[15] can i deduct 100% of the meals and entertainment costs? Under this new irs guidance, you may deduct 50 percent of your client and prospect business meals if 2 1.

[16] what kind of records should i keep?

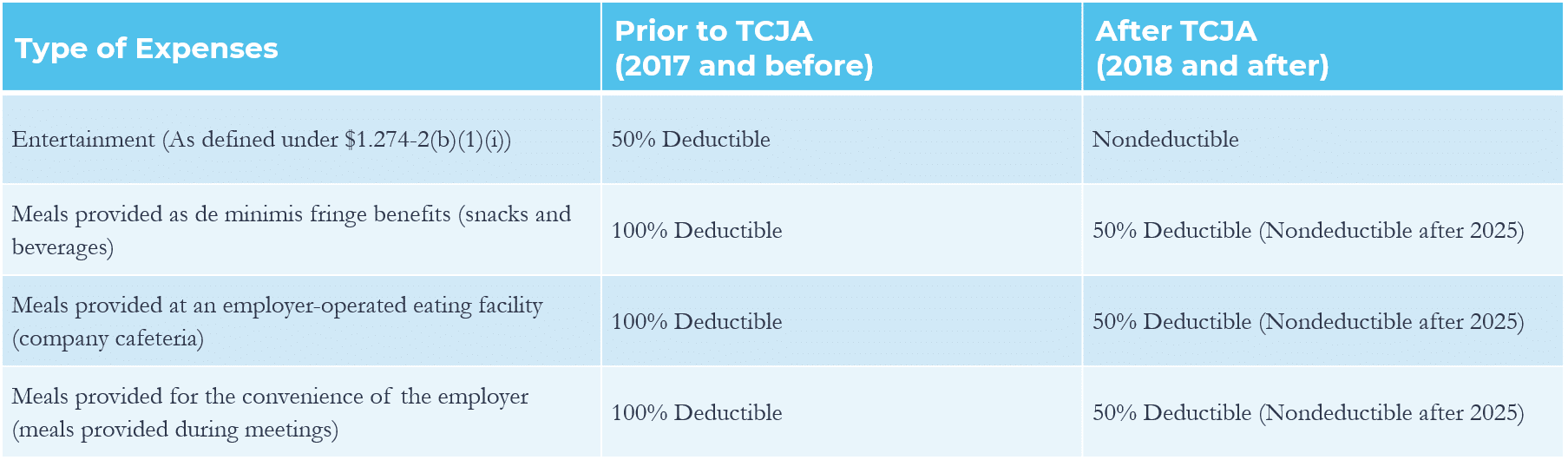

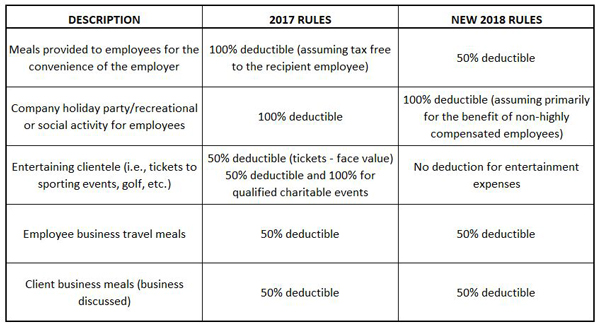

Irs tax deductions for meals and entertainment. Entertainment expenses that are reported on your tax return as taxable compensation to your employees. Food and beverages will be 100% deductible if purchased from a restaurant in 2021 and 2022. In the past (before tcja), meals and entertainment were.

The temporary exception allows a 100% deduction for food or beverages from restaurants. The 2017 tcja eliminated the deduction for any expenses related to activities generally considered entertainment,. Meals and entertainment expenses related to fundraising events for charities are fully deductible as a charitable deduction.

Meals in office during meetings of employees, stockholders, agents, or directors (50% deductible) 100% deductible in 2021 and 2022 if the meals are provided by a restaurant meals during business travel (50% deductible) 100% deductible in 2021/22 meals at a seminar or conference (50% deductible) 100% deductible in 2021/22 Food and beverage (meal) expenses and entertainment expenses to 50 percent of the amount that otherwise would have been allowable. 7 rows meals and entertainment before the new rules.

Entertainment expenses for recreational or social activities for your employees, such as a holiday party or a company picnic. Since entertainment is not deductible, you can only deduct meal costs at entertainment events if the cost can be separated (like a catered meal delivered to a skybox at a sporting event and invoiced separately). However, meals expenses incurred as part of an entertainment activity may still be classified as a 50% deductible meals expense if they’re purchased separately from the entertainment or if the cost of the food or beverage is separately stated on the invoice.

Taxpayers may continue to deduct 50 percent of the cost of business meals if the taxpayer (or an employee of the taxpayer) is present and the food or beverages are not considered lavish or extravagant. Thus, under prior law, taxpayers could deduct 50 percent of meal expenses and could deduct 50 percent of entertainment expenses that met the directly related or business discussion exceptions. The expense is an ordinary and necessary expense under internal revenue code (irc) section 162(a) that is paid or incurred during the.

The provisions of the tcja made it less advantageous to use meals as a vehicle for business development. The irs released guidance on thursday explaining when the temporary 100% deduction for restaurant meals is available and when the 50% limitation on the deduction for food and beverages continues to apply for sec. [15] can i deduct 100% of the meals and entertainment costs?

[17] can i deduct gifts? Type of expense deduction entertaining clients (concert tickets, golf games, etc.) 0% deductible business meals with clients 50% deductible office snacks and meals If food or beverages are provided during or at an entertainment event, and the food and beverages were purchased separately from the entertainment or the cost of the food and beverages was stated separately from the cost of the entertainment on one or more bills, invoices, or receipts, you may be able to deduct the separately stated costs as a meal expense.

The irs is notoriously stingy when it comes to deducting business meal expenses. The new deduction limits have no effect on the current entertainment expense rules. 274 (a) (1), but is subject to the 50% limit on expenses for meals under sec.

The cost of dinner, which is purchased separately from the cost of the tickets, is not considered entertainment and is therefore deductible, as meals not disallowed by regs. Under this new irs guidance, you may deduct 50 percent of your client and prospect business meals if 2 1. What costs can i deduct when i travel for my job?

The 2017 tcja generally eliminated the deduction for any expenses related to. Usually, if you can’t meet the substantiation rules under the. The 2017 tcja eliminated the deduction for any expenses related to activities generally considered entertainment, amusement or recreation.

If your job requires you or your employees to travel, you will incur expenses. 2 meals deductible at 100% some meal and entertainment expenses may be fully deducted. [16] what kind of records should i keep?

Washington — the internal revenue service issued final regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja). Irs issues final regulations on the deduction for meals and entertainment. Food and entertainment expenses are 100% deductible for industries that are in the business of providing food, such as restaurants and catering businesses.

The act added a temporary exception to the 50% limit on the amount that businesses may deduct for food or beverages. Washington — the internal revenue service issued proposed regulations on the business expense deduction for meals and entertainment following changes made by the tax cuts and jobs act (tcja). Under the tcja, all meal deductions were limited to 50%, whether from a restaurant or grocery store.

[18] are small gifts included in the $25 yearly minimum? Beginning january 1, 2021, through december 31, 2022, businesses can claim 100% of their food or beverage expenses paid to restaurants as long as. Overview in summary, here�s a quick reference of deductibility per type of expense: