necessary” business expenses.

Truck driver tax deductions the irs allows truck drivers to deduct “ordinary and necessary” business expenses. Although they can vary based on an individual level, there are.