The nonprofit wont put a dollar value on the receipt, but the paperwork will help you prove that you did, indeed, donate the property if the irs asks. You have to reduce the fair market value of the furniture by.

If the taxpayer�s total itemized deductions add up to less than the standard deduction that the internal revenue service (irs) allows everyone to take, it does not make sense to itemize deductions.

Irs tax deductions for furniture donations. Ad donate used furniture & appliances. Any donated household item must be new or used but in good condition and as mentioned above, there is no fixed method for determining the value of these donated items. If the taxpayer�s total itemized deductions add up to less than the standard deduction that the internal revenue service (irs) allows everyone to take, it does not make sense to itemize deductions.

Listing donations on form 8283. Normally, you can deduct up to 60% of your adjusted gross income (agi) for gifts to charity. According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth.

This is the trickiest part of. The $300 charitable deduction comes on top of the standard deduction, which is $12,400 for single filers in the 2020 federal income tax year and $24,800 for those married and filing jointly. He claimed false deductions and expenses associated with rental properties he owned, while faking real.

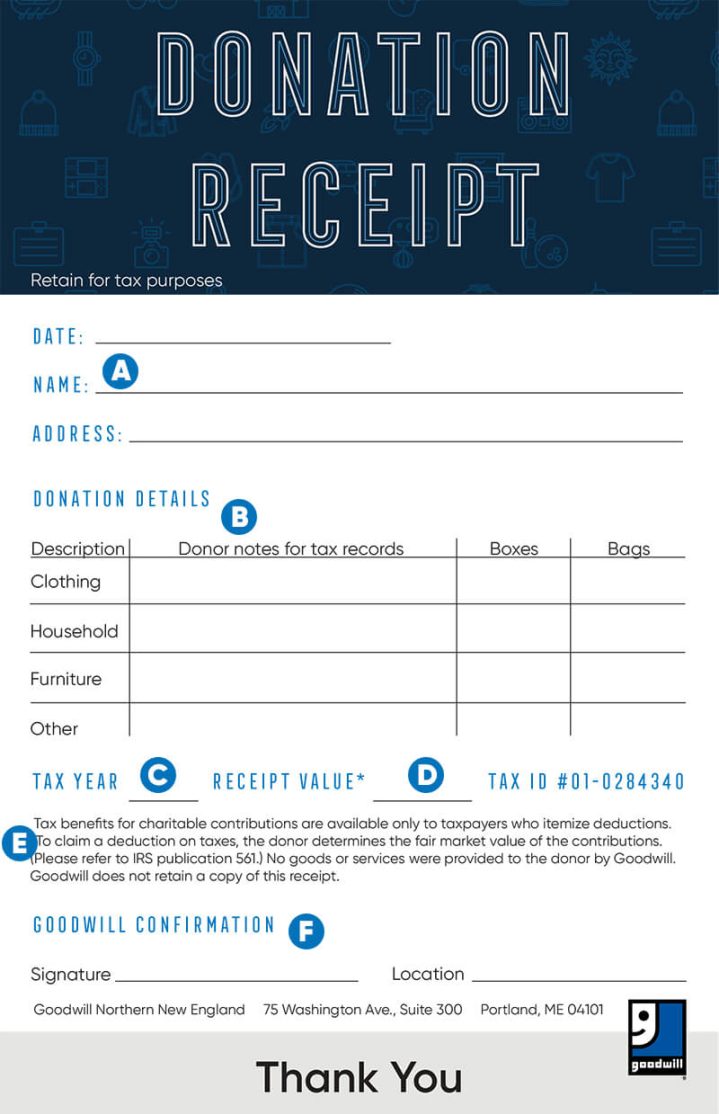

You can take a tax deduction for donated furniture, however, subject to some rules. How much tax deduction for furniture donation. If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations.

This 100% limit doesn�t apply automatically, though. That�s right — you can theoretically eliminate all of your taxable income through charitable giving. Turbotax® makes it easy to find deductions to maximize your refund.

The deduction for charitable clothing donations is one of many that you can itemize, or list individually on your tax return. How to donate furniture for a tax deduction step 1. Provided you don�t take a deduction in excess of $5,000 for any single donated item, or group of similar items, you�ll only have to list the charity�s name and address, and a short description of the item, explains the irs.

In 2020 and 2021, though, this limit has been raised to 100%. The irs defines fmv as what a consumer would willingly pay for an item if neither the seller nor the buyer was under any duress to make the sale. If you claim a deduction of $500 or.

The general rule for furniture donations is that you can write off the fair market value of the. Generally, you can only deduct charitable contributions if you itemize deductions on schedule a (form 1040), itemized deductions. Listing your donations on form 8283 is required if your donations are worth more than $500.

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your goodwill donations. To figure out the fmv for the items you donated, you can look to the cost or actual selling price of the item, sales of the same or similar goods, what it would cost. The irs says donated clothing and other household goods must be “in good used condition or better.”.

See that form and the instructions in the itemized deductions worksheet for more info on how much you can deduct. The irs requires an item to be in good condition or better to take a deduction. You have to reduce the fair market value of the furniture by.

Your deduction may be further limited to 50%, 30%, or 20% of your adjusted gross income, depending on the type of property you give and the type of organization you give it to. The irs allows taxpayers to deduct the fmv of food, clothing or household items such as furniture, furnishings, linens, appliances and electronics. How much can you deduct for donations?

According to the internal revenue service (irs), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. The irs uses “ fair market value ” (fmv) to establish the amount you can deduct for almost all donated items. People who are 65 and over or blind can claim an additional standard deduction of $1,300 ($1,650 if filing singly or as head of household).

Unfortunately, the internal revenue service won�t give you a tax credit for donating furniture. The irs allows you to deduct the fair market value for household goods like furniture and appliances, and fmv is defined as the price you could get for the item on the open market. Credits are limited, with specific qualifications set by the government, and they decrease or eliminate your tax bill to the irs.

Ad we maximize your tax deductions & credits to ensure you get back every dollar you deserve. However, for 2021, individuals who do not itemize their deductions may deduct up to $300 ($600 for married individuals filing joint returns) from gross income for their qualified cash charitable contributions to public charities, private. Call or schedule a pickup online.

The nonprofit wont put a dollar value on the receipt, but the paperwork will help you prove that you did, indeed, donate the property if the irs asks. Determine the fair market value of the items you are donating. Getting answers to your tax questions.

From 2012 through 2016, garvin prepared and filed with the irs individual income tax returns. How much of a tax deduction do i get from donating furniture? The sales tax deduction calculator (irs.gov/salestax) figures the amount you can claim if you itemize deductions on schedule a (form 1040).